Get the free mastercoverage

Show details

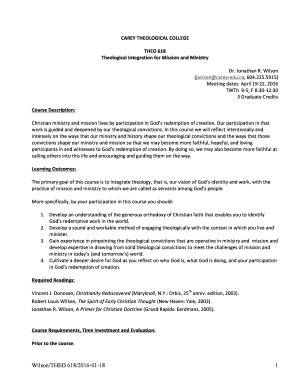

11143 MCCoverageBroLGv2.QED 7/28/05 10:19 AM Page 2 MasterCoverage The liability protection program in control under protection 11143 MCCoverageBroLGv2.QED 7/28/05 10:19 AM Page 1 Introduction Effectively

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mastercoverage form

Edit your mastercoverage form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mastercoverage form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mastercoverage form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mastercoverage form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mastercoverage form

How to fill out master coverage:

01

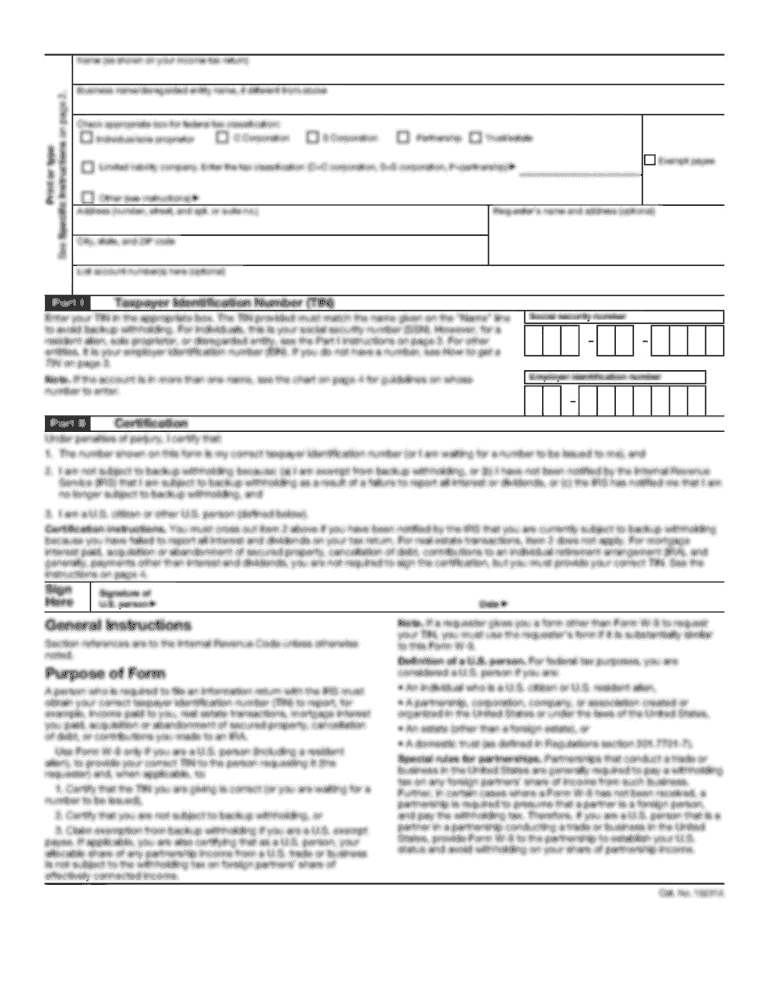

Collect all necessary information: Before filling out master coverage, gather all the required information. This may include personal details such as name, address, and contact information, as well as any relevant documentation or proof of ownership.

02

Understand the coverage options: Take the time to understand the different coverage options provided by master coverage. Read through the policy's terms and conditions, coverage limits, deductibles, and any exclusions that may apply. This will help you make informed decisions while filling out the form.

03

Provide accurate and detailed information: When filling out the form, ensure that you provide accurate and detailed information. Double-check spellings, addresses, and other personal details to avoid any discrepancies or potential issues in the future. Be honest and transparent while answering the questions to avoid any potential claim denial.

04

Seek assistance if needed: If you encounter any difficulties or have questions while filling out master coverage, don't hesitate to seek assistance. You can reach out to the insurance provider's customer support, an insurance agent, or a professional advisor who can help you navigate through the process.

Who needs master coverage:

01

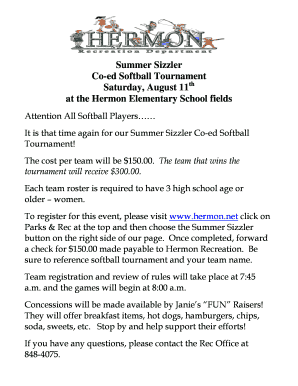

Homeowners: Homeowners usually opt for master coverage to ensure their property and belongings are adequately protected. Master coverage provides comprehensive insurance against various risks, including fire, theft, vandalism, and other perils.

02

Condo owners: Condo owners often need master coverage as it protects the entire building and shared areas. The master coverage typically includes common areas, such as hallways, elevators, pools, and gyms, and acts as a collective protection for all unit owners.

03

Commercial property owners: Those who own commercial properties, such as office buildings, shopping centers, or warehouses, may require master coverage. This type of coverage safeguards the property against risks like damage, theft, liability claims, and business interruption.

04

Property management companies: Property management companies that oversee multiple properties can benefit from master coverage. It provides a comprehensive solution to manage and protect all the properties under their care, streamlining the insurance process.

05

Landlords: Landlords who rent out their properties can obtain master coverage to protect against risks related to rental properties. This coverage may include protection against property damage, liability claims from tenants or visitors, and loss of rental income.

In summary, anyone who owns property, whether residential or commercial, and wants comprehensive insurance protection should consider master coverage. It provides peace of mind and financial security in the event of unforeseen incidents or damages.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mastercoverage?

Mastercoverage is a form or documentation that provides information about coverage or insurance policies that a person or organization has.

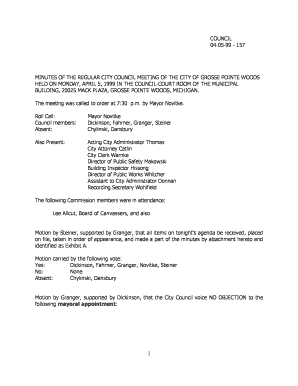

Who is required to file mastercoverage?

The individuals or organizations who are required to file mastercoverage depend on the specific regulations or requirements set by the governing authority, such as insurance regulators or government agencies.

How to fill out mastercoverage?

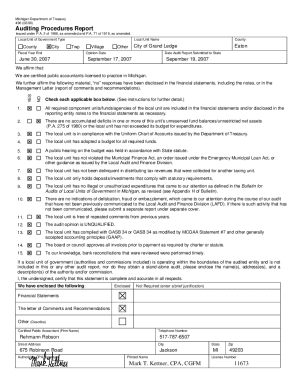

The process of filling out mastercoverage involves providing information about the insurance policies and coverage details, which may vary depending on the specific requirements and forms provided by the governing authority.

What is the purpose of mastercoverage?

The purpose of mastercoverage is to document and provide a comprehensive overview of the insurance policies and coverage held by an individual or organization. It helps in assessing the extent of coverage and managing risk.

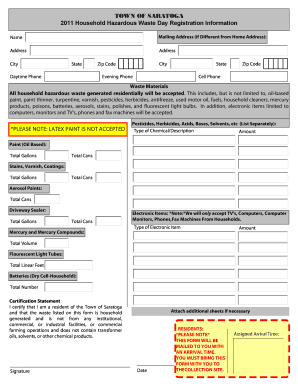

What information must be reported on mastercoverage?

The specific information required to be reported on mastercoverage may vary depending on the governing authority's regulations and requirements. It commonly includes details of insurance policies, coverage limits, insurers, and policy effective dates.

Where do I find mastercoverage form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific mastercoverage form and other forms. Find the template you want and tweak it with powerful editing tools.

Can I sign the mastercoverage form electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your mastercoverage form in seconds.

How can I edit mastercoverage form on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing mastercoverage form.

Fill out your mastercoverage form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mastercoverage Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.