India HDFC Bank Application Form ATM/Domestic Debit Card for Mandate/Power of Attorney Holders in NRE/NRO Accounts 2006 free printable template

Show details

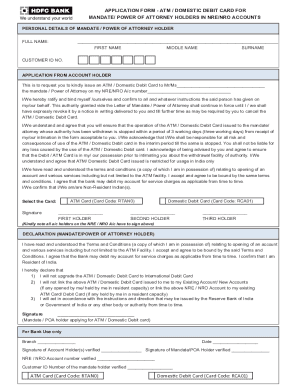

APPLICATION FORM FOR ATM CARD FOR MANDATE/ POWER OF ATTORNEY HOLDERS ON NRI ACCOUNTS PERSONAL DETAILS OF MANDATE HOLDER FULL NAME FIRST NAME MIDDLE NAME SURNAME CUSTOMER ID NO. APPLICATION FROM ACCOUNT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign India HDFC Bank Application Form ATMDomestic

Edit your India HDFC Bank Application Form ATMDomestic form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your India HDFC Bank Application Form ATMDomestic form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit India HDFC Bank Application Form ATMDomestic online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit India HDFC Bank Application Form ATMDomestic. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

India HDFC Bank Application Form ATM/Domestic Debit Card for Mandate/Power of Attorney Holders in NRE/NRO Accounts Form Versions

Version

Form Popularity

Fillable & printabley

4.8 Satisfied (123 Votes)

How to fill out India HDFC Bank Application Form ATMDomestic

How to fill out India HDFC Bank Application Form ATM/Domestic Debit

01

Gather required documents such as ID proof and address proof.

02

Visit the nearest HDFC Bank branch.

03

Request the ATM/Domestic Debit Application Form from the bank staff.

04

Fill in personal details such as name, address, and contact information in the appropriate sections.

05

Provide the required identification details including PAN number if applicable.

06

Select the type of account for which the ATM card is being requested.

07

Sign the form at the designated area and ensure all information is accurate.

08

Submit the completed application form along with the necessary documents to the bank official.

09

Receive an acknowledgment receipt for your application submission.

Who needs India HDFC Bank Application Form ATM/Domestic Debit?

01

Individuals who have an HDFC Bank savings or current account.

02

Customers who frequently make transactions and withdrawals using debit cards.

03

New account holders who want to access ATM services.

04

Anyone looking to obtain a debit card for online purchases.

Fill

form

: Try Risk Free

People Also Ask about

What is the full form of HDFC financial?

The Housing Development Finance Corporation Limited or HDFC was among the first financial institutions in India to receive an “in principle” approval from the Reserve Bank of India (RBI) to set up a bank in the private sector.

What is HDFC margin on home loan?

The margin is 20% of the property cost for loans up to Rs. 75 Lakhs and 25% of the property cost for loans above Rs. 75 Lakhs.

What are the benefits of HDFC home loan?

Features and benefits of HDFC Bank home loan Easy and transparent process; no hidden charges. Pre-approval of home loan available. Free and safe document storage. Competitive interest rates.

What is the full form of HDFC housing development?

The full form of HDFC is the Housing Development Finance Corporation. HDFC is a renowned Indian housing financial institution, mainly providing home loans to middle and low-class citizens to buy houses and builders for building projects.

Where to submit HDFC POA?

Ans: You need to submit your POA either at the nearest branch OR courier it to our customer care department. 14.

What is the full form of HDFC home loan?

Housing Development Finance Corporation Limited (HDFC) is an Indian private development finance institution based in Mumbai. It is a major housing finance provider in India.

Why POA is required in HDFC Securities?

A power of attorney (PoA) is a document that gives another person the legal authority to act on your behalf as per the terms mentioned in the document. In the case of a demat account, the PoA gives the online broker the legal authority to take certain decisions on your account.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete India HDFC Bank Application Form ATMDomestic on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your India HDFC Bank Application Form ATMDomestic. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I edit India HDFC Bank Application Form ATMDomestic on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share India HDFC Bank Application Form ATMDomestic on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I fill out India HDFC Bank Application Form ATMDomestic on an Android device?

Use the pdfFiller mobile app to complete your India HDFC Bank Application Form ATMDomestic on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is India HDFC Bank Application Form ATM/Domestic Debit?

The India HDFC Bank Application Form ATM/Domestic Debit is a document that customers need to fill out to request an ATM or domestic debit card from HDFC Bank.

Who is required to file India HDFC Bank Application Form ATM/Domestic Debit?

Individuals who wish to obtain an ATM or domestic debit card from HDFC Bank must file this application form.

How to fill out India HDFC Bank Application Form ATM/Domestic Debit?

To fill out the application form, provide the required personal details, including your name, address, contact number, account details, and any other requested information before submitting it to the bank.

What is the purpose of India HDFC Bank Application Form ATM/Domestic Debit?

The purpose of the form is to facilitate the issuance of an ATM or domestic debit card to eligible customers, allowing them to access their funds and make transactions.

What information must be reported on India HDFC Bank Application Form ATM/Domestic Debit?

The information that must be reported includes personal identification details, account number, mobile number, email address, and any other specific information required by the bank.

Fill out your India HDFC Bank Application Form ATMDomestic online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

India HDFC Bank Application Form ATMDomestic is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.