PG Form TIN1 2014 free printable template

Show details

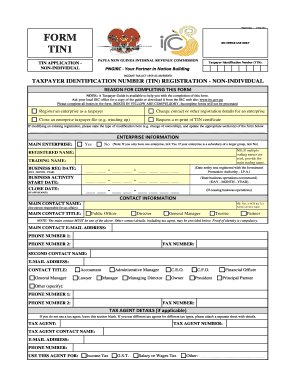

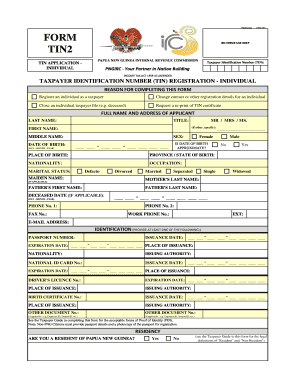

FORM TIN1 PLACE SIGMAS BAR CODE HERE Papua New Guinea INTERNAL REVENUE COMMISSION TIN APPLICATION INDIVIDUAL Taxpayer Identification Number (TIN): PNG IRC Your Partner in Nation Building Effective

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign PG Form TIN1

Edit your PG Form TIN1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PG Form TIN1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PG Form TIN1 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PG Form TIN1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PG Form TIN1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PG Form TIN1

How to fill out PG Form TIN1

01

Start by downloading the PG Form TIN1 from the official website or obtain a physical copy.

02

Fill in your personal information at the top of the form, including your full name, address, and contact information.

03

Provide your Tax Identification Number (TIN) if you have one; if not, indicate that you are applying for a TIN.

04

Specify the purpose for which you need the TIN in the designated section.

05

Attach any required documents that support your application, such as proof of identity or residency.

06

Review all the information filled out to ensure accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form either online (if applicable) or send it to the designated authority via mail.

Who needs PG Form TIN1?

01

Individuals who are applying for a Tax Identification Number (TIN).

02

Business owners who need a TIN for tax-related purposes.

03

Foreign nationals needing to comply with local tax regulations.

04

Anyone required by law to provide a TIN for financial transactions.

Fill

form

: Try Risk Free

People Also Ask about

How can I get my ITIN number immediately?

You can call the IRS toll-free at 800-829-1040 if you are in the United States or 267-941-1000 (not a toll-free number) if you are outside the United States.

How do I find my TIN?

The U.S. Taxpayer Identification Number may be found on a number of documents, including tax returns and forms filed with the IRS, and in the case of an SSN, on a social security card issued by the Social Security Administration.

How can I get my TIN number online PNG?

Get your Tax Identification Number (TIN) from the Internal Revenue Commission (IRC) After registering your business at IPA and getting your certificate of incorporation, what you need next is your TIN from IRC. Go down to Revenue House in down town Port Moresby and pick up a TIN Application form.

How do I get a TIN from the IRS?

You can use the IRS's Interactive Tax Assistant tool to help determine if you should file an application to receive an Individual Taxpayer Identification Number (ITIN). To obtain an ITIN, you must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number.

How long does it take to get an ITIN number 2022?

Q11: How long does it take to get an ITIN? A11: If you qualify for an ITIN and your application is complete, you will receive a letter from the IRS assigning your tax identification number usually within seven weeks (up to 11 weeks if requested during peak tax time (January 15 through April 30) or from abroad).

What is the purpose of IRC in PNG?

Income tax was first levied in PNG in 1959. The power to levy income tax is one given solely to the National Government by the Constitution. The Internal Revenue Commission (“IRC”) and PNG Customs are responsible for the collection of most of PNG's taxation revenue.

How do I get a TIN form?

TIN Number Requirements BIR Form 1904 (Application for Registration for One-Time Taxpayer and Person Registering under E.O. 98) Valid government-issued ID (e.g., birth certificate, passport, driver's license, etc.) Marriage certificate (for married women) For OFWs: Employment contract.

What is the requirements for BIR?

Register your business in the Bureau of Internal Revenue (BIR) DTI Certificate of Registration. Barangay Business Clearance. Mayor's Permit. Certificate of Lease (if the place is rented) or Certificate of Land Title (if owned) Government-issued identification (Passport, Driver's License, Birth Certificate, etc.

How do I get a UK TIN?

If a person resides regularly in the UK they will automatically have a NINO allocated to them or can be issued with one on request. A young adult about to turn 16 will be automatically issued with their own NINO, which will be used on a range of official documents for the rest of their life.

Can I get TIN through online?

You can apply for a TIN online, but if you want to get a TIN ID card, you still have to visit your respective RDO to claim it. BIR allows you to apply via the New Business Registration (NewBizReg) Portal. Follow the instructions, and once you already have a TIN, claim the card on the assigned date.

How can I get TIN ID Online 2022?

Visit the revenue district office (RDO) in charge of collecting your taxes in the area where you live. Complete and submit BIR Form 1904 in two copies. Submit all of the necessary paperwork. Wait for your TIN to be processed, and then apply for a TIN ID card thereafter.

How can I get a copy of my ITIN number online?

What Do You Do If You Lose Your ITIN Number? Call the IRS toll-free helpline on 800-829-1040. Answer the security questions to verify your identity. Follow the instructions to receive your ITIN.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit PG Form TIN1 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing PG Form TIN1 right away.

Can I edit PG Form TIN1 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like PG Form TIN1. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I fill out PG Form TIN1 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your PG Form TIN1. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is PG Form TIN1?

PG Form TIN1 is a tax form used for reporting taxpayer identification numbers (TINs) for individuals or entities in certain jurisdictions.

Who is required to file PG Form TIN1?

Individuals or entities that are required to report their taxpayer identification numbers to tax authorities must file PG Form TIN1.

How to fill out PG Form TIN1?

To fill out PG Form TIN1, you need to provide accurate identification details, including name, address, and taxpayer identification number, following the instructions provided on the form.

What is the purpose of PG Form TIN1?

The purpose of PG Form TIN1 is to ensure accurate reporting of taxpayer identification numbers to help in tax compliance and record-keeping.

What information must be reported on PG Form TIN1?

The information that must be reported on PG Form TIN1 includes the taxpayer's name, address, and taxpayer identification number (TIN).

Fill out your PG Form TIN1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PG Form tin1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.