Get the free rl 31

Show details

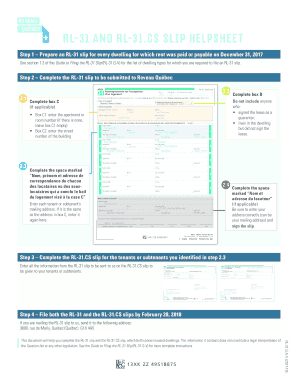

Guide to Filing the RL31 Slip Information About a Leased Dwelling www.revenuquebec.ca By issuing RL31 slips, you provide individuals with information they need to claim the solidarity tax credit.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rl 31 slip form

Edit your rl31 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your releve 31 online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rl31 form online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit releve 31 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out releve 31 slip form

How to fill out rl 31 slip pdf:

01

Download the rl 31 slip pdf form from a reliable source or request it from your employer or landlord.

02

Open the downloaded file using a PDF reader software, such as Adobe Acrobat or Preview.

03

Fill in your personal information accurately, including your full name, address, social security number, and contact details.

04

Provide the necessary information about the property, such as the address and any additional tenants.

05

In the appropriate sections, indicate the beginning and ending dates of your tenancy period.

06

If applicable, fill in the appropriate portion related to the property owner or landlord's information.

07

Double-check all the information you entered to ensure accuracy and completeness.

08

Save the filled-out form as a new PDF file or print a hard copy for submission.

Who needs rl 31 slip pdf:

01

Individuals who are renting a property in the Czech Republic are required to fill out the rl 31 slip pdf.

02

Landlords or property owners may also need the form to report rental income to the tax authorities.

03

The rl 31 slip pdf is essential for both tenants and landlords to fulfill their legal obligations regarding rental properties in the Czech Republic.

Fill

file rl31 online

: Try Risk Free

People Also Ask about rl 31 form

What is the Releve 31 in Quebec?

The Relevé 31 (RL-31) slip reports information about an eligible leased dwelling* for which rent was paid or was payable on December 31 and is filed with Revenu Québec by the owner of the rental property. If you're a tenant or a subtenant of a leased dwelling, you'll receive a copy of the RL-31 slip (RL-31.

What is a Releve 3 slip?

The information on the RL-3 slip is used by recipients to complete the personal income tax return (TP-1-V), the Déclaration de revenus des sociétés (CO-17), the Partnership Information Return (TP-600-V) or the Trust Income Tax Return (TP-646-V), as applicable.

How do I file a Releve 31?

Filing your RL-31 slips online is quick and easy! You can use the Prepare and View the RL-31 slipThis hyperlink will open in a new window online service on the Revenu Québec website. You have until February 28, 2023, to complete your slips and send a copy to Revenu Québec and your tenants or subtenants.

What is the Releve 31 benefit?

RL-31 is a tax slip filled out by your landlord, which allows you to claim the housing component of the solidarity tax credit. Any tenant or subtenant is eligible to receive this tax break, however, an occupant of a property is not.

How do I get my RL-31?

Filing your RL-31 slips online is quick and easy! You can use the Prepare and View the RL-31 slipThis hyperlink will open in a new window online service on the Revenu Québec website. You have until February 28, 2023, to complete your slips and send a copy to Revenu Québec and your tenants or subtenants.

What is rl31 information?

If you are a landlord and you leased an eligible dwelling for which rent was paid or payable on December 31, 2022, you must file an RL-31 slip with us and give a copy to your tenants. The RL-31 slip is used to report information about leased dwellings on December 31, 2022.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the relevé 31 formulaire en ligne in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your releve 31 form and you'll be done in minutes.

How can I edit rl31 online on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing rl 31 cs right away.

How do I edit prepare rl 31 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share formulaire relevé 31 pour imprimer from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is rl 31 slip pdf?

The RL-31 slip is a tax document used in Canada for reporting the income of individuals, specifically related to rental properties. It is important for both landlords and tenants for tax purposes.

Who is required to file rl 31 slip pdf?

Landlords who receive rental income need to file the RL-31 slip to report the details of rental payments received during the tax year.

How to fill out rl 31 slip pdf?

To fill out the RL-31 slip, you must provide information such as the landlord's and tenant's names, the address of the rental property, total rent paid, and any other necessary details as required by the form.

What is the purpose of rl 31 slip pdf?

The purpose of the RL-31 slip is to provide the government with a clear record of rental income for taxation purposes and to ensure accurate reporting for both landlords and tenants.

What information must be reported on rl 31 slip pdf?

The information that must be reported includes the landlord's name and address, tenant's name and address, rental property's address, the total rent paid, and the year for which the slip is being filed.

Fill out your rl 31 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Releve 31 For Tenants is not the form you're looking for?Search for another form here.

Keywords relevant to relevé 31 pdf

Related to rl 31 slip tenant

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.