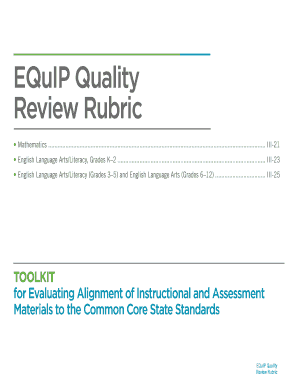

Get the free Low Income Housing Tax Credit Tax Return & Audit Preparation Guide

Show details

This guide provides comprehensive instructions for the preparation of tax returns for operating partnerships that are part of the Massachusetts Housing Equity Fund Limited Partnerships and have Low

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign low income housing tax

Edit your low income housing tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your low income housing tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit low income housing tax online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit low income housing tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out low income housing tax

How to fill out Low Income Housing Tax Credit Tax Return & Audit Preparation Guide

01

Gather all necessary financial documents and tenant information.

02

Review the eligibility requirements for your property under the Low Income Housing Tax Credit program.

03

Complete the tax return form, ensuring that all income and expenses are accurately reported.

04

Calculate the tax credits based on the qualified basis of the property and the applicable tax rates.

05

If applicable, prepare and attach supporting documents such as rent rolls, tenant income certifications, and any required schedules.

06

Double-check all entries for accuracy and completeness before submission.

07

Retain copies of the submitted forms and documents for audit purposes.

Who needs Low Income Housing Tax Credit Tax Return & Audit Preparation Guide?

01

Property owners and developers involved in the Low Income Housing Tax Credit program.

02

Tax professionals and accountants working with low-income housing projects.

03

Nonprofit organizations managing affordable housing initiatives.

04

State agencies administering the Low Income Housing Tax Credit program.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between hud and LIHTC?

While the LIHTC program requires the property to be affordable for a certain period, HUD requires the property to remain affordable permanently, so your housing affordability will not be impacted by the LIHTC program.

What are the minimum income requirements for LIHTC?

At least 20% of the units must be occupied by tenants with an income that's 50% or less of the area's median income (AMI). For example, if $50,000 is the AMI, 20% of the tenants must have an income of $25,000 or less. At least 40% of the units must be occupied by tenants with an income that's 60% or less of the AMI.

How does the low-income housing tax credit work and who does it serve?

The LIHTC gives investors a dollar-for-dollar reduction in their federal tax liability in exchange for providing financing to develop affordable rental housing. Investors' equity contribution subsidizes low-income housing development, thus allowing some units to rent at below-market rates.

What is a 50% tax credit?

You may be able to claim this credit if you contribute to the California Access Tax Credit (CATC) Fund. This fund helps provide financial aid to low-income college students. You will receive a tax credit of 50% of your contribution. This credit is available until tax year 2027.

What is the 50% test for low-income housing tax credit?

The test is to verify that 50% or more of the tax-exempt bond proceeds are used to finance the aggregate basis of any building and the land on which the building is located. Failure to meet the 50% Test is catastrophic to a low-income housing tax credit project.

What is the maximum income for low-income housing?

Eligible basis is a component of the qualified basis of an LIHC project. It is generally equal to the adjusted basis of the building, excluding land but including amenities and common areas. An existing building is a building that has been previously placed in service.

What is the eligible basis for the low income housing tax credit?

Purpose of 95/5 test is to show that a bond issue qualifies as a tax-exempt bond issue – the interest income earned by the holders of the bonds will be excluded from income for federal income tax purposes. The Test is that Qualified Costs of a project must equal or exceed 95% of the Net Bond Proceeds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Low Income Housing Tax Credit Tax Return & Audit Preparation Guide?

The Low Income Housing Tax Credit Tax Return & Audit Preparation Guide is a resource designed to assist property owners and developers in understanding and fulfilling their tax return obligations related to the Low Income Housing Tax Credit program. It outlines the necessary steps for filing the tax returns and provides guidelines for preparing for audits.

Who is required to file Low Income Housing Tax Credit Tax Return & Audit Preparation Guide?

Entities that own or operate properties that are receiving Low Income Housing Tax Credits are required to file the Low Income Housing Tax Credit Tax Return. This includes partnerships, corporations, and limited liability companies that hold ownership interests in these properties.

How to fill out Low Income Housing Tax Credit Tax Return & Audit Preparation Guide?

To fill out the Low Income Housing Tax Credit Tax Return, property owners must gather relevant financial records, complete the required forms accurately, ensuring all income, expenses, and tenant information are reported correctly. Consulting the guide for specific instructions and examples is also recommended.

What is the purpose of Low Income Housing Tax Credit Tax Return & Audit Preparation Guide?

The purpose of the Low Income Housing Tax Credit Tax Return & Audit Preparation Guide is to ensure compliance with tax laws and regulations governing the use of Low Income Housing Tax Credits. It helps in providing clear instructions on reporting requirements and preparing for audits, ultimately promoting accountability and transparency.

What information must be reported on Low Income Housing Tax Credit Tax Return & Audit Preparation Guide?

The information that must be reported includes details about the property, such as its location and the number of units, financial details, including income and expenses related to the property, tenant information that demonstrates compliance with income restrictions, and any other relevant financial documentation.

Fill out your low income housing tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Low Income Housing Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.