UK HMRC TC846 2013 free printable template

Get, Create, Make and Sign tc846 - hmrc gov

How to edit tc846 - hmrc gov online

Uncompromising security for your PDF editing and eSignature needs

UK HMRC TC846 Form Versions

How to fill out tc846 - hmrc gov

How to fill out UK HMRC TC846

Who needs UK HMRC TC846?

Instructions and Help about tc846 - hmrc gov

Music Music Music to guys what is that on is dog back here how you guys doing hope you guys will enjoy this video so quick intro before I get into the base built just wanted to say to you guys I'MSO happy for what is going on right noon my channel I will be uploading little more often hopefully soon but apart from that get into the base field okay so to show off this base firstly on the outside we have the huge high external stone gate yes so second you step inside these they're inside pretty relative pretty relatively decent sized compound where you can have large furnaces turn a skiing on let×39;get a load of fumes from up top not going to do that but entering that the first thought to this face almost you'begot two or three daughters and you'regretting up three doors until what thesis where your PC is your PC gets coming in there this is the stubble looks activity base design you have one model which we do your letter hatch now this is a jump leather hat first you know it makes it harder for radius to get in to the next floor which is your loot room it doesn'thave to be this room or the other room can be swapped around and this is where would put the loop personally and obviously where I put the second floor TC right inside there and you just close that so it#39’s where you guys get to seem amazing skills when I jump in their okay so yep you've got this inside herein we go out to the right we get to see some storage obviously you can put furnaces and sleeping bags stuff Evening you have a larger group I personallyhaven'’t, but you can if you want this is where you get to see my amazing jumping skills as I was describing a second ago not coming come through stride all right anyway you now have this store here which leads to another area because it fences and stuff and to extra loop areas that are still does pretty well, so the loop is relatively well protected inside the space if I can make this jump leap some plans I can'sometimes I can all zenith#39’s really quite annoying together but inside here I just have another bed into photos just to show what you can doing this section, and you know in this section if you wanted to oh yeah that×39;that pretty much to showcase what toucan do if you wanted to yeah so will now take you up to the next floor which is the primary shooting room floor in my personal cleaning that's why I call it whoever you want obviously intro I got rid of one of these windows glass yes you have two window bars here and the doors obviously to put your things around clear so London#39’t get headshots easy base protection and still the best bicycle section you can have and obviously in flight here play about this you can have the bunch of guns like sex guns and like chests and stuff in here just so that you do not get an easy klutz fucked UPI I take will you stuff down Heather#39’re not going to get your guns upset, and they think that#39’ve got everything moving on to the final fours baked melon sucker cooker cook godlike...

People Also Ask about

What are tax credits UK?

What is the best time to call tax credit helpline?

Does dispute mean I get my money back?

What happens when a dispute is filed?

What does dispute transaction mean on cash App?

What is the meaning of dispute recovery?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get tc846 - hmrc gov?

How do I edit tc846 - hmrc gov online?

Can I sign the tc846 - hmrc gov electronically in Chrome?

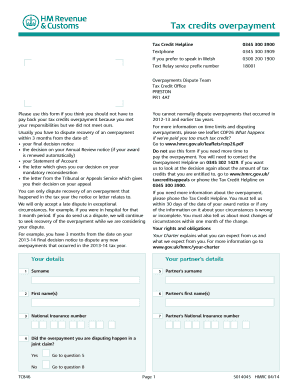

What is UK HMRC TC846?

Who is required to file UK HMRC TC846?

How to fill out UK HMRC TC846?

What is the purpose of UK HMRC TC846?

What information must be reported on UK HMRC TC846?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.