Get the free wage statement example

Get, Create, Make and Sign wage print out form

Editing gross wage print out online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 52 week wage statement form

How to fill out wage statement template:

Who needs wage statement template:

Video instructions and help with filling out and completing wage statement example

Instructions and Help about wage statement example form

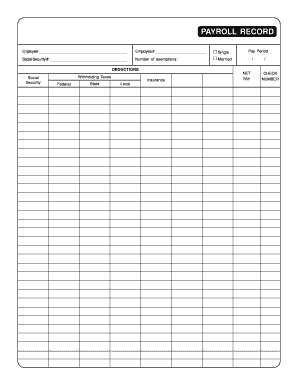

Hi there my name is Jason Perkins I'm a Georgia workers compensation attorney, and I'd like to welcome you to another edition in my Georgia workers compensation video series where I regularly provide you with helpful information about Georgia's workers compensation law today I'd like to discuss with you a document that you may receive me a workers' compensation case called a form WC dash six wage statement there's a lot of forms in Georgia's workers compensation law the form WC — 6 is a form that your employer or the insurance company files to say what wages you earn before your injury the insurance company is going to calculate what's called your average weekly wage that determines how much your weekly workers compensation benefits are in most cases your average weekly wage is based on what you made in the 13 weeks before you were injured that's basically a three-month period so the form WC — 6 wage statement lists your earnings for the 13 weeks before your injury it breaks it down week by week it's going to include what you were paid in salary if you made tips that should include that as well or if you had a per diem or bonuses or other form of earnings they should all be listed on that form WC that six wage statement the insurance company uses this to calculate an average weekly amount that you earned before your injury and then pays you either temporary total disability benefits or a later point in your case permanent partial disability benefits based on that amount you're not going to receive the full amount of your average weekly wage you're going to receive two-thirds of your average weekly wage up to a maximum of 575 a week if you suffered an injury in 2017 if your injury was before then the maximum you could receive might be lower no let's talk about that again a little more you don't necessarily receive the maximum amount you just can't receive more than the maximum amount so even if you made 1000 a week and two-thirds of your average weekly wage with 666 dot 67 cents a week the insurance company is still only going to pay you the maximum of five hundred and seventy-five dollars a week hopefully the information on the form W see that six wage statement will be accurate, but you should be able to check it against pay stubs that you have from your employer if you have those or if you don't retain those you could go to your employer and get them to provide you with that information, so you could compare it and make sure that the information reported on the form is accurate because if it wasn't accurate you might end up getting paid too low an amount by the workers' compensation insurance company in some instances the wages listed on the form will not be your wages and that's the situation where if you didn't work for your employer thirteen weeks before your injury so in other words if you have only been working there a month or two when you got hurt they will not use your wages on that form, but they'll use the wages of what's called a...

People Also Ask about

What is a pay statement?

How do I get a payroll statement?

What is required on a wage statement in BC?

What must be included on a wage statement?

What needs to be on a wage statement?

What is a wage statement?

Is a statement of earnings the same as a pay stub?

What information must appear on the wage statement?

How do you fill out a wage statement?

Is a wage statement a pay stub?

What is a wage statement also known as?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send wage statement example form to be eSigned by others?

How do I complete wage statement example form online?

Can I create an eSignature for the wage statement example form in Gmail?

What is wage statement template?

Who is required to file wage statement template?

How to fill out wage statement template?

What is the purpose of wage statement template?

What information must be reported on wage statement template?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.