OPM SF 1187 1989-2025 free printable template

Show details

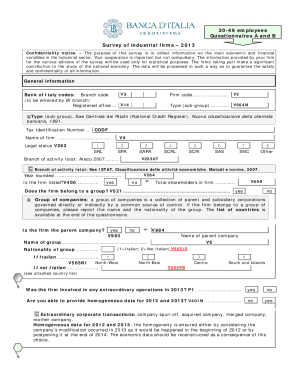

U.S. Federal Form sf-1187 REQUEST FOR PAYROLL DEDUCTIONS FOR LABOR ORGANIZATION DUES Standard Form 1187 Revised March 1989 U.S. Office of Personnel Management Privacy Act Statement Section 5525 of Title 5 United States Code Allotments and Assignments of Pay permits Federal agencies to collect this information. This completed form is used to request that labor organization dues be deducted from your pay and to notify your labor organization of the deduction. Completing this form is voluntary...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 1187 fillable form

Edit your 1187 download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standard form 1187 payroll deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1187 online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit how to 1187 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1187 online form

How to fill out OPM SF 1187

01

Obtain a copy of OPM SF 1187 from the appropriate website or office.

02

Read the instructions carefully before filling out the form.

03

Fill in your personal information, including your name, address, and Social Security number in the designated fields.

04

Indicate your agency, department, and position title on the form.

05

Check the box corresponding to your request type (e.g., retirement, life insurance).

06

Specify the information regarding your beneficiaries, if applicable.

07

Sign and date the form to certify the accuracy of the information provided.

08

Submit the completed form to your agency's personnel or benefits office as instructed.

Who needs OPM SF 1187?

01

Federal employees participating in specific benefit programs.

02

Employees looking to enroll in retirement or life insurance plans.

03

Those who need to designate beneficiaries for benefits.

Fill

1187 regulation

: Try Risk Free

People Also Ask about how to 1187 fillable

How do I cancel USPS union dues?

Active dues-withholding NAPS members must submit the PS Form 1188 to USPS HRSSC (Human Resources & Shared Services Center) in order to cancel their membership and stop automatic dues payroll deductions. The form may be submitted at any time.

What is a Form 1187?

The 1187 form is used by federal agencies and federal payroll processors to assign membership to the correct employee and initiate withdrawal of bi-weekly membership dues.

Are union dues tax deductible 2023?

Can I Deduct Union Dues Now? Tax reform changed the rules of union due deductions. For tax years 2018 through 2025, union dues – and all employee expenses – are no longer deductible, even if the employee can itemize deductions.

Are union dues pre tax deductions?

These were expenses paid by W-2 employees while performing their jobs, and they could be written off at tax time. The Tax Cuts and Jobs Act (TCJA) of 2017 put a stop to that. Thanks to this law, W-2 employees can no longer deduct their business expenses for the tax years 2018 to 2025 — including union dues.

Did Saladin lose to King Baldwin?

Baldwin IV, outnumbered, inexperienced, suffering leprosy, and only 16 years old, defeated Saladin who, ing to the chronicler William of Tyre (l. 1130-1186), only escaped capture by fleeing the field on a camel. His defeat resulted in a loss of prestige, which he then needed to win back.

Who defeated Saladin?

On this day, September 7, 1191, an army led by England's King Richard the Lionheart conquered the seaside town of Arsuf from the forces of Saladin.

How did Baldwin defeat Saladin?

In November 1177 Saladin marched from Egypt to attack Ascalon, and Baldwin rushed to the aid of the city. Trapped within its fortifications, he broke out and defeated Saladin near Mont Gisard.

What major event happened in 1187?

Battle of Ḥaṭṭīn, (July 4, 1187), battle in northern Palestine that marked the defeat and annihilation of the Christian Crusader armies of Guy de Lusignan, king of Jerusalem (reigned 1186–92), by the Muslim forces of Saladin.

Was Saladin ever defeated?

From 1189 to 1192, Saladin lost Acre and Jaffa and was defeated in the field at Arsūf. The Crusaders retreated to Europe without seizing Jerusalem, but Saladin's military reputation had been damaged. He died in 1193.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify labor my cancellation without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your labor cancellation identification into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the organization payroll cancellation electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your labor form cancellation in seconds.

Can I edit agency form dues online on an iOS device?

Use the pdfFiller mobile app to create, edit, and share agency form dues from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is OPM SF 1187?

OPM SF 1187 is a form used by federal employees to request a change in their retirement plan or to elect immediate retirement.

Who is required to file OPM SF 1187?

Federal employees who wish to change their retirement plan or elect immediate retirement are required to file OPM SF 1187.

How to fill out OPM SF 1187?

To fill out OPM SF 1187, employees need to provide their personal information, select the appropriate retirement plan options, and sign the form before submitting it to their human resources office.

What is the purpose of OPM SF 1187?

The purpose of OPM SF 1187 is to facilitate the process for federal employees to change their retirement plan or elect immediate retirement, ensuring that the correct information is submitted for processing.

What information must be reported on OPM SF 1187?

OPM SF 1187 requires employees to report personal information such as name, social security number, contact information, and details regarding their current and desired retirement plans.

Fill out your standard form 1187 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trial Standard Form 1187 Payroll Deduction is not the form you're looking for?Search for another form here.

Keywords relevant to dues employee identification template

Related to labor cancellation named form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.