NZ IR 526 2013 free printable template

Show details

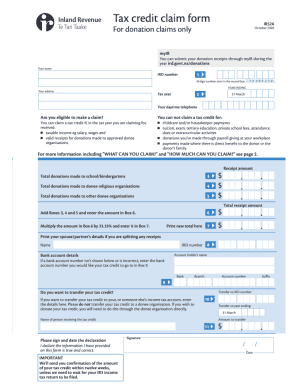

Tax credit claim form 2013 IR 526 (13) For donation claims only March 2013 1 April 2012 31 March 2013 POSTAL ADDRESS Inland Revenue PO Box 39090 WELLINGTON MAIL Center Lower Hunt 5045 Your name IRD

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NZ IR 526

Edit your NZ IR 526 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NZ IR 526 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NZ IR 526 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NZ IR 526. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NZ IR 526 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NZ IR 526

How to fill out NZ IR 526

01

Obtain the NZ IR 526 form from the official website or relevant authority.

02

Fill in personal details, including your name, date of birth, and NZ address.

03

Provide your tax identification number and bank account details.

04

Complete the income and expense sections accurately.

05

Declare any other income sources and relevant tax credits.

06

Review your application for any errors or omissions.

07

Sign and date the form to confirm the information is true and correct.

08

Submit the completed form by the specified method, either online or via mail.

Who needs NZ IR 526?

01

Individuals who are applying for a tax refund in New Zealand.

02

People who need to declare their income for a specific tax year.

03

Residents and non-residents earning income in New Zealand who need to report tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is an IR215?

You can make all your income adjustments for a student loan or WfFTC on one form. You don't need to complete this form if you've already contacted Inland Revenue with your end-of-year income adjustment information. If both you and your partner have adjustments to make, you will each need to complete an IR215 form.

What tax form do I need for charitable donations?

Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500.

What is a IR526?

Submit copies of your donation receipt electronically throughout the year to your myIR account and claim donation tax credits as part of your end of year income tax process. File tax credit claim form (IR526) for the relevant tax year from April of the following year.

How do I claim church tithes on my taxes?

In most years, the donations you make to your church throughout the year can be deducted from your taxes only if you itemize your expenses on Schedule A when you file your personal tax return. Most taxpayers use Schedule A, when their total itemized deductions exceed the standard deduction for their filing status.

How do I prove my donations to my taxes?

Written acknowledgement from the charity is required and must be obtained from the charity on or before the earlier of the date when the tax return is filed or the due date of the tax return (including extensions). The written acknowledgement must contain: Charity name. Amount of cash contribution.

How do I add church donations to my taxes?

See if you qualify. To deduct donations you make to your church, you must itemize your expenses on Schedule A when you file your personal tax return. You will only benefit from itemization when your deductions exceed the Standard Deduction for your filing status.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the NZ IR 526 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your NZ IR 526 in minutes.

Can I create an electronic signature for signing my NZ IR 526 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your NZ IR 526 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out NZ IR 526 on an Android device?

Complete NZ IR 526 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is NZ IR 526?

NZ IR 526 is a tax form used in New Zealand for individuals who need to report their income and claim tax credits. It is commonly associated with income tax returns.

Who is required to file NZ IR 526?

Individuals who have received income that is not taxed at source or who want to claim tax credits and refunds are typically required to file NZ IR 526.

How to fill out NZ IR 526?

To fill out NZ IR 526, gather your income information, tax credits, and personal details. Follow the instructions provided in the form, ensuring all sections are completed accurately before submitting it to the New Zealand Inland Revenue.

What is the purpose of NZ IR 526?

The purpose of NZ IR 526 is to allow taxpayers in New Zealand to report their income, claim eligible tax credits, and ensure they are taxed correctly based on their total income for the year.

What information must be reported on NZ IR 526?

NZ IR 526 requires reporting of personal details, total income earned, any deductions, tax credits being claimed, and banking details for any refunds due.

Fill out your NZ IR 526 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NZ IR 526 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.