Get the free visit the nearest axis bank branch and collect details sign the form using your authorized signature

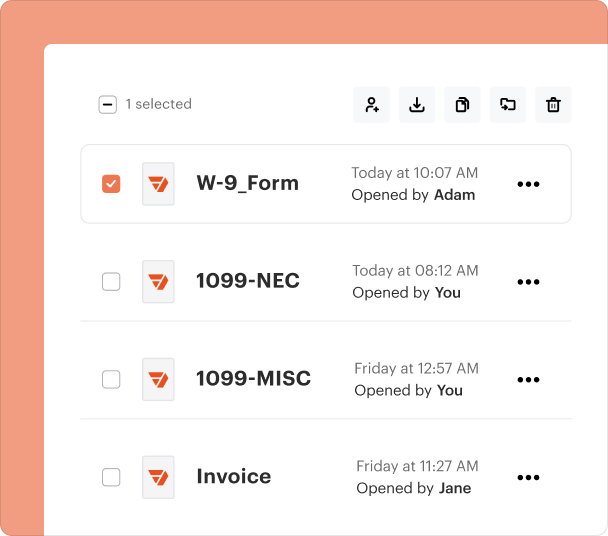

Fill out, sign, and share forms from a single PDF platform

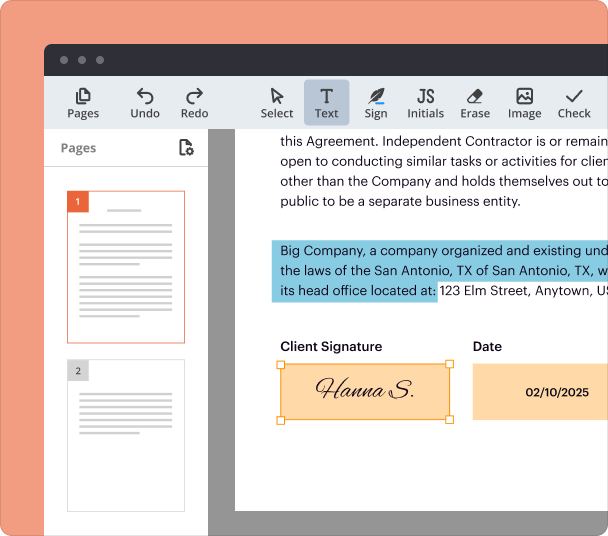

Edit and sign in one place

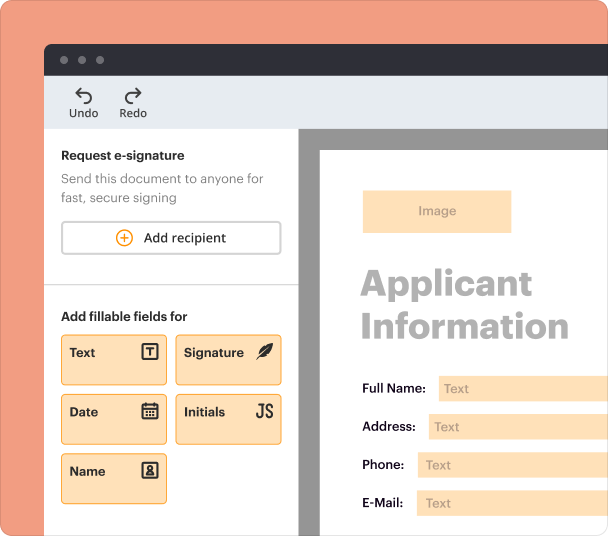

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding the Axis Bank Signature Verification Form

Overview of the Axis Bank Signature Verification Form

The Axis Bank signature verification form is a crucial document used by customers to authenticate their identity when initiating specific banking services. This form plays a significant role in transactions that require confirmation of a customer's signature, ensuring that only authorized individuals can perform transactions and access banking services.

Key Features of the Axis Bank Signature Verification Form

This form includes essential details that aid in verifying signatures linked to a customer's account. Key features involve spaces for the customer's name, account number, customer ID, and Aadhaar number. The form also includes sections for branch certification and customer signature or thumb impression, which are vital for authenticating requests.

Eligibility Criteria for the Axis Bank Signature Verification Form

To complete the signature verification form, a customer must be an account holder with Axis Bank. It is necessary to provide accurate identification details, including the Aadhaar number and other relevant personal information, to ensure the verification process is seamless.

How to Fill the Axis Bank Signature Verification Form

Filling out the Axis Bank signature verification form requires careful attention to detail. Customers should start by entering their name, account number, and customer ID in the designated sections. Next, they need to provide their Aadhaar number, ensuring all information is accurate to avoid delays. Finally, the form must be signed or accompanied by a thumb impression, as appropriate.

Common Errors and Troubleshooting

While completing the signature verification form, common errors include misspelling names or providing incorrect account details. It is crucial to double-check all entries before submission. Customers should ensure all required fields are filled out appropriately to prevent delays in processing their requests.

Benefits of Using the Axis Bank Signature Verification Form

Utilizing the Axis Bank signature verification form enhances security in banking transactions. It offers a standardized method of confirming identity, thus protecting against fraud. By ensuring that only individuals with accurate and verified information can conduct banking operations, the form significantly contributes to the overall integrity of banking processes.

Frequently Asked Questions about axis bank signature verification form

What is the purpose of the Axis Bank signature verification form?

The Axis Bank signature verification form is used to verify a customer's identity through signature authentication during specific banking transactions.

What information is required to fill out the form?

Customers need to provide their name, account number, customer ID, Aadhaar number, and a signature or thumb impression.

How can I avoid mistakes on the signature verification form?

Double-check all entries for accuracy, and ensure all required fields are filled appropriately before submission.

Who needs to fill out the Axis Bank signature verification form?

Any customer of Axis Bank who is initiating a transaction that requires signature verification must complete this form.

pdfFiller scores top ratings on review platforms