Get the free Form ET-706: September 2004, New York State Estate ... - FormSend

Show details

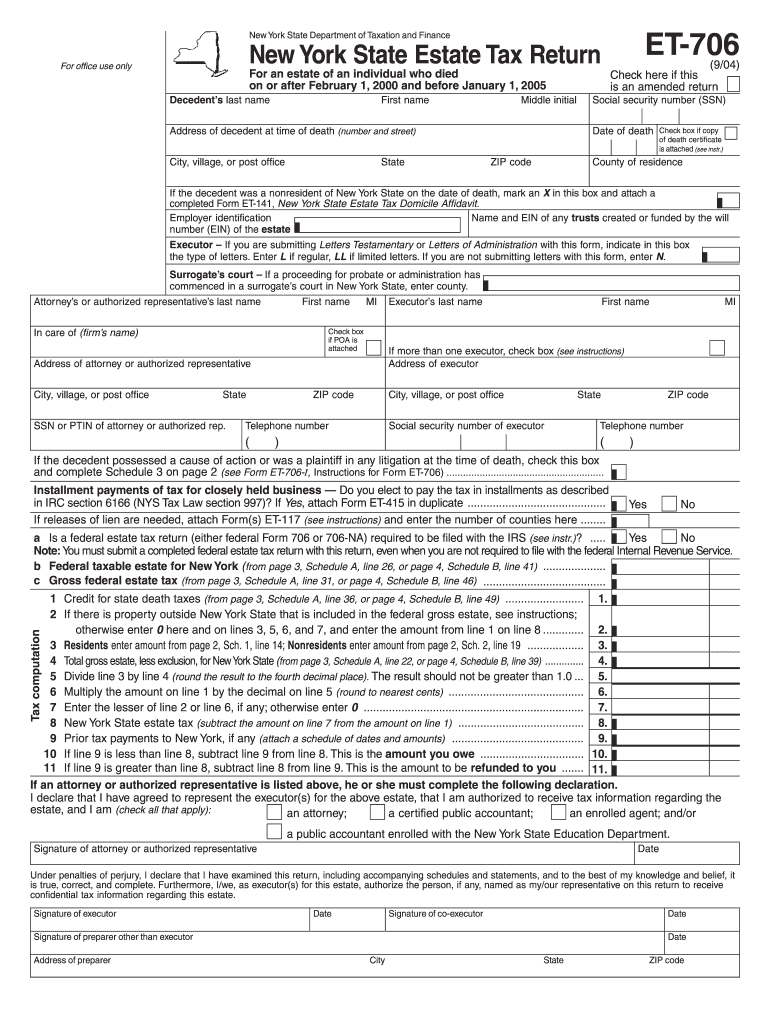

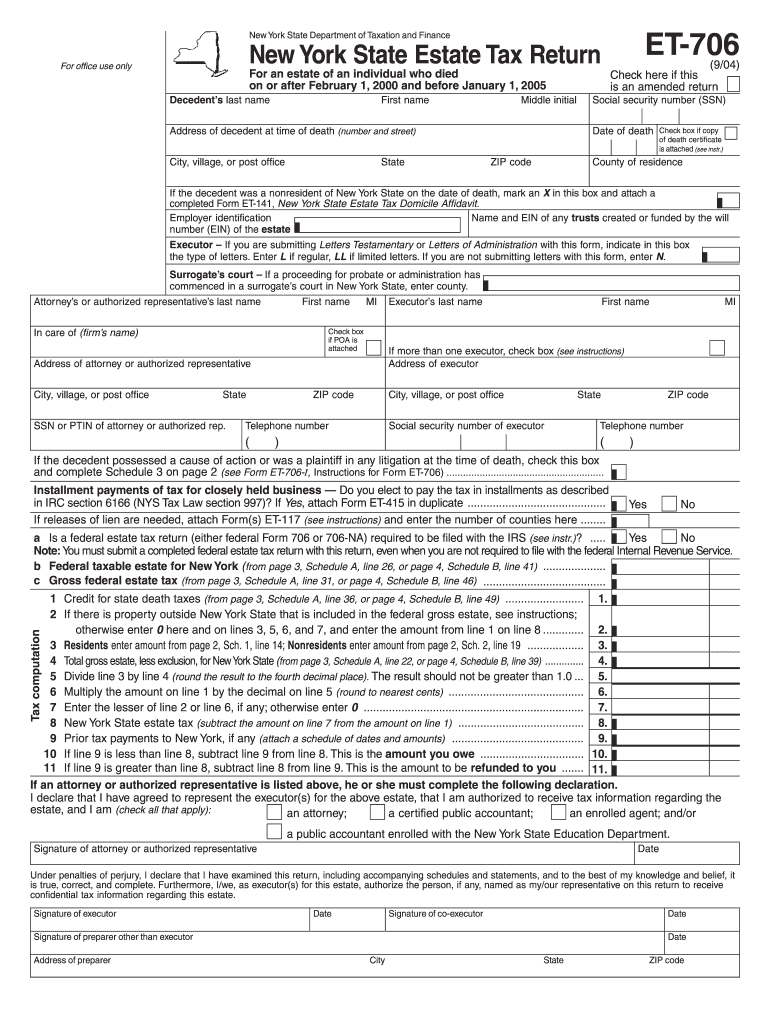

New York State Department of Taxation and Finance ET-706 New York State Estate Tax Return For office use only (9/04) Check here if this is an amended return For an estate of an individual who died

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form et-706 september 2004

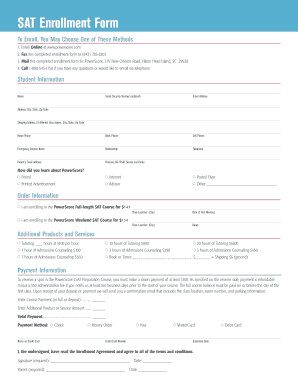

Edit your form et-706 september 2004 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form et-706 september 2004 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form et-706 september 2004 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form et-706 september 2004. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form et-706 september 2004

How to fill out NY DTF ET-706

01

Gather all necessary personal information including your name, address, and Social Security number.

02

Obtain any required documentation related to your tax situation or financial records.

03

Start filling out the form by following the specified sections: income, deductions, and credits.

04

Carefully read the instructions provided on the form to understand which boxes to check and what information to include.

05

Double-check all entries for accuracy and completeness before submitting the form.

06

Sign and date the form as required.

07

Submit the completed NY DTF ET-706 form to the appropriate tax authority via mail or electronically as instructed.

Who needs NY DTF ET-706?

01

Individuals who are beneficiaries of an estate or trust in New York.

02

Executors or administrators of an estate who need to report income and taxes.

03

Anyone required to file for the estate or trust for compliance with New York tax laws.

Fill

form

: Try Risk Free

People Also Ask about

Do I file Form 706 or Form 1041?

Form 1041 is used to report income taxes for both trusts and estates (not to be confused with Form 706, used when filing an estate tax return).

Does an estate need to file Form 706?

An estate tax return (Form 706) must be filed if the gross estate of the decedent (who is a U.S. citizen or resident), increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the decedent's death, as shown in the table below.

What is the due date for a decedent's final tax return?

The Internal Revenue Service generally gives you until April 15 of the year following the taxpayer's death to file a final 1040 form. If the deceased was married, a surviving spouse has the option to file a final joint federal tax return for the last year in which the deceased lived.

Is Form 706 is due 6 months after decedent's date of death?

You must file Form 706 to report estate and/or GST tax within 9 months after the date of the decedent's death. If you are unable to file Form 706 by the due date, you may receive an extension of time to file.

What is the due date of 706 estate return?

When to File. Generally, the estate tax return is due nine months after the date of death. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. The gift tax return is due on April 15th following the year in which the gift is made.

How many months after your death is the federal estate tax due?

The due date of the estate tax return is nine months after the decedent's date of death, however, the estate's representative may request an extension of time to file the return for up to six months.

What's the difference between estate tax and inheritance tax?

Estate and inheritance taxes are taxes levied on the transfer of property at death. An estate tax is levied on the estate of the deceased while an inheritance tax is levied on the heirs of the deceased.

Does a beneficiary have to pay federal taxes?

Generally, beneficiaries do not pay income tax on money or property that they inherit, but there are exceptions for retirement accounts, life insurance proceeds, and savings bond interest. Money inherited from a 401(k), 403(b), or IRA is taxable if that money was tax deductible when it was contributed.

Do beneficiaries pay federal taxes on estate distributions?

Once the executor of the estate has divided up the assets and distributed them to the beneficiaries, the inheritance tax comes into play. The amount of tax is calculated separately for each individual beneficiary, and the beneficiary has to pay the tax.

What is the estate exemption for 2004?

The exemption amount for estates increased from $675,000 for 2001 deaths to $1.0 million for 2002 deaths to $1.5 million for 2004 deaths (Figure A). The exemption increased to $2.0 million for 2006 deaths and will rise to $3.5 million for 2009 deaths. For 2010 deaths, no estate tax will apply.

Is the distribution from an estate taxable to the beneficiary?

The fiduciary distributes the income and assets of the trust or estate in ance with the terms of the trust or will. Income required to be distributed to the beneficiaries is taxable to them regardless if it is distributed during the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form et-706 september 2004 online?

Filling out and eSigning form et-706 september 2004 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit form et-706 september 2004 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign form et-706 september 2004 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Can I edit form et-706 september 2004 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute form et-706 september 2004 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is NY DTF ET-706?

NY DTF ET-706 is a tax form used by certain entities in New York State to report and pay the New York State excise tax on certain types of entertainment, specifically for live performances and events.

Who is required to file NY DTF ET-706?

Entities such as promoters, producers, and venues that host live entertainment events with admission fees are required to file NY DTF ET-706 if their events fall under the applicable tax regulations.

How to fill out NY DTF ET-706?

To fill out NY DTF ET-706, you need to provide details about the event including the name of the event, date, location, and admission fees collected, as well as calculate the appropriate excise tax based on the total admissions.

What is the purpose of NY DTF ET-706?

The purpose of NY DTF ET-706 is to ensure compliance with New York State excise tax laws on entertainment events, allowing the state to collect taxes on revenue generated from these activities.

What information must be reported on NY DTF ET-706?

The information required on NY DTF ET-706 includes the event details (name, date, location), the total number of admissions sold, the admission fees charged, the total gross receipts, and the calculated excise tax owed.

Fill out your form et-706 september 2004 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Et-706 September 2004 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.