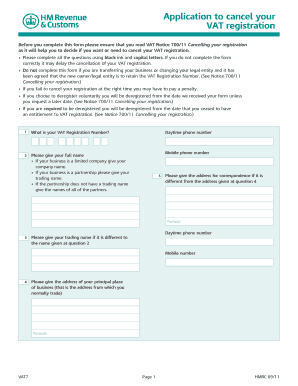

UK VAT7 2014-2025 free printable template

Show details

To complete this form please complete all the questions using black ink and capital letters If you do not complete the form correctly it may delay the cancellation of your VAT registration. Please note if you fail to cancel your registration at the right time you may have to pay a penalty if you choose to deregister voluntarily you will be deregistered from the date we received your form unless you request a later date see Notice 700/11 Cancelling your registration if you are required to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign vat7 form pdf

Edit your vat7 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat 7 pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vat 7 form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit vat7 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK VAT7 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out vat 7 deregistration form

How to fill out UK VAT7

01

Gather your financial records and sales information for the relevant VAT period.

02

Obtain a VAT7 form from HM Revenue and Customs (HMRC) or download it from their website.

03

Fill in your business name and VAT registration number at the top of the form.

04

Indicate the period for which you are reporting VAT by specifying the start and end dates.

05

Provide details about your total sales, including VAT exempt and zero-rated sales.

06

Enter your total purchases and the corresponding VAT paid on those purchases.

07

Calculate the VAT due or refundable by subtracting the input VAT from the output VAT.

08

Review the completed form for accuracy and ensure all fields are filled out correctly.

09

Submit the completed VAT7 form to HMRC by the due date.

Who needs UK VAT7?

01

Businesses that are registered for VAT in the UK and need to report their VAT liability or reclaim VAT.

Fill

hud 52515 fillable

: Try Risk Free

People Also Ask about vat7 form online

Where do I send a VAT 7?

Send the form to HMRC.

What form do I need to deregister for VAT?

You can cancel your VAT registration online by logging into your VAT online account (aka your “Government Gateway account“). Should you prefer to deregister for VAT by post, you can fill in and send form VAT7 to the address stated.

What is a VAT7 form?

The VAT 7 Form is the document you submit to HMRC if you're no longer eligible to make VAT payments.

Where do I send my VAT7 form?

VAT7 The only VAT7 form that should be used (or replicated exactly) is. VAT7 v1.3. This form is located on GOV.UK via the Insolvency (VAT. The final page of the print and post form states: What to do now. Please send the completed form to: BT VAT, HM Revenue & Customs.

What happens if I don't register for VAT?

If your customers are mainly non-VAT registered private individuals, they cannot reclaim the cost of the VAT which you have charged them on your sale price. This means that your product or service becomes up to 23% more expensive for them to use.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify application cancel vat without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your 1998 application cancel vat into a dynamic fillable form that you can manage and eSign from anywhere.

Can I edit request vat7 form on an iOS device?

Create, modify, and share form vat7 vat print using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I edit form vat7 2014-2025 on an Android device?

You can make any changes to PDF files, like form vat7 2014-2025, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is UK VAT7?

UK VAT7 is a form used by businesses in the United Kingdom to claim back VAT they have overpaid or to report certain adjustments to their VAT returns.

Who is required to file UK VAT7?

Businesses registered for VAT in the UK that need to make adjustments to their VAT returns or reclaim overpaid VAT are required to file UK VAT7.

How to fill out UK VAT7?

To fill out UK VAT7, a business must provide details of the VAT they are claiming back, including the period the claim relates to, the reasons for the claim, and any supporting evidence or documentation.

What is the purpose of UK VAT7?

The purpose of UK VAT7 is to facilitate the process for businesses to adjust their VAT records and ensure that they are reclaiming the correct amounts of VAT that they have overpaid.

What information must be reported on UK VAT7?

The information that must be reported on UK VAT7 includes the VAT registration number, the claim period, the total VAT claimed, the reasons for the claim, and any necessary supporting documentation.

Fill out your form vat7 2014-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form vat7 2014-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.