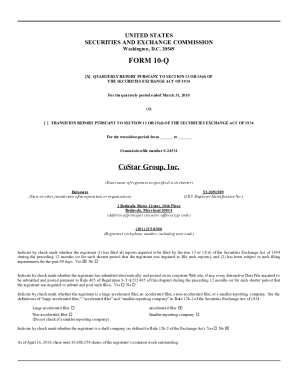

Get the free Certificate For No Information Reporting

Show details

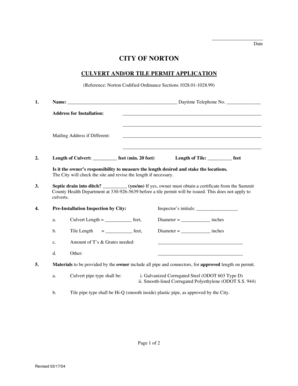

This form is completed by the seller(s) of a principal residence to determine the necessity of reporting the sale or exchange to the seller(s) and to the Internal Revenue Service on Form 1099-S. It

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate for no information

Edit your certificate for no information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate for no information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificate for no information online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit certificate for no information. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

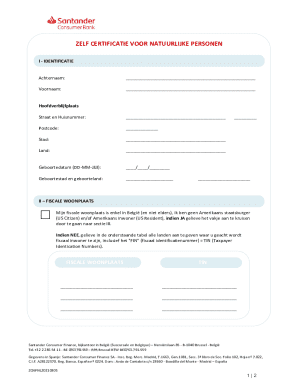

How to fill out certificate for no information

How to fill out Certificate For No Information Reporting

01

Obtain the Certificate for No Information Reporting form from the relevant authority or website.

02

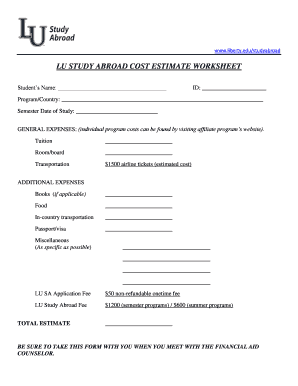

Fill in your personal details, including your name, address, and taxpayer identification number.

03

Specify the period for which you are requesting the certificate.

04

Indicate the reason for requesting the certificate in the designated section.

05

Review all information for accuracy and completeness.

06

Sign and date the form to validate your request.

07

Submit the completed form to the appropriate agency or authority.

Who needs Certificate For No Information Reporting?

01

Individuals or businesses that have not received any income reportable to the tax authorities for a specific period.

02

Taxpayers who require proof of no information reporting for compliance or verification purposes.

03

Organizations applying for loans, grants, or other financial dealings may require this certificate.

Fill

form

: Try Risk Free

People Also Ask about

What happens if you don't report a 1099-S?

If you fail to file any type of 1099 form, the IRS can technically start issuing penalties starting at $250 per failure to those who don't follow through with this requirement (that is, if they ever find out about it).

Do you always get a 1099s when you sell your house?

If you sell real estate—whether it's your primary home, vacation house, or investment property—you'll receive a 1099-S. The settlement agent reports the sale to the IRS, so ensure it's included in your tax return to avoid issues. #RealEstateTaxes #1099S #TaxReporting #StayCompliant.

Why didn't I get a 1099 after selling my house?

Most of the time when a primary residence is sold it's not reported unless it's an expensive house or explicitly described as not your primary residence. Odds are, your real estate agent or title company filed a 1099-s when they had no reason to do so and then failed to supply you with a copy.

Who sends a 1099 when you sell a house?

Form 1099-S is used to report the sale or exchange of present or future interests in real estate. It is generally filed by the person responsible for closing the transaction, but depending on the circumstances it might also be filed by the mortgage lender or a broker for one side or other in the transaction.

Who fills out the 1099s form?

Depending on the specific transaction circumstances, different parties may be responsible for sending Form 1099-S. ing to IRS instructions, the person responsible for closing the transaction should be the one to fill out the form.

Who do you not have to send a 1099 to?

Situations that don't require 1099s But you won't send one to the self-employed housekeeper who cleans your home. The IRS lists other non-reportable activities, such as: Most payments to a corporation or an LLC treated as an S corporation. Rental payments to property managers or real estate agents.

Who is exempt recipient for 1099 reporting purposes?

You are not required to file or issue Form 1099-INT for exempt recipients including, but not limited to, the following. A corporation. A broker. A middleman/nominee.

Who is exempt from receiving a 1099 form?

Corporations. You do not need to provide a 1099-MISC/NEC to most Corporations, including entities that elect to be taxed as an S-Corp. However, this exception does not apply if the payment is for legal services or medical/healthcare.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Certificate For No Information Reporting?

The Certificate For No Information Reporting is a document used to declare that there are no specific information reporting requirements for the taxpayer or entity during a particular period.

Who is required to file Certificate For No Information Reporting?

Entities or individuals who did not engage in any activities or transactions that would require them to report information to tax authorities are required to file this certificate.

How to fill out Certificate For No Information Reporting?

To fill out the Certificate For No Information Reporting, one must provide identifying information such as name, address, and taxpayer identification number, and clearly indicate the period for which no reporting is required.

What is the purpose of Certificate For No Information Reporting?

The purpose of the Certificate For No Information Reporting is to formalize the lack of reportable activities by an individual or entity, thus avoiding penalties or compliance issues with tax authorities.

What information must be reported on Certificate For No Information Reporting?

The information required typically includes the taxpayer's name, address, taxpayer identification number, and a statement confirming that no reportable transactions occurred during the specified period.

Fill out your certificate for no information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate For No Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.