CO Sales Use Tax Return free printable template

Show details

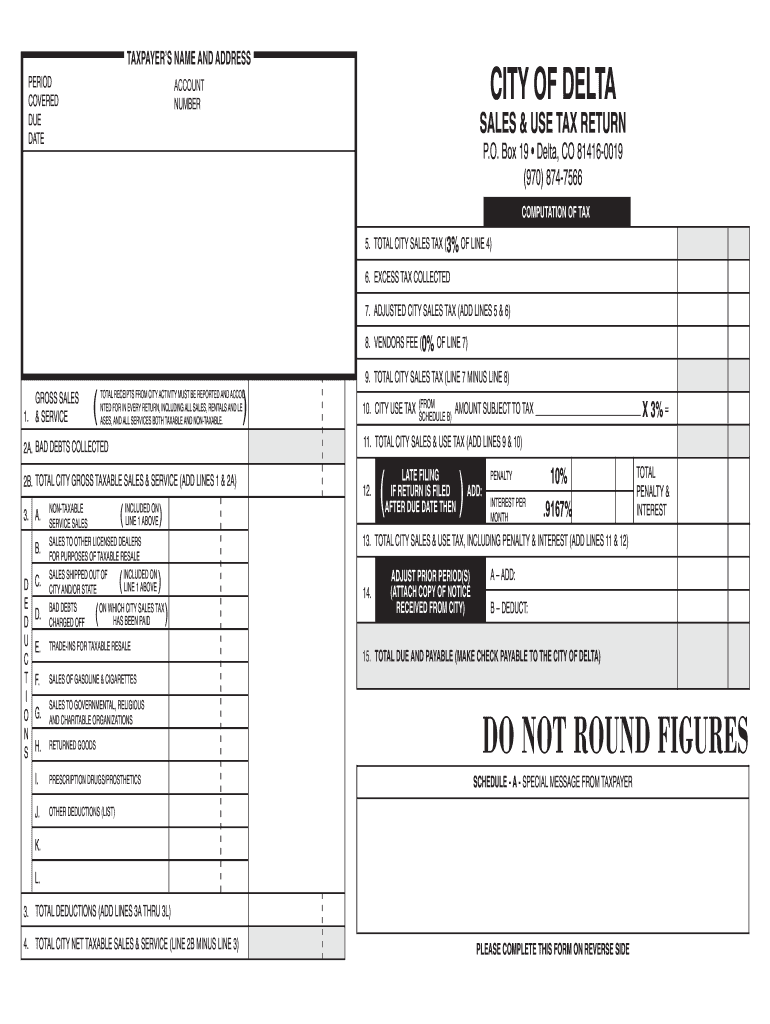

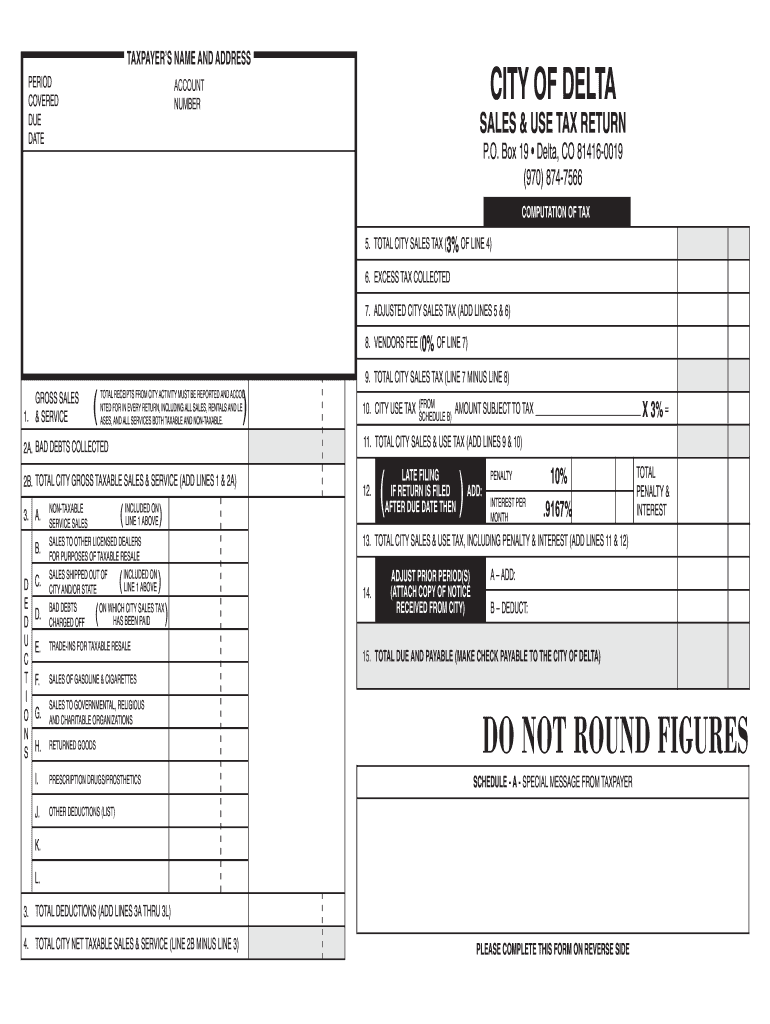

PLEASE COMPLETE THIS FORM ON REVERSE SIDE. CITY OF DELTA. SALES & USE TAX RETURN. P.O. Box 19 Delta, CO 81416-0019. (970) 874-7566.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign colorado delta city tax form

Edit your city use return form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your delta city sales tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing delta sales tax online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit colorado delta sales use tax form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out colorado delta use tax edit form

How to fill out CO Sales & Use Tax Return

01

Gather necessary documentation such as sales records and purchase invoices.

02

Verify if your business needs to collect sales tax based on your revenue and products sold.

03

Download the CO Sales & Use Tax Return form from the Colorado Department of Revenue website.

04

Fill out your business information including name, address, and tax identification number.

05

Report total sales in the appropriate section, ensuring all sales figures are accurate.

06

Deduct any exempt sales, if applicable, from your total sales.

07

Calculate the total sales tax due using the applicable rate for your jurisdiction.

08

Complete any necessary schedules or additional forms if you have specific tax situations.

09

Review the return for completeness and accuracy.

10

Submit the completed return by the due date, either electronically or by mail.

Who needs CO Sales & Use Tax Return?

01

Businesses operating in Colorado that sell taxable goods or services.

02

Retailers making sales to consumers.

03

Wholesalers who sell tangible personal property to end users.

04

Businesses engaged in renting or leasing products in Colorado.

05

Online sellers with a nexus in Colorado.

Fill

colorado delta use return

: Try Risk Free

People Also Ask about colorado delta tax return

What is the sales tax for Delta Colorado?

What is the sales tax rate in Delta, Colorado? The minimum combined 2023 sales tax rate for Delta, Colorado is 9.5%. This is the total of state, county and city sales tax rates.

What is the retailers use tax return in Colorado?

The Retailer's Use Tax Return (DR 0173) is used to report not only Colorado retailer's use tax, but also retailer's use taxes administered by the Colorado Department of Revenue for various special districts in the state.

What is sales tax in Denver CO?

What is the sales tax rate in Denver, Colorado? The minimum combined 2023 sales tax rate for Denver, Colorado is 8.81%. This is the total of state, county and city sales tax rates.

What is a DR 0100 form Colorado?

The Colorado Retail Sales Tax Return (DR 0100) is used to report not only Colorado sales tax, but also sales taxes administered by the Colorado Department of Revenue for various cities, counties, and special districts in the state.

What is Colorado City use tax?

What is the sales tax rate in Colorado City, Colorado? The minimum combined 2023 sales tax rate for Colorado City, Colorado is 3.9%. This is the total of state, county and city sales tax rates.

What services are taxable in Colorado?

Colorado taxes retail sales of tangible personal property and select services including telephone services, rooms and accommodations, food for immediate consumption, and certain utility services.

What is the local sales tax?

The statewide tax rate is 7.25%. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Those district tax rates range from 0.10% to 1.00%. Some areas may have more than one district tax in effect.

Does Delta Junction have sales tax?

The Delta Junction sales tax rate is 0%.

What is the local sales tax in Colorado?

Colorado also has a 2.90 percent state sales tax rate, a max local sales tax rate of 8.30 percent, and an average combined state and local sales tax rate of 7.78 percent. Colorado's tax system ranks 21th overall on our 2023 State Business Tax Climate Index.

Can you deduct sales on tax return?

More In Credits & Deductions Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately).

What is Delta County sales tax?

What is the sales tax rate in Delta County? The minimum combined 2023 sales tax rate for Delta County, Colorado is 6.5%. This is the total of state and county sales tax rates. The Colorado state sales tax rate is currently 2.9%.

Is Delta Colorado a home rule city?

The City of Delta is a home rule city that collects and administers its own sales and use tax, which is currently 3%. You must obtain a Sales and Use Tax License in order to conduct business in the City of Delta.

How do I report sales on my tax return?

You must report the transaction (gain on sale) on Form 8949, Sales and Other Dispositions of Capital AssetsPDF, and Form 1040, U.S. Individual Income Tax Return, Schedule D, Capital Gains and LossesPDF.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify colorado delta use tax return get without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including colorado delta city use return make. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make edits in colorado delta use return form blank without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing taxable use delta form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out colorado delta sales use return online on an Android device?

On an Android device, use the pdfFiller mobile app to finish your colorado delta tax return fill. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is CO Sales & Use Tax Return?

The CO Sales & Use Tax Return is a form used by businesses in Colorado to report and pay sales tax and use tax collected from customers on taxable sales and purchases.

Who is required to file CO Sales & Use Tax Return?

Businesses that have a sales tax license in Colorado and collect sales tax from customers are required to file the CO Sales & Use Tax Return.

How to fill out CO Sales & Use Tax Return?

To fill out the CO Sales & Use Tax Return, businesses must provide specific details such as total sales, taxable sales, and the amount of tax collected. The form typically requires information to be entered in designated fields and submitted either online or via mail.

What is the purpose of CO Sales & Use Tax Return?

The purpose of the CO Sales & Use Tax Return is to report the amount of sales tax collected and to remit that tax to the state of Colorado, ensuring compliance with state tax laws.

What information must be reported on CO Sales & Use Tax Return?

The CO Sales & Use Tax Return requires reporting of total sales, exempt sales, taxable sales, the amount of tax collected, and any applicable deductions or credits.

Fill out your colorado sales tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Colorado Delta Sales Return Make is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.