Get the free business insurance

Show details

Business Insurance Quotation Form Please complete ALL relevant sections of this form as accurately as possible to ensure your quotation is correctly calculated. Should there be any questions you are

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business insurance

Edit your business insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business insurance online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business insurance

How to fill out business insurance:

01

Research the types of insurance coverage that are necessary for your specific business needs. This may include general liability insurance, property insurance, professional liability insurance, and workers' compensation insurance.

02

Contact multiple insurance providers to gather quotes and compare coverage options. It's important to find a plan that adequately protects your business without exceeding your budget.

03

Carefully review the terms and conditions of each insurance policy to understand the extent of coverage and any limitations or exclusions.

04

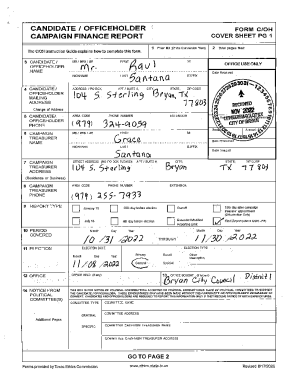

Fill out the application forms provided by the insurance company. These forms typically require detailed information about your business, including its name, address, industry, annual revenue, and number of employees.

05

Provide accurate and up-to-date financial information, such as your business's revenue and expenses, as this may affect the cost of your insurance premiums.

06

Submit any required supporting documentation along with the application, such as business licenses, contracts, or risk assessments.

07

Once the application is submitted, the insurance company may schedule a risk assessment or inspection of your business premises to evaluate potential liabilities and determine the appropriate coverage.

08

Review the insurance policy documents carefully before signing them. It's crucial to understand the coverage provided, deductibles, limits, and any additional endorsements or add-ons.

09

Make the initial premium payment to activate the insurance policy. Keep track of payment due dates to ensure continuous coverage.

10

Periodically review and update your business insurance to keep up with any changes in your business operations, risks, or legal requirements.

Who needs business insurance:

01

Business owners: Whether you operate a small business or a large corporation, having business insurance can protect your assets and shield you from financial loss in the event of an unforeseen incident or lawsuit. It provides a safety net to help cover the costs of property damage, liability claims, legal fees, or employee injuries.

02

Self-employed individuals: Freelancers, consultants, and independent contractors often need business insurance to protect themselves and their clients from potential risks or mistakes. Professional liability insurance can be particularly important in these cases.

03

Employers: If you have employees, workers' compensation insurance is typically required by law in many jurisdictions. This coverage provides medical benefits and wage replacement to employees who are injured or become ill while performing their job duties.

04

Business lenders: When applying for a business loan, many lenders may require proof of insurance coverage to protect their investment in case of unexpected events that may affect your ability to repay the loan.

05

Business partners or shareholders: Business insurance can provide peace of mind and protect the financial interests of partners or shareholders in case of unexpected events that could jeopardize the business's stability or continuity.

Note: The specific insurance needs may vary depending on the type of business, industry, location, and legal requirements. Consulting with an insurance professional or broker can help identify the most suitable coverage options for your business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business insurance in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign business insurance and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit business insurance straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing business insurance, you need to install and log in to the app.

Can I edit business insurance on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign business insurance. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is business insurance?

Business insurance is a type of coverage that protects a company against financial losses resulting from accidents, property damage, liability, or other unforeseen events.

Who is required to file business insurance?

Businesses of all sizes and types are required to have some form of business insurance, however, the specific requirements may vary depending on the industry, location, and size of the business.

How to fill out business insurance?

To fill out business insurance, you will need to provide information about your business, such as its name, address, industry, number of employees, revenue, and any potential risks or liabilities.

What is the purpose of business insurance?

The purpose of business insurance is to protect a company from financial losses that may result from unforeseen events, such as accidents, property damage, or lawsuits.

What information must be reported on business insurance?

The information that must be reported on business insurance typically includes details about the business's operations, assets, liabilities, and risks.

Fill out your business insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.