Get the free salary acquittance register

Fill out, sign, and share forms from a single PDF platform

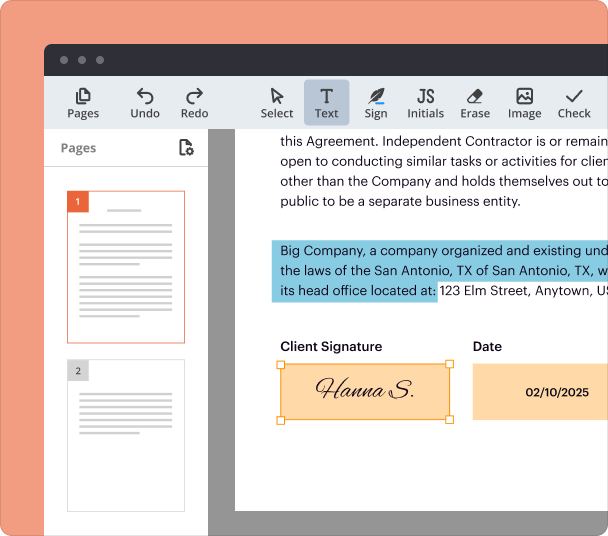

Edit and sign in one place

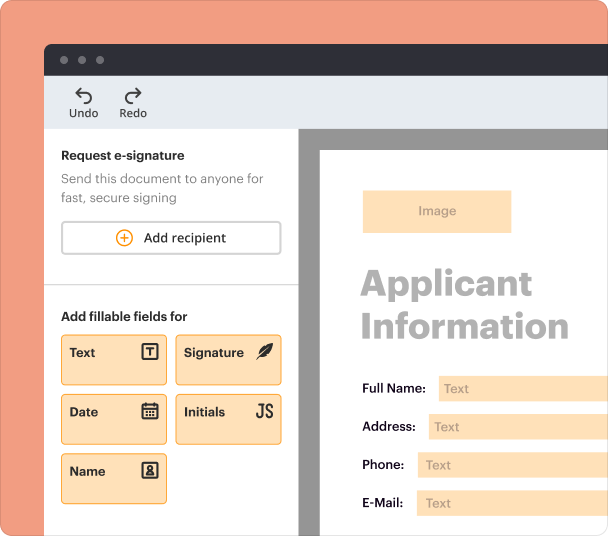

Create professional forms

Simplify data collection

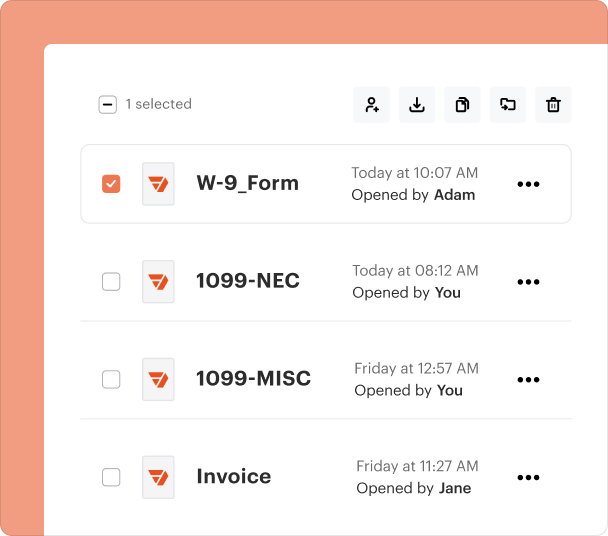

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Guide to Filling Out the Salary Acquittance Register Form

How to effectively fill out a salary acquittance register form?

Filling out a salary acquittance register form is essential for accurate payroll management and financial accountability. To do this effectively, gather all necessary information regarding employees, including details such as their name, designation, and amount payable. Following the step-by-step instructions provided in this guide will ensure your form is completed correctly.

Understanding the salary acquittance register form

The salary acquittance register is crucial for tracking employee payments and ensuring accountability within payroll processes.

-

It's a document used to record salary payments made to employees. Its primary purpose is to provide a clear account of payments made and to whom.

-

It aids in maintaining financial accountability, ensuring that an organization tracks all employee compensations effectively.

-

Typically, HR personnel, payroll managers, and accountants are the primary users of the salary acquittance register form.

What are the components of the salary acquittance register form?

Understanding the components of this form is critical for ensuring accurate and effective payroll processing.

-

A sequential number assigned to each entry for easy reference.

-

The full name of the employee receiving payment.

-

The employee's job title and department within the organization.

-

The total salary amount owed to the employee, after any deductions.

-

The form must be signed and stamped to confirm accuracy and authorization.

-

Any outstanding payments should be clearly indicated along with their proper documentation.

-

The cumulative amount of any unpaid salaries listed in the register.

-

A final figure indicating the total salary approved for distribution with appropriate authorization.

How to fill out the salary acquittance register form step-by-step?

Filling out the salary acquittance register requires careful attention to detail. Follow these steps for accurate completion.

-

Before starting, ensure you have all required information for each employee listed in the register.

-

Fill out each field methodically: provide the Item No., employee Name, and their Designation.

-

Deduct taxes and other charges to arrive at the Net Amount Payable for each employee.

-

Ensure the form is signed by authorized personnel and appropriately stamped.

-

Carefully total unpaid amounts and the total approved amount, ensuring alignment with financial records.

-

Review the completed form for accuracy and completeness before submitting.

How can pdfFiller aid in managing the salary acquittance register?

pdfFiller provides tools that simplify the editing and management of the salary acquittance register, enhancing workflow efficiency.

-

Use pdfFiller to easily access and modify the salary acquittance register online.

-

Leverage built-in tools to add notes, making the process collaborative.

-

Utilize eSigning features to ensure compliance and timely approvals.

-

Efficiently manage multiple submissions, keeping track of revisions made to the document.

What are the compliance and best practices for salary acquittance?

Adhering to compliance guidelines and best practices can enhance the accuracy and reliability of payroll documentation.

-

Understand the regulatory frameworks that govern payroll documentation in your region.

-

Maintain the confidentiality and security of sensitive employee information at all times.

-

Regularly review acquittance records to ensure accuracy and compliance with standards.

What common mistakes should be avoided?

Awareness of common errors can prevent complications in payroll processing.

-

Mistakes like incorrect figures or missing signatures can cause delays in processing.

-

Inaccuracies can lead to employee dissatisfaction and potential legal issues.

-

Double-check calculations and ensure all fields are completed before submission.

Where can you find further assistance?

For additional guidance, there are numerous resources available to assist with filling out the salary acquittance register form.

-

Find supplementary templates and forms on pdfFiller for assistance.

-

Visit official regulating agencies' websites for payroll management guidelines.

-

Reach out to customer support for personalized help regarding specific queries.

Frequently Asked Questions about भुगतान पत्र acquittance roll pdf form

What is a salary acquittance register form?

A salary acquittance register form is a document used to record payments made to employees. It is essential for ensuring accurate payroll processing and financial accountability.

Why is it important to fill out this form correctly?

Filling out the salary acquittance register form correctly is vital as it helps avoid payroll discrepancies, ensures compliance with regulations, and maintains employee trust.

How often should the salary acquittance register be updated?

The salary acquittance register should be updated at least monthly or per pay period to reflect accurate employee compensation and any outstanding balances.

Can pdfFiller support eSigning for payroll documents?

Yes, pdfFiller supports eSigning, allowing for secure approvals of payroll documents while facilitating compliance with legal standards.

What should I do if I discover an error in the form after submission?

If an error is discovered post-submission, you should notify the payroll department immediately. Corrections can often be made with supporting documentation.

pdfFiller scores top ratings on review platforms