Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

There is no specific information available about FSA 578. It is possible that you may be referring to a specific document, form, or regulation that is relevant to a certain field or organization. Without more context, it is difficult to provide a precise answer.

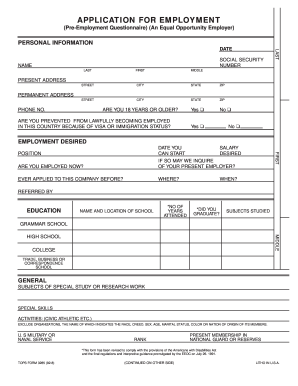

Who is required to file fsa 578?

The FSA 578 form is typically filed by farmers or ranchers who receive a farm loan or are participating in Farm Service Agency (FSA) programs.

Form FSA 578, Report of Disposition of County-Owned Personal Property, is used to record any sale, transfer, or other disposition of personal property that is owned by a county or a county subdivision. Here are the steps to fill out the form:

1. Identify the county or county subdivision that owns the personal property being disposed of. Enter the name of the county or subdivision in the "County/Subdivision" field at the top of the form.

2. Provide the date of the report in the "Date" field. This is the date on which the report is being filled out.

3. In the "Page of" field, enter the page number and the total number of pages in the report. For example, if it is the first page of a three-page report, enter "1 of 3".

4. Next, provide a brief description of the personal property being disposed of in the "Description" field. This should include enough information to identify the item or items being disposed of, such as type, model, brand, or any unique identifiers.

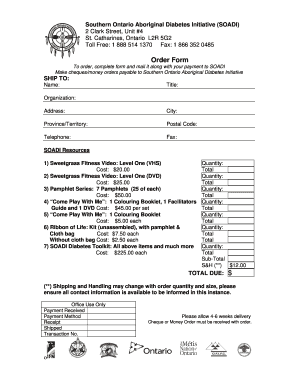

5. Specify the quantity of the personal property being disposed of in the "Quantity" field. This could be the number of individual items or the total amount of a bulk sale, for example.

6. Enter the net book value of the property in the "Net Book Value" field. This is the value of the property after depreciation and can be found in your accounting records.

7. If there were any proceeds received from the disposal, enter the amount in the "Proceeds" field. This would typically be the amount of money received from a sale or any other form of compensation.

8. Indicate the method of disposition by marking the appropriate box in the "Disposal Method" section. This could be "Sale," "Transfer," "Trade-In," or any other applicable option.

9. If the personal property was sold, provide the name of the buyer or recipient in the "Buyer/Recipient" field. If the property was transferred or traded, enter the name of the recipient or the entity involved in the transaction.

10. Finally, provide any additional remarks, comments, or explanations in the "Remarks" field if necessary.

Once you have completed all the required fields, review the form for accuracy and ensure that all information is correct. Sign and date the form, then submit it to the appropriate authority or department as per your organization's processes.

What is the purpose of fsa 578?

FSA 578 is a form used to report farm income and expenses for tax purposes. Its purpose is to provide the necessary information to accurately calculate the tax liability of farmers and ranchers. This form allows farmers to report their gross income, deductible expenses, and calculates the net income or loss from farming operations. It is used by the Internal Revenue Service (IRS) to ensure compliance with tax laws and regulations.

What information must be reported on fsa 578?

The Farm Service Agency (FSA) Form 578, commonly known as the Report of Acreage, is used to report the details of the farm and land usage for each crop or commodity grown on a particular farm. The information that must be reported on FSA 578 includes:

1. Name and address of the operator or producer reporting the acreage.

2. Farm Serial Number (FSN) or Farm and Tract Numbers for the specific land being reported.

3. Field or tract number where the crop or commodity is being grown.

4. Crop or commodity being planted, such as wheat, corn, soybeans, etc.

5. The intended use of the crop, whether it is for grain, hay, pasture, seed, etc.

6. Number of acres or quantity of the crop being planted.

7. Cropping practices, such as whether it is irrigated, dryland, organic, etc.

8. The planting and harvesting dates for the crop.

9. Status of the land, whether it is owned, rented, or leased.

10. Any cover crops planted on the reported acreage.

This information helps the FSA maintain accurate and up-to-date data on the acreage and crop production in the United States, which is important for various agricultural and economic analyses, government programs, and policy decisions.

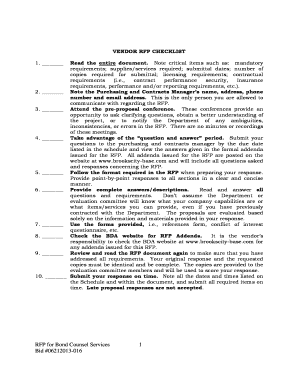

How do I execute file pdf online?

pdfFiller has made it easy to fill out and sign fsa 578 form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit fsa 578 manual in Chrome?

Install the pdfFiller Google Chrome Extension to edit what is a 578 form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit fsa 578 codes straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing fsa 578 example form, you can start right away.