AZ Form 5000A 2015 free printable template

Get, Create, Make and Sign AZ Form 5000A

How to edit AZ Form 5000A online

Uncompromising security for your PDF editing and eSignature needs

AZ Form 5000A Form Versions

How to fill out AZ Form 5000A

How to fill out AZ Form 5000A

Who needs AZ Form 5000A?

Instructions and Help about AZ Form 5000A

Not exciting the again live the two USA here well This is something I want to show you it has been sitting for quite a while, but you know you guys has been following my series about everything with the MPP solar peep hybrid inverter charger which is a 50 48 5 kilowatt 48 volt hybrid inverter chargers right here these I'm talking about so the demonstration I'm going to do today or the unboxing is going to be on the transformers because these guys are 230 volt international it's not American so for international guys you don't have to worry about dealing with the Transformers these are the specs right here take a look I just want to show you guys, and you look for yourself made by MPP Sold incorporated in Taiwan, so these are the machines right here lets go back to the boxes and unbox everything welcome back, so these are the transformers here which is going to be transformed is transforming the power coming out from the pip Q the transformer and the transformer are going to step it down to the US version I'm right now I'm in the United States, so I'm using the opportunity of big even voters so that because the peeps we don't have any of the bigger peeps like 4 3 5 kilowatt they are all on 2400 24 kilowatts so being said that, so I have to go through MPP solar and get of the 5 kilowatt each which are two of them is 10 kilowatts they already configured serious will reconfigure to parallel, so they can be a 10 kilowatt so these transformers here going to be five kilowatts each 5000 watts each transformer which going to be configured soon and see how this guy is going to be working to walking hand-in-hand with the people and the power system, so this is what we have here, so I'm so excited to show you guys this stuff you know I've been longing to show you, but I have to go through the series step-by-step configuration as you guys can see the model number right here is the TC — 500 g 5000 G sorry and you guys can see me by seven stars and these are the Transformers believe it or not these are the Transformers right here so were going to be dealing with this stuff these guys here, and it's going to give us awesome power this transformer can convert from — from 240 to 120 from 220 to 110 so the hybrid side they are rated for 230 volts you guys saw the specs there, and it's going to down or step it down to these so if your international mostly travel overseas you have to have you in America you have to have a step-up transformer to step the voltage of the no to step down the voltage over there to match your luxury cell phone or whatever because the cell phone sorry the cell phones already have the both 120 and to something for overseas but for other special things like you know some special stereos or whatever some other things you want to use and maybe like women growling peeing, or you know all that kind of stuff dryer hair dry blower all our stuff they have to go to a step-down transformer to work for the US but if the US stuff oversee stuff comes...

People Also Ask about

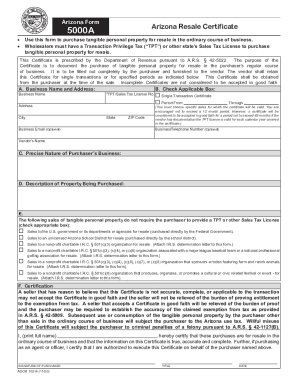

What is an Arizona Form 5000A?

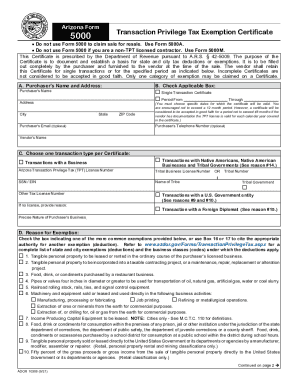

What is the difference between AZ Form 5000 and 5005?

What is the difference between AZ Form 5000 and 5000A?

Does Arizona have tax exemption?

How do I get sales tax exemption in AZ?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit AZ Form 5000A online?

How can I edit AZ Form 5000A on a smartphone?

How do I fill out AZ Form 5000A on an Android device?

What is AZ Form 5000A?

Who is required to file AZ Form 5000A?

How to fill out AZ Form 5000A?

What is the purpose of AZ Form 5000A?

What information must be reported on AZ Form 5000A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.