Get the free pdffiller

Show details

Change in person to contact for tax matters Name Phone Number For Agency Use Only Signature of person authorizing change NCUI 101-A-I Rev. 02/2012 Action Taken Operator Date. Account Number CHANGE IN STATUS REPORT Employer Name and Address Return to NC Dept. of Commerce Division of Employment Security P.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ncui 101 a form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdffiller form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pdffiller form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

01

To fill out ncui 101 a, start by gathering all the necessary information such as your personal details, employment history, and any relevant financial information.

02

Next, carefully read through the instructions provided on the form to ensure you understand each section and what information is required.

03

Begin filling out the form by providing your full name, address, social security number, and contact information in the designated fields.

04

Move on to the employment history section and provide details about your current and previous jobs, including the names of the employers, dates of employment, and the reason for separation from each job.

05

If there is a section on the form related to your income or earnings, ensure that you accurately report all relevant information, including wages, tips, bonuses, and any other sources of income.

06

If there are any additional sections on the form, such as questions regarding eligibility for certain benefits, carefully review and answer them as accurately as possible.

07

Once you have completed all sections of the form, double-check for any errors or missing information. It is important to ensure the form is filled out correctly to avoid any delays or issues with the processing of your application.

08

Finally, sign and date the form in the designated area to certify that the information you provided is true and accurate to the best of your knowledge.

Who needs ncui 101 a?

01

Individuals who have recently been employed or are currently employed and need to file for unemployment benefits may need to fill out ncui 101 a.

02

Employers may also need to fill out ncui 101 a if they are required to report information about their employees' wages, hours worked, and other employment details to the state's unemployment agency.

03

Additionally, individuals who are applying for any other type of benefit that requires information about their income or employment history may need to fill out ncui 101 a as part of the application process.

Fill

form

: Try Risk Free

People Also Ask about

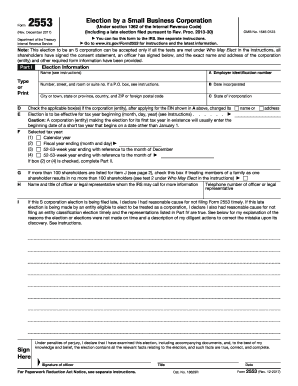

What is a NCUI 101 form?

The Employer's Quarterly Tax and Wage Report (Form NCUI 101) is used to report wage and tax information. You may download a blank Employer's Quarterly Tax and Wage Report (Form NCUI 101) from our website, or contact the Employer Call Center at 919-707-1150 to request that a blank form be mailed to you.

Does nc send out 1099-G?

If you claimed itemized deductions on your federal return and received a state refund last year you will receive a Form 1099G. This statement shows the amount of your state refund received last year but does not mean you are entitled to an additional refund.

Can I look up my 1099 online?

Sign in to your my Social Security account to get your copy Creating a free my Social Security account takes less than 10 minutes, lets you download your SSA-1099 or SSA-1042S and gives you access to many other online services.

What is the tax form for NC unemployment?

The Division of Employment Security (DES) prepares an IRS Form 1099-G for each person who received unemployment benefits. The form reports the total amount in unemployment benefits a person received in the previous calendar year, plus any state or federal taxes that were withheld.

What wages are subject to NC unemployment tax?

Who is liable for Unemployment Tax? A general business employer with gross payroll of at least $1,500 in any calendar quarter or with at least one worker in 20 different weeks during a calendar year.

What is the penalty for filing Ncui 101 late?

The maximum late filing penalty is 25% (. 25).

What are the wage requirements for unemployment in NC?

During the base period, your earnings must meet both of the following requirements: You must have earned wages in at least two quarters of the base period. You must have earned at least $790 in one of the last two quarters of the base period.

How do I file Ncui 101?

Paper Filing The Employer's Quarterly Tax and Wage Report (Form NCUI 101) is used to report wage and tax information. You may download a blank Employer's Quarterly Tax and Wage Report (Form NCUI 101) from our website, or contact the Employer Call Center at 919-707-1150 to request that a blank form be mailed to you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pdffiller form without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your pdffiller form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I get pdffiller form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the pdffiller form in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an eSignature for the pdffiller form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your pdffiller form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is ncui 101 a form?

The NCUI 101 A form is a specific document used for reporting information related to unemployment insurance claims.

Who is required to file ncui 101 a form?

Employers who are subject to state unemployment compensation laws are required to file the NCUI 101 A form.

How to fill out ncui 101 a form?

To fill out the NCUI 101 A form, you should provide accurate employee information, wages, and details about the unemployment claims as instructed in the form guidelines.

What is the purpose of ncui 101 a form?

The purpose of the NCUI 101 A form is to collect and report employer and employee information necessary for processing unemployment insurance claims.

What information must be reported on ncui 101 a form?

The NCUI 101 A form requires reporting employee wages, hours worked, social security numbers, and reasons for unemployment among other relevant details.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.