AU MS016 2012 free printable template

Show details

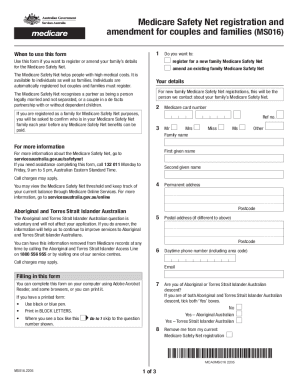

Medicare Safety Net Registration and Amendment for Couples and Families 1 Do you want to: When to use this form Complete this form if you want to register or amend your family s details for the Medicare

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign AU MS016

Edit your AU MS016 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU MS016 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU MS016 online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AU MS016. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU MS016 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU MS016

How to fill out AU MS016

01

Gather all necessary personal information, including your name, address, and contact details.

02

Obtain your tax file number (TFN) if applicable.

03

Fill in the sections related to your income sources, such as employment or business income.

04

Include any deductions you wish to claim, ensuring you have supporting documentation.

05

Review the completed form for accuracy and completeness.

06

Submit the form according to the instructions provided, either online or by mail.

Who needs AU MS016?

01

Individuals or entities in Australia who need to report their income and claim deductions for tax purposes.

02

Self-employed individuals needing to report business income.

03

Taxpayers who are required to provide a declaration of their income for tax assessment.

Fill

form

: Try Risk Free

People Also Ask about

What is the threshold for safety net?

All the co-payments you and your dependant family members make within a calendar year combine towards the annual Safety Net threshold. There are 2 Safety Net thresholds: The concessional patient Safety Net threshold is $262.80. The general patient Safety Net threshold is $1,563.50.

What is the safety net rule?

The Safety Net early supply rule means that for some PBS medicines a repeat supply of the same medicine within less than a specified interval will fall outside the Safety Net.

How do I check my safety net?

Sign in to myGov and select Medicare. If you're using a computer, sign in to myGov and select Medicare. If you're using the app, open it and enter your myGov PIN. Select Safety Net from the Services menu.

What is the Medicare threshold for 2023?

There are some parameters to qualify for the program, mostly related to income and assets. The government has updated the income limits for 2023, which — per Medicare Interactive — are now: up to $1,719 monthly income for individuals. up to $2,309 monthly income for married couples.

What is the 20 day safety net rule?

If you buy a PBS medicine less than 20 days after a previous supply of the same medicine, the cost may not count towards your PBS Safety Net threshold. If you have already reached the Safety Net you may have to pay your pre-Safety Net price.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my AU MS016 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign AU MS016 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make changes in AU MS016?

With pdfFiller, it's easy to make changes. Open your AU MS016 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit AU MS016 on an iOS device?

Create, modify, and share AU MS016 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is AU MS016?

AU MS016 is a specific form used in Australia for the reporting of certain financial and tax information by businesses and individuals.

Who is required to file AU MS016?

Individuals and entities that meet specific criteria regarding their financial activities and income levels are required to file AU MS016.

How to fill out AU MS016?

To fill out AU MS016, gather all required financial documentation, complete the form with the necessary information, ensure accuracy, and submit it before the due date.

What is the purpose of AU MS016?

The purpose of AU MS016 is to collect data for tax assessment and compliance, ensuring that taxpayers report their income accurately.

What information must be reported on AU MS016?

Information that must be reported on AU MS016 includes income details, deductions, and any other relevant financial data as specified by regulatory guidelines.

Fill out your AU MS016 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU ms016 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.