AZ Strategic Tax Planning Client Questionnaire 2011-2025 free printable template

Get, Create, Make and Sign living trust sample pdf

How to edit living trust sample pdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out living trust sample pdf

How to fill out AZ Strategic Tax Planning Client Questionnaire

Who needs AZ Strategic Tax Planning Client Questionnaire?

Video instructions and help with filling out and completing living trust sample pdf

Instructions and Help about living trust sample pdf

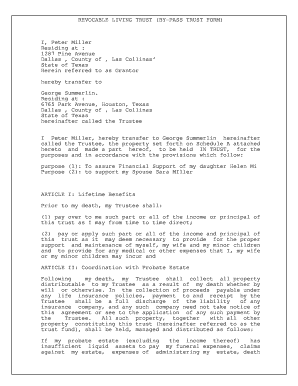

Hey guys in this video I'm going to show you how to make a trust and then apply through the ATF website the e forms website to do a form 1 to make a suppressor I've got a couple that I've made here these are ones that I've made in my shop on my mill and lathe I'll show you how to do those in future videos they sound perfect compared to the freeze plug baffles that my friends have done and if you want to do an SBR it's a very similar process I'll put a link in the description below for the SPR method that's been pretty well documented, but I found that to do a suppressor there's a lot of incorrect information out there so at the very least I'll show you how to make a trust and if you want to make an SBR you can use somebody else's guide, but this is the successful process of used to get suppressor stamps so first let's start with the trust in the description below you'll find a link to download five documents, and you're going to fill these out let's start with the first one this is going to be the declaration of trust you want to read through this carefully there are fields where there stars, and you fill out what goes between the stars take out the stars, so there will be five fields about five, so there's me your name you should use your full name here you have to pick a beneficiary this is person who gets you trust when you are either incapacitated or you're no longer live there are three people you need to pick for your incapacity board members these people will choose if the successor gets the property held in the trust if you're incapacitated you'll also have to put your state in one fields or two the fields here I just make sure you go through the whole document there's just search for the stars it's the only stars in these five documents there's also the date and when we get to the notary product part I'll tell you an important detail about the date so this one's the Declaration of Trust you got to put your name in here and scroll down the bottom there's a couple spots in the middle so make sure you don't miss those you can just do a control laughs and search for all the fields there is the successor trustee and the beneficiary right here and at the bottom there is a place to get this notarized what's important is that you do not sign anything on this paper until you get to your notary most banks will do this for free if not I think the post office will do it for you so what's important is that there is a section right here where it says I certify from here all the way down to the bottom where it says my commission expires this must be on the same page we can't have this part broken into two different pages if you do that you will get denied during your form one process and down here if you can see it is says your state, so this is the living trust the second document we have is called a certification trust, so there's a bunch of fields and in here there is a month date and year you must put in this must match the month date and year...

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send living trust sample pdf for eSignature?

How do I edit living trust sample pdf in Chrome?

Can I create an electronic signature for the living trust sample pdf in Chrome?

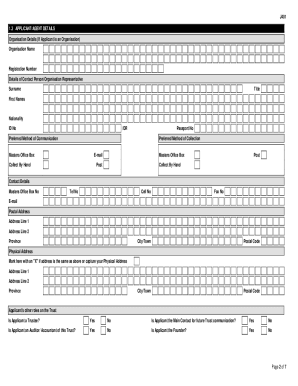

What is AZ Strategic Tax Planning Client Questionnaire?

Who is required to file AZ Strategic Tax Planning Client Questionnaire?

How to fill out AZ Strategic Tax Planning Client Questionnaire?

What is the purpose of AZ Strategic Tax Planning Client Questionnaire?

What information must be reported on AZ Strategic Tax Planning Client Questionnaire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.