Get the free commercial liability umbrella

Show details

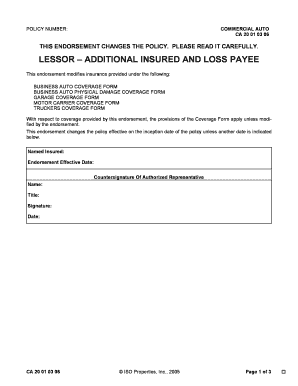

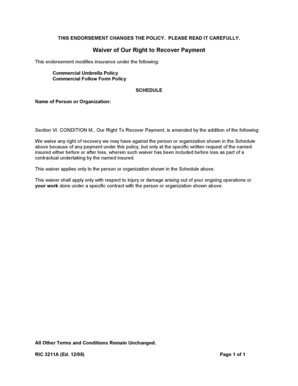

This document is an endorsement for a commercial liability umbrella policy, modifying coverage to include a lessor as an additional insured and loss payee.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loss payable endorsement form

Edit your commercial liability umbrella form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial liability umbrella form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loss payee endorsement pdf online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit loss payee endorsement pdf. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial liability umbrella

How to fill out commercial liability umbrella

01

Obtain the commercial liability umbrella form from your insurance provider.

02

Fill in the basic information, including your business name, address, and contact details.

03

Provide details about your primary insurance policies (e.g., general liability, auto liability).

04

Indicate the coverage limits you desire for the umbrella policy.

05

Complete any required questionnaires about the nature of your business and operations.

06

Review any optional coverages or endorsements that may apply.

07

Submit the completed form to your insurance agent for review.

08

Pay the applicable premiums once your policy is approved.

Who needs commercial liability umbrella?

01

Businesses that have significant assets to protect from potential lawsuits.

02

Companies that engage in high-risk activities or industries.

03

Organizations looking to enhance their liability coverage beyond standard limits.

04

Commercial landlords wanting additional protection for tenant-related claims.

05

Non-profit organizations that need protection against potential legal claims.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a loss payee?

For example, if fire damage to a building was $100,000 and the loss payee owned 50% of the building, it would only receive the portion of the funds equating to its direct financial loss.

How do I add a loss payee to my policy?

How to add a loss payee to your business insurance Contact your insurance company to ask which policies are eligible for a loss payee endorsement. Make sure your business insurance coverage meets any requirements set by the loss payee. Provide the loss payee's name and contact information to your insurance company.

What is the loss payee endorsement?

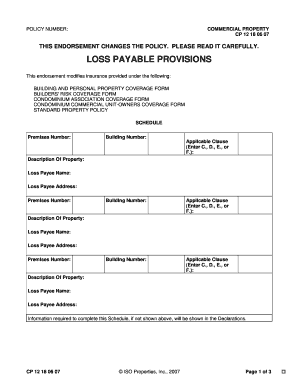

A loss payable endorsement will give the loss payee a share of the payment that is received from the insurer in the case that their insurable interest (the property that has been insured) has sustained any damage.

What is a loss payee?

What Is a Loss Payee? A loss payee is the party or entity that gets paid first in the event of a loss connected with a property in which it has a financial interest. This property is often held or used by someone other than the person who is named as the loss payee.

What is a loss payee form?

A loss payee is a third party listed on an insurance policy's declarations page that has first rights on insurance claim payments after a property loss. Why does the insured come second? Because the loss payee has an insurable interest in the property that must be protected first.

What is 438BFU endorsement?

As you know, the Lender's Loss Payable Endorsement accompanies each loan originated by a mortgage bank. This document, also known as Form 438BFU, outlines the semantics of the relationship between lenders and insurers on properties that are added into the loan portfolio of a loan servicer.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is commercial liability umbrella?

A commercial liability umbrella is an insurance policy that provides additional liability coverage over and above the limits of other business liability policies, offering extra financial protection against potential lawsuits and claims.

Who is required to file commercial liability umbrella?

Businesses that have significant assets, higher risk profiles, or those that want additional protection beyond standard liability coverage are typically advised to file for a commercial liability umbrella policy.

How to fill out commercial liability umbrella?

To fill out a commercial liability umbrella application, businesses usually need to provide information regarding their existing liability policies, detail their operations, disclose any past claims, and outline their desired coverage limits.

What is the purpose of commercial liability umbrella?

The purpose of a commercial liability umbrella is to protect businesses from large claims and lawsuits by providing a safety net of additional coverage, thus safeguarding their financial stability.

What information must be reported on commercial liability umbrella?

Information that must be reported includes existing policy details, types of business activities, history of claims, current coverage limits, and information regarding assets and employees.

Fill out your commercial liability umbrella online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loss Payee Endorsement Pdf is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.