HI DoT N-20 - Schedule K-1 2015 free printable template

Show details

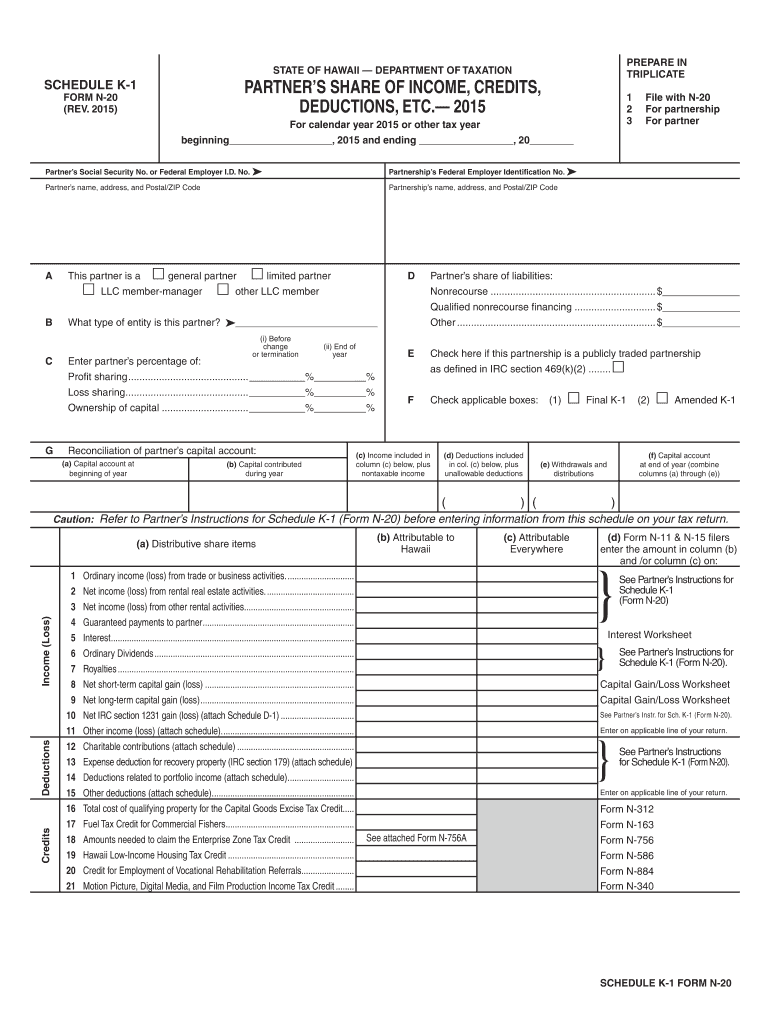

See attached Form N-756A 19 Hawaii Low-Income Housing Tax Credit. 20 Credit for Employment of Vocational Rehabilitation Referrals. Clear Form PREPARE IN TRIPLICATE STATE OF HAWAII DEPARTMENT OF TAXATION PARTNER S SHARE OF INCOME CREDITS DEDUCTIONS ETC. 2015 SCHEDULE K-1 FORM N-20 REV. 2015 For calendar year 2015 or other tax year 2015 and ending beginning File with N-20 For partnership Partner s Social Security No. or Federal Employer I. F Check applicable boxes c Income included in column c...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI DoT N-20 - Schedule K-1

Edit your HI DoT N-20 - Schedule K-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI DoT N-20 - Schedule K-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing HI DoT N-20 - Schedule K-1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit HI DoT N-20 - Schedule K-1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT N-20 - Schedule K-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI DoT N-20 - Schedule K-1

How to fill out HI DoT N-20 - Schedule K-1

01

Obtain the HI DoT N-20 form and the Schedule K-1 template.

02

Enter your business information at the top of the form including the name, address, and tax identification number.

03

Provide the year for which you're reporting.

04

Fill out the partner's information, including their name, address, and taxpayer identification number.

05

Report the partner's share of income, deductions, and credits in the appropriate sections of Schedule K-1.

06

Ensure all entries are accurate and complete, double-checking for any errors.

07

Sign and date the form where required.

08

Distribute copies to all partners and retain a copy for your records.

Who needs HI DoT N-20 - Schedule K-1?

01

Partners in a partnership who receive income, deductions, or credits must file HI DoT N-20 - Schedule K-1.

02

Businesses operating as partnerships in Hawaii need to provide the completed Schedule K-1 to their partners.

Fill

form

: Try Risk Free

People Also Ask about

What can I deduct as a partner?

You can deduct unreimbursed partnership expenses (UPE) if you were required to pay partnership expenses personally under the partnership agreement. Don't include any expenses you can deduct as an itemized deduction. Don't combine these expenses with — or net them against — any other amounts from the partnership.

How does a K1 affect my personal taxes?

How does Schedule K-1 affect personal taxes? In general, a K-1 can affect personal taxes in two ways: either by increasing a partner's tax liability or by providing them with a tax deduction. It will likely increase their total tax liability for the year if the K-1 is associated with an income.

Who typically receives a Schedule K-1?

Who Gets an IRS Schedule K-1? Among those likely to receive a Schedule K-1 are: S corporation shareholders. Partners in limited liability corporations (LLCs), limited liability partnerships (LLPs), or other business partnerships.

What can I deduct as a k1 partner?

You may be allowed to deduct unreimbursed ordinary and necessary expenses you paid on behalf of the partnership (including qualified expenses for the business use of your home) if you were required to pay these expenses under the partnership agreement and they are trade or business expenses under section 162.

Do all partners receive a K-1?

K-1s are provided to the IRS with the partnership's tax return and also to each partner so that they can add the information to their own tax returns. For example, if a business earns $100,000 of taxable income and has four equal partners, each partner should receive a K-1 with $25,000 of income on it.

What type of partner gets a Schedule K-1?

A Schedule K-1 is issued to taxpayers who have invested in limited partnerships (LPs) and some exchange-traded funds (ETFs). There are also K-1 forms for shareholders in S-Corporations and beneficiaries of estates or trusts.

What is line 20 on Schedule k1?

Line 20. Other information reported on Schedule K-1 (EL-1065), column A, line 20, is information used by the partner to determine income included on an income line of the partner's Form 1040 (lines 7 to 21). An example of is recapture of a section 179 deduction.

Can I fill out my own K-1?

How do I file my own Schedule K-1 form? You can file your Schedule K-1 form when you submit your Form 1065 or 1120S to the IRS. The easiest thing to do is to submit the form electronically by using IRS Free File or tax prep software. You can also file the form by mail.

What is code 20N on partnership k1?

Schedule K-1 line 20N is the partner's share of the amount allowed on page 1 of the 1065 as a deduction. The disallowed portion appears on Schedule K-1 line 13k.

What is required to be reported on Schedule K-1?

Schedule K-1 requires the business entity to track each participant's basis or ownership stake in the enterprise. Several different types of income can be reported on Schedule K-1. Schedule K-1s should be issued to taxpayers no later than Mar. 15 or the third month after the end of the entity's fiscal year.

How do I fill out a k1 schedule?

3:15 9:04 How to Fill out Schedule K-1 (IRS Form 1065) - YouTube YouTube Start of suggested clip End of suggested clip In the day-to-day functions of the business a limited partner is someone who invests in the businessMoreIn the day-to-day functions of the business a limited partner is someone who invests in the business. But does not participate actively in day-to-day decision-making.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit HI DoT N-20 - Schedule K-1 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing HI DoT N-20 - Schedule K-1 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit HI DoT N-20 - Schedule K-1 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share HI DoT N-20 - Schedule K-1 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How can I fill out HI DoT N-20 - Schedule K-1 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your HI DoT N-20 - Schedule K-1, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is HI DoT N-20 - Schedule K-1?

HI DoT N-20 - Schedule K-1 is a tax form used in Hawaii for partnerships and certain entities to report the income, deductions, and credits allocated to each partner or member.

Who is required to file HI DoT N-20 - Schedule K-1?

Entities that are classified as partnerships, including limited liability companies (LLCs) treated as partnerships, are required to file HI DoT N-20 - Schedule K-1 for their partners or members.

How to fill out HI DoT N-20 - Schedule K-1?

To fill out HI DoT N-20 - Schedule K-1, gather all necessary financial information from the partnership's tax return, including income, deductions, and credits. Complete the form by entering the partner's information, their share of the profit or loss, and any other required contributions or distributions.

What is the purpose of HI DoT N-20 - Schedule K-1?

The purpose of HI DoT N-20 - Schedule K-1 is to report each partner's share of the partnership's income, deductions, and credits to ensure accurate tax reporting and compliance based on the partner's ownership interest.

What information must be reported on HI DoT N-20 - Schedule K-1?

The information that must be reported on HI DoT N-20 - Schedule K-1 includes the partner's name and address, their ownership percentage, distributive share of income, deductions, and credits, as well as any other relevant financial details specific to the partner's interest in the partnership.

Fill out your HI DoT N-20 - Schedule K-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI DoT N-20 - Schedule K-1 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.