MO Individual Vehicle Mileage and Fuel free printable template

Show details

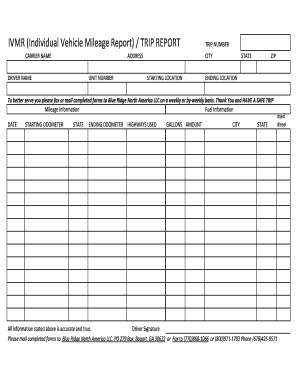

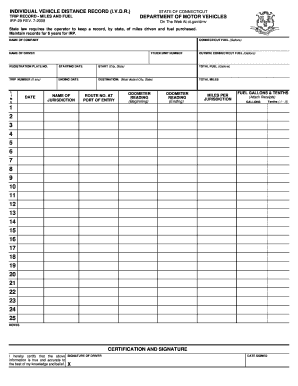

Individual Vehicle Mileage And Fuel Record Load Information Date Driver Name Account Number Carrier Origins: Unit Number Driver Comments Destinations: Town Origin Jurisdiction Lines Town Destination

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO Individual Vehicle Mileage and Fuel

Edit your MO Individual Vehicle Mileage and Fuel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO Individual Vehicle Mileage and Fuel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO Individual Vehicle Mileage and Fuel online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MO Individual Vehicle Mileage and Fuel. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out MO Individual Vehicle Mileage and Fuel

How to fill out MO Individual Vehicle Mileage and Fuel Record

01

Start by entering the date in the 'Date' column for each entry.

02

Record the vehicle's starting odometer reading in the 'Starting Odometer' column.

03

Enter the ending odometer reading in the 'Ending Odometer' column after the trip.

04

Calculate and fill in the total miles driven in the 'Total Mileage' column by subtracting the starting odometer from the ending odometer.

05

Record the date of fuel purchase in the 'Date of Fuel' column if applicable.

06

Fill in the gallons of fuel purchased in the 'Gallons' column.

07

Note the cost of fuel in the 'Cost' column.

08

Add any additional notes or important details related to the trip in the 'Notes' column.

Who needs MO Individual Vehicle Mileage and Fuel Record?

01

Anyone who operates a vehicle for business purposes needs the MO Individual Vehicle Mileage and Fuel Record.

02

Employees who are reimbursed for mileage or fuel expenses.

03

Businesses that require detailed mileage tracking for tax or accounting purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the mileage form for taxes?

If you are a business owner or self-employed, you will record your vehicle expenses on Schedule C, Part ll, Line 9. This will be the standard mileage deduction or actual expenses you calculated.

How do I create a mileage form?

ing to the IRS, you must include the following in your mileage log template: The mileage driven for each business-related trip. The date of each trip. The destination and purpose of your trip. The total mileage you've driven for the year.

What is the mileage rate for 2023?

The standard mileage rate for transportation or travel expenses is 65.5 cents per mile for all miles of business use (business standard mileage rate).

Will federal mileage rate increase in 2023?

The new IRS mileage rates apply to travel starting on January 1, 2023. The new mileage rates are up from 58.5 cents per mile for business purposes and 18 cents per mile for medical or moving purposes in early 2022 and 62.5 cents per mile for business purposes in the second half of 2022.

What is proof of mileage for IRS?

If you're keeping a mileage log for IRS purposes, your log must be able to prove the amount of miles driven for each business-related trip, the date and time each trip took place, the destination for each trip, and the business-related purpose for traveling to this destination.

How do I get IRS mileage reimbursement?

The simplest method of claiming IRS mileage is through the standard mileage method. With it, you use the mileage rate set by the IRS for your business miles. Use the actual expense method to claim the expenses you've had for running your vehicle for business uses throughout the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MO Individual Vehicle Mileage and Fuel to be eSigned by others?

To distribute your MO Individual Vehicle Mileage and Fuel, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get MO Individual Vehicle Mileage and Fuel?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific MO Individual Vehicle Mileage and Fuel and other forms. Find the template you need and change it using powerful tools.

How do I execute MO Individual Vehicle Mileage and Fuel online?

With pdfFiller, you may easily complete and sign MO Individual Vehicle Mileage and Fuel online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is MO Individual Vehicle Mileage and Fuel Record?

The MO Individual Vehicle Mileage and Fuel Record is a document used by individuals and businesses in Missouri to track and report mileage and fuel consumption for their vehicles.

Who is required to file MO Individual Vehicle Mileage and Fuel Record?

Individuals and businesses that operate vehicles in Missouri and need to report their mileage and fuel usage, particularly for tax deduction purposes or to comply with state regulations, are required to file this record.

How to fill out MO Individual Vehicle Mileage and Fuel Record?

To fill out the MO Individual Vehicle Mileage and Fuel Record, you should collect the necessary data on your vehicle's mileage and fuel purchases, then enter this information into the designated fields on the form, ensuring accuracy and completeness.

What is the purpose of MO Individual Vehicle Mileage and Fuel Record?

The purpose of the MO Individual Vehicle Mileage and Fuel Record is to provide a systematic way to document mileage and fuel expenses for vehicles used for business or personal purposes, facilitating accurate reporting for tax benefits and compliance.

What information must be reported on MO Individual Vehicle Mileage and Fuel Record?

The information that must be reported includes the date of each trip, the destination, the purpose of travel, the starting and ending odometer readings, and the total miles driven, along with the amount of fuel purchased and the cost of the fuel.

Fill out your MO Individual Vehicle Mileage and Fuel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO Individual Vehicle Mileage And Fuel is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.