Get the free TEXAS EMPLOYER NEW HIRE REPORTING PROGRAM

Show details

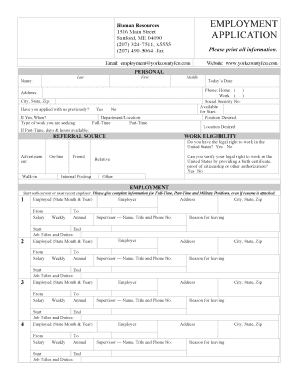

This document is used for employers in Texas to report new hires to the state. It requires completion of various employer and employee information fields and must be submitted within 20 calendar days

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign texas employer new hire

Edit your texas employer new hire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas employer new hire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas employer new hire online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit texas employer new hire. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas employer new hire

How to fill out TEXAS EMPLOYER NEW HIRE REPORTING PROGRAM

01

Obtain the Texas Employer New Hire Reporting Form from the Texas Workforce Commission website or through your employer resources.

02

Fill in the employer details, including the company name, address, and Federal Employer Identification Number (FEIN).

03

Provide employee information, such as the new hire's name, address, date of birth, and Social Security Number (SSN).

04

Include the employee's start date in the designated field.

05

Sign and date the form as the employer or authorized representative.

06

Submit the completed form to the Texas Workforce Commission within 20 days of the employee's start date via mail, fax, or online submission.

Who needs TEXAS EMPLOYER NEW HIRE REPORTING PROGRAM?

01

All employers in Texas who hire new employees must complete the Texas Employer New Hire Reporting Program.

02

Employers who are required to report employee information to assist in child support enforcement and other state requirements.

Fill

form

: Try Risk Free

People Also Ask about

Does Texas require new hire reporting?

Employers must report new hires and rehires within 20 calendar days of the hire date. If you report electronically, you must report 12 to 16 days apart, which is about twice a month.

What do I need to hire an employee in Texas?

3. Hire and onboard your new employee The official offer letter. An Employee Personal Data Form. A W2 Tax Form. The I-9 Form, which proves their right to work in the United States. A Direct Deposit Authorization Form. A Federal W-4 Form. Company Workers' Compensation Insurance Policy Forms.

Does Texas have mandatory reporting?

Texas Mandatory Reporting Law This mandatory reporting applies to all individuals and is not limited to teachers or health care professionals. The law even extends to individuals whose personal communications may be otherwise privileged, such as attorneys, clergy members, and health care professionals.

How do I report an employer in Texas?

Where can I report workplace harassment and discrimination? If you believe that you may have been the victim of discrimination or harassment, you can contact the Equal Employment Opportunity Commission by calling 800-669-4000 or the TWC's Civil Rights Division by calling 888-452-4778 to further discuss your issues.

What new hire paperwork is needed in Texas?

Form I-9. Form I-9 is used to verify an employee's legal eligibility to work in the United States of America. Section one must be completed by the employee on or before the first day of employment. The I-9 can be completed prior to the start date, so long as an employment offer has been extended.

Do I need to report new hires in Texas?

Employers must report new hires and rehires within 20 calendar days of the hire date. If you report electronically, you must report 12 to 16 days apart, which is about twice a month. You must report all newly hired or rehired employees who live or work in any state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TEXAS EMPLOYER NEW HIRE REPORTING PROGRAM?

The Texas Employer New Hire Reporting Program is a program designed to collect information about newly hired employees to assist in the enforcement of child support obligations and to ensure compliance with various state and federal laws.

Who is required to file TEXAS EMPLOYER NEW HIRE REPORTING PROGRAM?

All employers in Texas who hire new employees or who reinstate employees after a break in employment are required to file reports with the Texas Employer New Hire Reporting Program.

How to fill out TEXAS EMPLOYER NEW HIRE REPORTING PROGRAM?

To fill out the Texas Employer New Hire Reporting Program form, employers must provide information such as the employee's name, address, Social Security number, and the employer's business information. Forms can be submitted online, by mail, or fax.

What is the purpose of TEXAS EMPLOYER NEW HIRE REPORTING PROGRAM?

The purpose of the Texas Employer New Hire Reporting Program is to help locate non-custodial parents who owe child support, to improve child support collections, and to facilitate assistance programs by ensuring accurate and timely reporting of new hires.

What information must be reported on TEXAS EMPLOYER NEW HIRE REPORTING PROGRAM?

Employers must report the employee's full name, address, Social Security number, date of hire, and the employer's name, address, and Federal Employer Identification Number (FEIN).

Fill out your texas employer new hire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Employer New Hire is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.