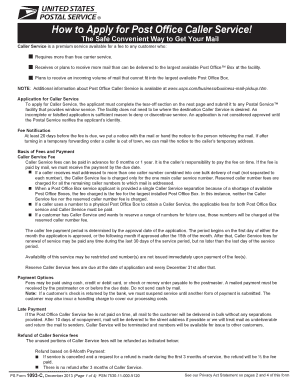

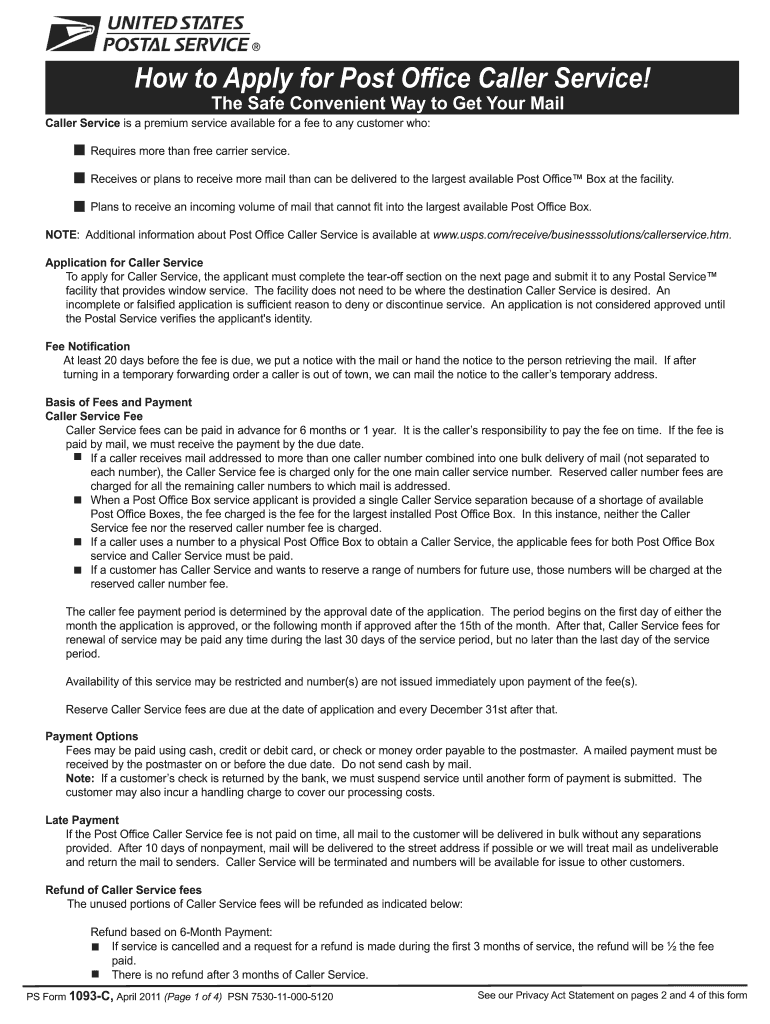

USPS PS 1093-C 2011 free printable template

Show details

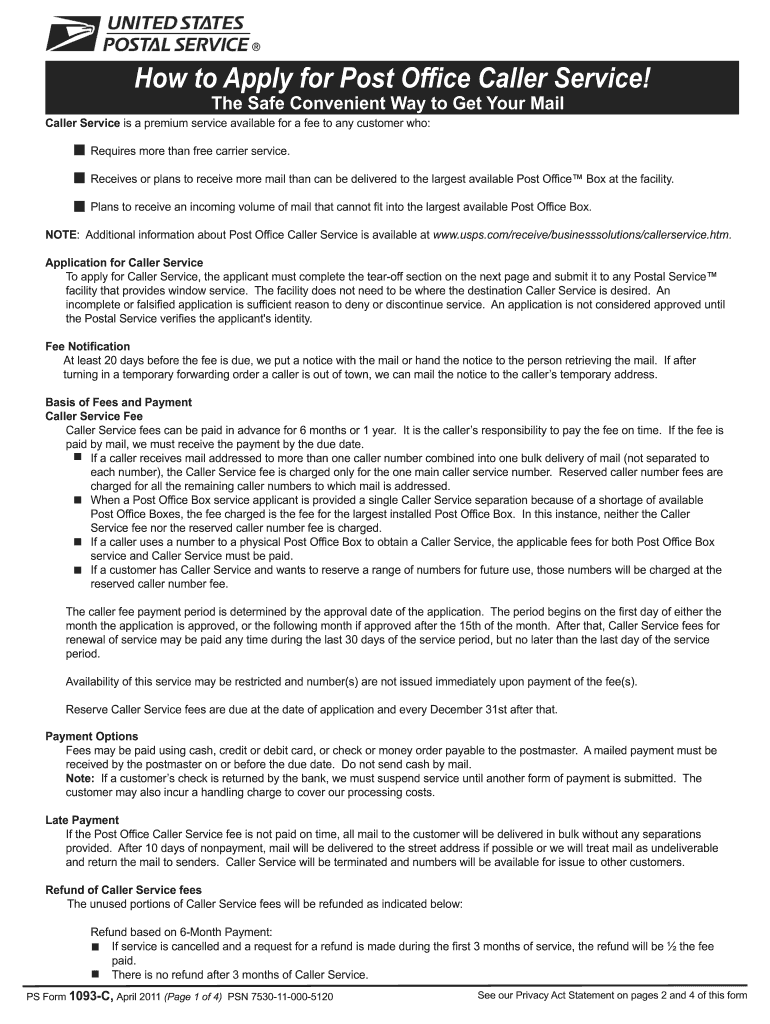

Privacy Notice Privacy Act Statement is available on pages 2 and 4 of this form. PS Form 1093-C April 2011 Page 3 of 4 PSN 7530-11-000-5120 Post Office Date Stamp Use this page to list information that could not be contained on the front of the form due to space constraints. Updating Information The information on the PS Form 1093-C must always be current. As soon as any information changes such as caller s street address telephone number etc. the caller is responsible for updating the form....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ps 1093 c 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ps 1093 c 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ps 1093 c 2011 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ps 1093 c 2011. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

USPS PS 1093-C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ps 1093 c 2011

How to fill out ps 1093 c 2011:

01

Gather all necessary information such as your personal identification details, income information, and any deductions or credits you may be eligible for.

02

Start by filling out your name, address, and Social Security number in the appropriate sections of the form.

03

Follow the instructions provided on the form to report your income from various sources such as wages, self-employment, investments, and any other applicable sources.

04

Complete the sections related to any deductions or credits you may qualify for, such as the Earned Income Credit or education-related deductions.

05

Double-check all the information you have entered, ensuring that it is accurate and complete.

06

Sign and date the form, and mail it to the appropriate address as indicated in the instructions.

Who needs ps 1093 c 2011:

01

Individuals who are required to file their income tax return with the Internal Revenue Service (IRS) for the year 2011.

02

Individuals who have earned income from various sources throughout the year and are obligated to report it to the IRS.

03

Anyone who believes they may qualify for certain deductions or credits, as this form allows them to claim those benefits.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file ps 1093 c form?

The PS Form 1093-C is used by Postal Service employees to apply for Civil Service Retirement System (CSRS) or Federal Employees Retirement System (FERS) coverage. This form is required to be filed by Postal Service employees who are seeking retirement benefits from either of these retirement systems. It is not applicable to the general public and is specific to Postal Service employees.

How to fill out ps 1093 c form?

To fill out a PS 1093-C form, follow these steps:

1. Obtain the form: Visit the official website of the United States Postal Service (USPS) or contact your local post office to obtain a copy of the PS 1093-C form.

2. Identify the type of change: The PS 1093-C form is used for reporting a change of address for corporate business mailers within the USPS. Determine the specific change you need to report, such as a change of company name, address, authorized representatives, or other details.

3. Gather necessary information: Collect all the required information, such as the old and new company name/address, current EIN (Employment Identification Number), company representative details, and any supporting documentation.

4. Complete the form: Carefully fill out all the sections of the PS 1093-C form. Provide accurate and up-to-date information, ensuring legibility. If any section does not apply to your situation, mark it as "N/A" or leave it blank.

5. Attach supporting documents: If you are submitting the form with supporting documents, such as articles of incorporation or proof of address, make sure to include them with the completed form.

6. Review and sign: Before submitting the form, double-check all the information for accuracy and completeness. Ensure that it is legible and that there are no errors or omissions. Sign and date the form in the designated space.

7. Submit the form: Send the completed form and any supporting documents to the appropriate address as indicated on the form. This may typically be the USPS Business Mail Entry Unit (BMEU) designated on your postal account.

8. Keep a copy for your records: Make a photocopy or digital scan of the completed form and any attachments for your records. This can be useful for future reference or proof of submission.

It is advisable to consult the official USPS instructions or contact the USPS directly for any specific queries related to the PS 1093-C form.

What is the purpose of ps 1093 c form?

There is no specific information available about a form named "ps 1093 c." It is possible that this form is specific to a certain organization or institution. Without further context, it is difficult to determine the purpose of this form.

What information must be reported on ps 1093 c form?

The PS 1093-C form is used to report income earned in the Commonwealth of Puerto Rico by an individual who is not a resident of Puerto Rico. The form must include information such as:

1. Personal information: Full name, Social Security number (SSN) or individual taxpayer identification number (ITIN), address, and phone number.

2. Employer information: Name, address, and Employer Identification Number (EIN).

3. Income information: Details of compensation received from Puerto Rican sources, including wages, tips, and self-employment income.

4. Withholding information: Amount of income tax withheld by the employer in Puerto Rico.

5. Special deductions and credits: Any deductions or credits that may be applicable, such as contributions to Puerto Rican retirement plans, dependent exemptions, foreign tax credits, etc.

6. Signature and date: The form must be signed and dated by the individual.

It's important to consult the latest version of the form and relevant instructions provided by the Internal Revenue Service (IRS) to ensure accurate reporting.

How do I modify my ps 1093 c 2011 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign ps 1093 c 2011 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send ps 1093 c 2011 to be eSigned by others?

When you're ready to share your ps 1093 c 2011, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit ps 1093 c 2011 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share ps 1093 c 2011 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your ps 1093 c 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.