Get the free Business Loan Application Form

Show details

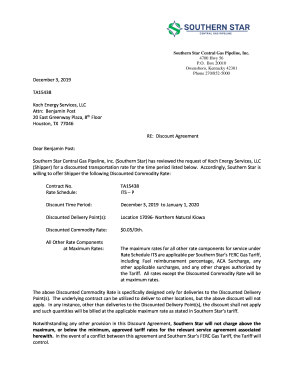

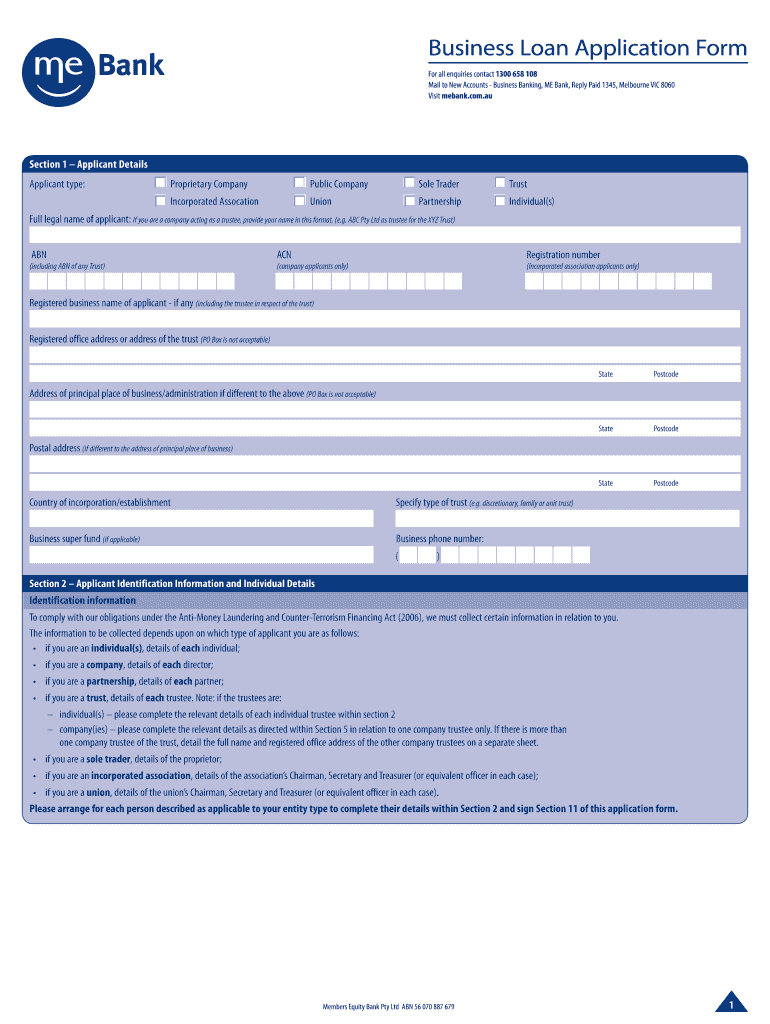

Este formulario está diseñado para que las empresas soliciten un préstamo comercial a ME Bank, requiriendo información detallada sobre el solicitante, la estructura de la empresa, la identificación

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business loan application form

Edit your business loan application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business loan application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

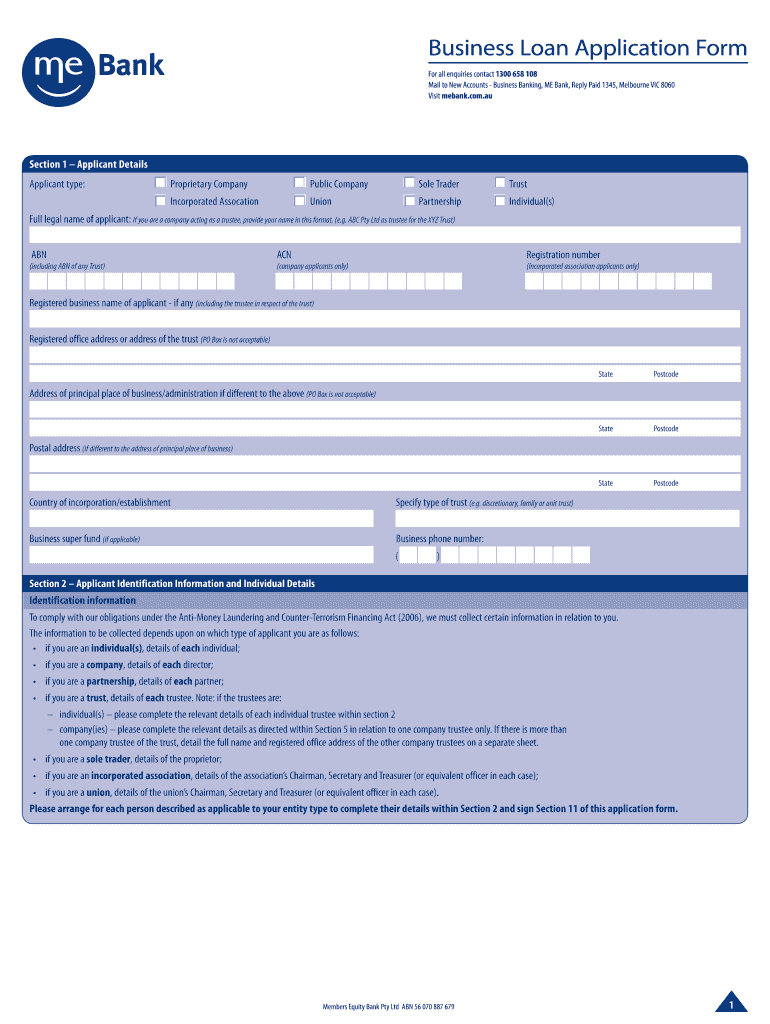

Editing business loan application form online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business loan application form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

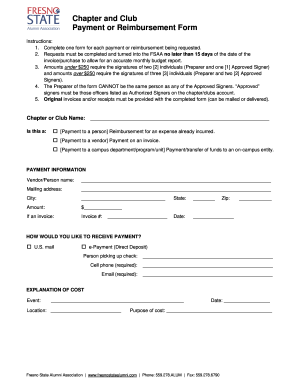

How to fill out business loan application form

How to fill out Business Loan Application Form

01

Start by downloading the Business Loan Application Form from the lender's website or obtain a physical copy.

02

Fill in the business information section, including the name, address, and contact details of your business.

03

Provide details about the owner(s) of the business, including their names, addresses, and social security numbers.

04

Describe the nature of your business, including the industry, type of products or services offered, and target market.

05

State the purpose of the loan, specifying how much money you are requesting and how it will be used.

06

Include financial information, such as your business's annual revenue, expenses, and existing debts.

07

Attach necessary documents like your business plan, tax returns, and financial statements if required.

08

Review all the information for accuracy and completeness before submitting the application.

09

Sign and date the application form.

Who needs Business Loan Application Form?

01

Small business owners looking for funding to expand their operations.

02

Entrepreneurs starting a new business who need capital to get off the ground.

03

Established businesses looking to purchase equipment or inventory.

04

Companies needing cash flow support for ongoing operations or expenses.

05

Business owners seeking to consolidate debt or refinance existing loans.

Fill

form

: Try Risk Free

People Also Ask about

Can a start-up LLC get a loan?

Yes, you can get a business loan with an LLC. Business lenders provide loans to LLCs, sole proprietors, and corporations. More information about business loans is available in my biography description.

Can a start-up LLC get a loan?

Yes, you can get a business loan with an LLC. Business lenders provide loans to LLCs, sole proprietors, and corporations. More information about business loans is available in my biography description.

How do I write a simple loan application?

Helpful Tips for Writing a Loan Request Letter Be Clear About Your Purpose. Money lenders appreciate knowing exactly why you need funds. Provide Complete Contact Information. Mention Your Repayment Plan. Keep It Professional. Attach Supporting Documents.

What paperwork is needed for a business loan?

You will likely need your balance sheet, income and cash flow statements, financial projections and a business plan to apply for a bank loan. You will also need to provide some personal information like your Social Security Number as well as your articles of formation and Employer Identification Number.

How to write a letter for a business loan?

Salutation: Use a formal greeting (eg, ``Dear (Recipient's Name),''). Introduction: State your purpose for writing. Body: Provide details about your loan request (amount, purpose, repayment terms, etc.). Conclusion: Thank the recipient and express your hope for a positive response.

How to write a business loan application?

How To Write A Business Loan Application Letter? Include a header. Add a subject line. Start with a greeting. Give a summary of the request. Provide necessary business information. Explain the purpose of the business loan. Describe the plan to repay the loan. Close the letter.

How do I write a business loan proposal?

Tips to write an effective commercial loan proposal Use simple, plain language. Avoid technical terms and acronyms. Don't forget that your proposal's purpose is to show your company at its best. Sell yourself! Throughout the proposal, focus on showing why your venture will succeed. Image counts.

How to write loan application in English?

By following these steps, you can ensure that your request is well-received and considered favourably. Add Basic Information About Yourself and the Lender. Write a Clear Subject Line. Clearly State the Purpose of the Loan. Assure the Lender of Repayment. Highlight Your Creditworthiness. Include Any Collateral (If Applicable)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business Loan Application Form?

A Business Loan Application Form is a document that businesses complete to apply for financial assistance from a lender, detailing information about the business, its financials, and the intended use of the loan.

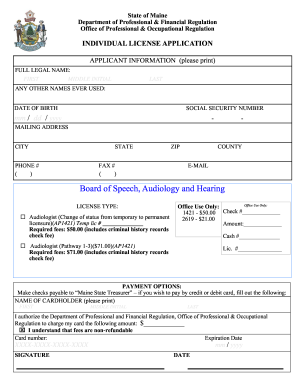

Who is required to file Business Loan Application Form?

Any business seeking financing from a bank or financial institution is required to file a Business Loan Application Form, including sole proprietorships, partnerships, and corporations.

How to fill out Business Loan Application Form?

To fill out the Business Loan Application Form, applicants should provide accurate and detailed information about the business, including ownership details, financial statements, loan amount requested, purpose of the loan, and any other required documentation.

What is the purpose of Business Loan Application Form?

The purpose of the Business Loan Application Form is to provide lenders with necessary information to assess the creditworthiness and financial health of the business, as well as the viability of the loan request.

What information must be reported on Business Loan Application Form?

The information that must be reported includes business name and address, type of business structure, financial statements, tax returns, business plan, details of collateral, and the intended purpose of the loan.

Fill out your business loan application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Loan Application Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.