OK SA&I 246 2009-2025 free printable template

Get, Create, Make and Sign oklahoma transfer on death deed form

How to edit oklahoma transfer on death deed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out transfer on death deed oklahoma form

How to fill out OK SA&I 246

Who needs OK SA&I 246?

Video instructions and help with filling out and completing tod deed form oklahoma

Instructions and Help about transfer on death deed form oklahoma

Everyone welcome to another episode of the ask Andy show my name is Edmund I'm Jennifer, and I'm Sydney, and we are the attorneys here at enemy Law Group today we're gonna talk about transform debts one of you asks us the question is a transfer on death deed better than a living trust, so today we're going to go through you know both transfer on death fee and a living trust to help you decide which one is better for you, so Jennifer can you start off that's off with explaining you know what is a transfer on death be sure so transfer on death deed essentially is putting a beneficiary's name on your deed ahead of time so that if something were to happen to you, and you pass away then based on the deed it'll already designate who's going to be the beneficiary of that specific property and so the question is whether that is sufficient for you to pass on your assets and whether you should actually do a living trust instead so maybe Cindy can kind of go through what I love you trust would be and kind of what how more beneficial it is than transfer on down the deep so it's quite a big difference between a transfer on death lead and the living trust and there's a lot of differences, but we can't cover all of those in our short video here today, but I think we can highlight some key points so first the transfer on death lead is pretty limited it does not allow for continued beneficiaries so earlier Jennifer said that you know basically you're putting somebody on your deed before anything happens, but it's its one person or maybe it's a couple of people but if anything had happened to those people before your passing then your estate could potentially face probate which is something that I'm sure you had intended to avoid when do you recorder that transfer on death Dean so if you know that that could be basically a huge issue for any he's trying to leave their assets to their heirs but can only name you know that one person at the time on their transformed F Dean Jennifer why don't you tell us some points I think the key point is that it's just really not flexible you name one individual or a couple individuals as beneficiaries if something happens to them then you know it still might go through probate, and also it's just not very flexible so let's say certain situations or conditions occur where this kind of fishers are facing some sort of debt so if you are inheriting that property then their creditors would be able to go after that property and there's really nothing that can prevent these beneficiaries from avoiding this creditor and taking this potentially taking this property whereas a living trust you know you can kind of customize it and have certain scenarios in there where if a certain condition occurs they have creditors against them then the trustee can hold on to that property and maybe potentially not even distribute that property outright at least not until the debt is settled so that also helps with the situation's of the beneficiaries...

People Also Ask about oklahoma transfer on death form

How to transfer a house deed to a family member in Oklahoma?

Is a transfer on death deed valid in Oklahoma?

What are the disadvantages of a transfer on death deed?

Is transfer on death a good idea?

How do I file a transfer on death deed in Oklahoma?

What are the drawbacks of a TOD?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send oklahoma transfer on death deed online for eSignature?

How do I edit oklahoma form transfer on death deed online?

Can I edit ok transfer on death deed on an iOS device?

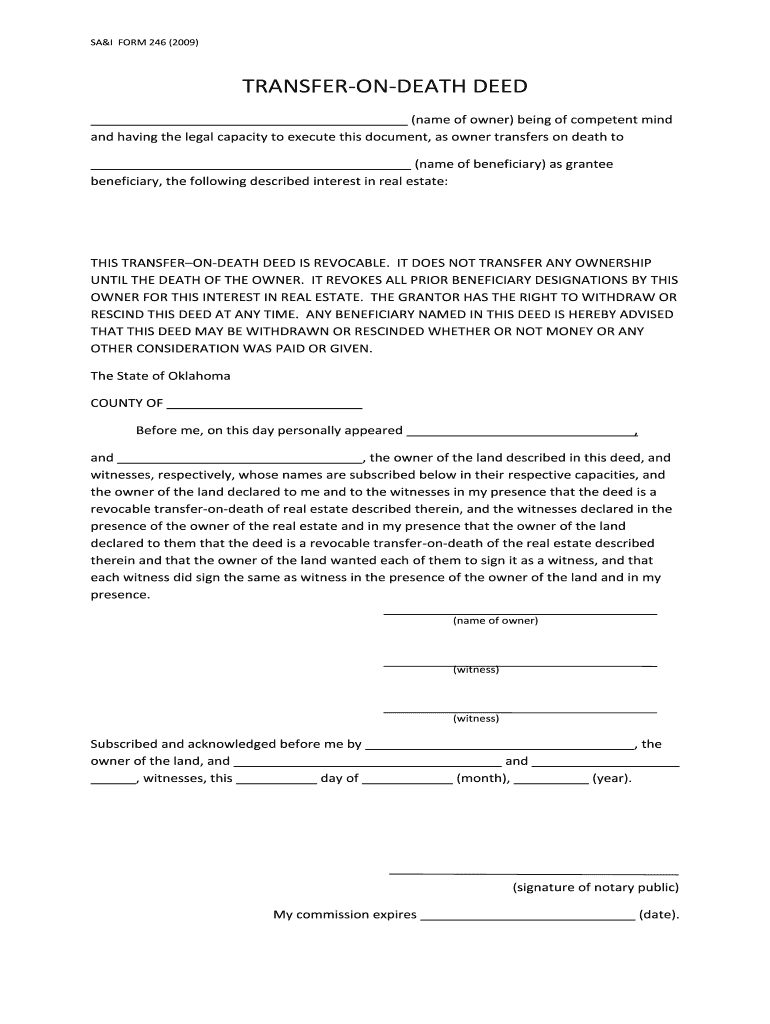

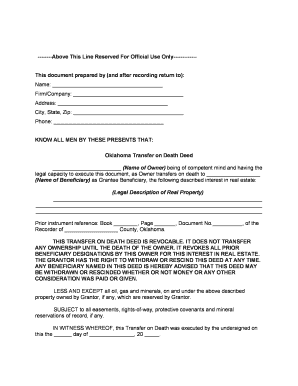

What is OK SA&I 246?

Who is required to file OK SA&I 246?

How to fill out OK SA&I 246?

What is the purpose of OK SA&I 246?

What information must be reported on OK SA&I 246?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.