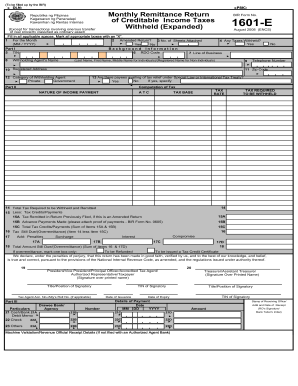

What is BIR Form 2550M?

BIR Form 2550M is called the Monthly Value-Added Tax Declaration. If you are a VAT-registered individual, you must file this declaration in triplicate. If you failed to register as a VAT, you still must complete and submit this form. The above-mentioned taxpayers must fill in this document as long as the registration for VAT is not canceled even if there were no taxable transactions during 30 days or if the general receipt for a year did not exceed the amount of £1,500,000.00.

What is BIR Form 2550M for?

BIR Form 2550M is designed to declare the value-added tax on monthly basis.

When is BIR Form 2550M Due?

Large and non-large taxpayers must file this declaration not later than the twentieth day following the end of the month. As far as there are several taxation groups, the due date is different. For group A, the deadline is 25 days following the end of the month, for group B — 24 days, for group — — 23 days, for group D — 22 days, and for group E — 21 days.

Is BIR Form 2550M Accompanied by Other Documents?

There are three documents you must attach to the Monthly Value-Added Tax Declaration. They are the duly issued certificate of creditable VAT withheld at source, tax compliance certificate and tax debit memo.

How do I Fill in BIR Form 2550M?

First, you must indicate the month of your tax return. You must select the period for which you declare (in this case it is Month). The following information must be provided:

-

TIN;

-

DO code;

-

Business/occupation;

-

Taxpayer's full name (for Individuals);

-

Registered address;

-

Telephone number.

The amount of sales to government must be provided. The total output tax will be automatically figured if you file an online form.

Where do I Send BIR Form 2550M?

Send the completed declaration to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer. After that, you will be issued a Revenue Official Receipt.