Get the free Notice to shareholders 2012

Show details

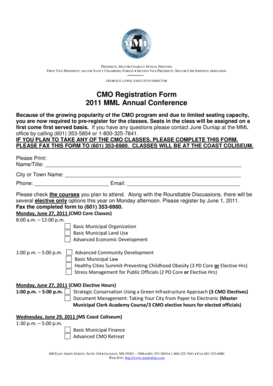

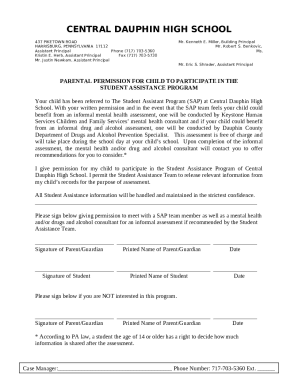

This document serves as a notice to the shareholders of KAP International Holdings Limited regarding the 34th annual general meeting, providing details such as the meeting's agenda, voting procedures,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice to shareholders 2012

Edit your notice to shareholders 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice to shareholders 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice to shareholders 2012 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit notice to shareholders 2012. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice to shareholders 2012

How to fill out Notice to shareholders 2012

01

Start with the title 'Notice to Shareholders 2012'.

02

Include the date of the notice at the top.

03

Clearly state the purpose of the notice.

04

Provide the company's name and registration details.

05

Specify the meeting date, time, and location.

06

List the agenda items to be discussed at the meeting.

07

Include instructions on how shareholders can vote or participate.

08

Add a statement regarding proxy voting if applicable.

09

Mention any documents that shareholders need to review beforehand.

10

Sign the notice and include contact information for further questions.

Who needs Notice to shareholders 2012?

01

All registered shareholders of the company need the Notice to Shareholders 2012.

02

Investors who hold shares in the company.

03

Persons who may want to attend the shareholders' meeting for updates on company performance.

Fill

form

: Try Risk Free

People Also Ask about

What is the notice period for shareholders?

Generally, companies must provide at least 21 days' written notice for a meeting, though longer periods may be specified in the company constitution.

What does a rights issue mean for shareholders?

A rights issue is when a company offers its current shareholders the chance to buy more shares at a discounted price. Why do companies undertake rights issues? Rights issues are typically employed when a company needs to raise funds for various objectives, such as expansion or debt repayment.

What is the difference between rights issue and private placement?

In simple terms Rights issue is when share capital is raised from the existing shareholders in proportion to their current shareholding while private placement as the name suggests is when offer to subscribe the shares of the company is made to new Investors without any public advertisement or marketing or media usage.

What is a shareholder notice?

Shareholder Notice means written notice from a Shareholder notifying the Company and the Selling Shareholder that such Shareholder intends to exercise its Secondary Refusal Right as to a portion of the Transfer Shares with respect to any Proposed Shareholder Transfer.

What are the requirements for a shareholder notice?

Notices must be sent to all shareholders at least 15 business days before the meeting for public companies and non-profit companies with voting members, and 10 business days for other entities. The notice must include: Date, time, location, and record date of the meeting. Agenda and proposed resolutions.

What is rights issue notice to shareholders?

The issue is called so as it gives the existing shareholders a pre-emptive right to buy new shares at a price that is lesser than market price. The Rights issue is an invitation to the existing shareholders to buy new shares in proportion to their existing shareholding.

Is stock rights offering good or bad?

The market may interpret a rights issue as a warning sign that a company could be struggling. This might even cause investors to sell their shares, which would bring the price down. With an increased supply of shares available following a rights issue, this could be very bad news for a company's market value.

What are the disadvantages of rights issues to shareholders?

The main advantage of the rights issue is that It gives existing shareholders the exclusive right to purchase additional shares at a predetermined price. However, potential disadvantages include dilution of ownership for non-participating shareholders and market distrust, which could lead to a decrease in stock value.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Notice to shareholders 2012?

The Notice to shareholders 2012 is a formal document that companies are required to send to their shareholders informing them of important events such as annual general meetings, proposed resolutions, and other significant information relating to the company's operations.

Who is required to file Notice to shareholders 2012?

Publicly traded companies and certain private companies that meet specific regulatory requirements are mandated to file the Notice to shareholders 2012.

How to fill out Notice to shareholders 2012?

To fill out the Notice to shareholders 2012, companies need to include details such as the date and time of the meeting, agenda items, proxy voting information, and any other relevant communication that needs to be conveyed to the shareholders.

What is the purpose of Notice to shareholders 2012?

The purpose of the Notice to shareholders 2012 is to ensure transparency and keep shareholders informed about key corporate events, enabling them to make informed decisions regarding their investment in the company.

What information must be reported on Notice to shareholders 2012?

The Notice to shareholders 2012 must report information such as the date and location of the shareholder meeting, resolutions to be discussed, eligibility to vote, and instructions on how to vote by proxy if applicable.

Fill out your notice to shareholders 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice To Shareholders 2012 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.