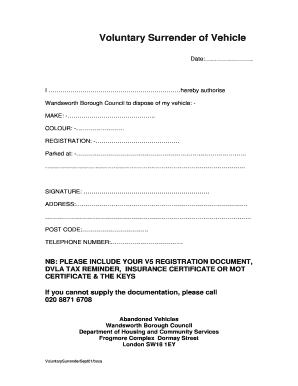

Voluntary Surrender of Motor Vehicle free printable template

Fill out, sign, and share forms from a single PDF platform

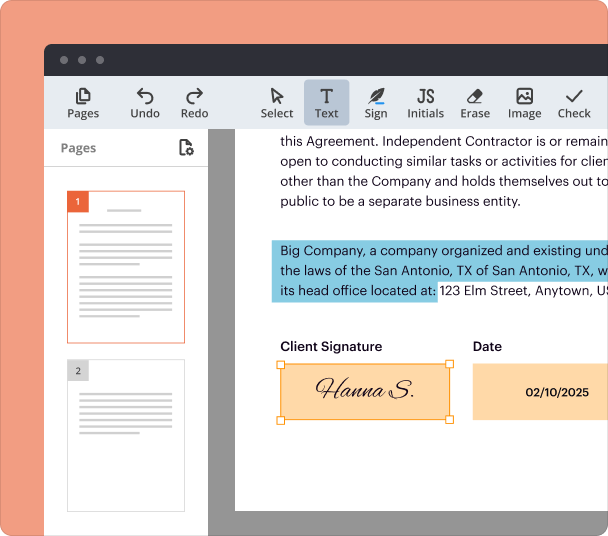

Edit and sign in one place

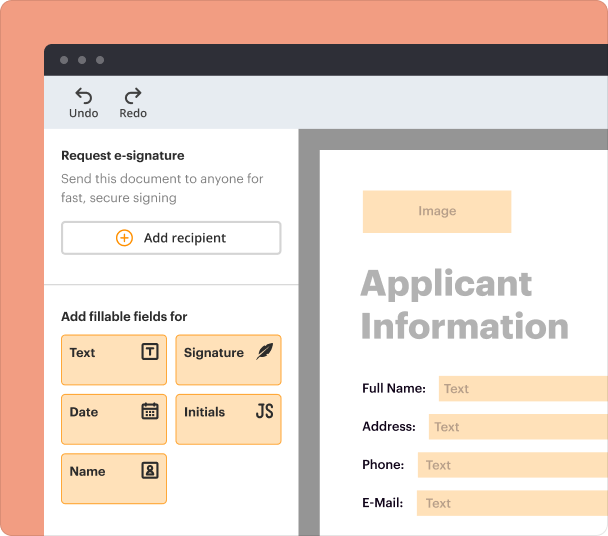

Create professional forms

Simplify data collection

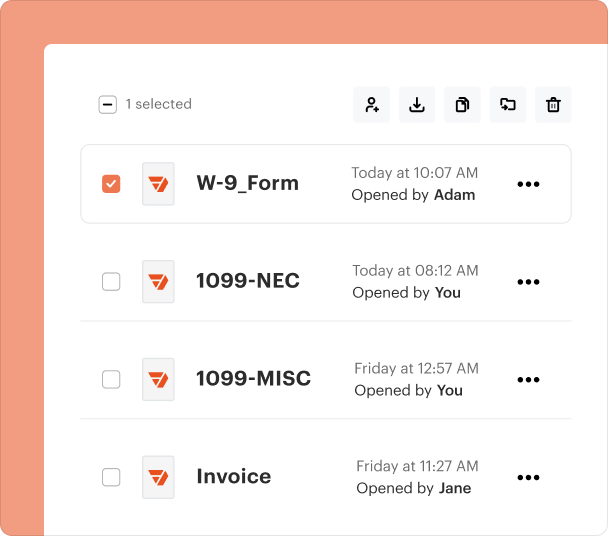

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

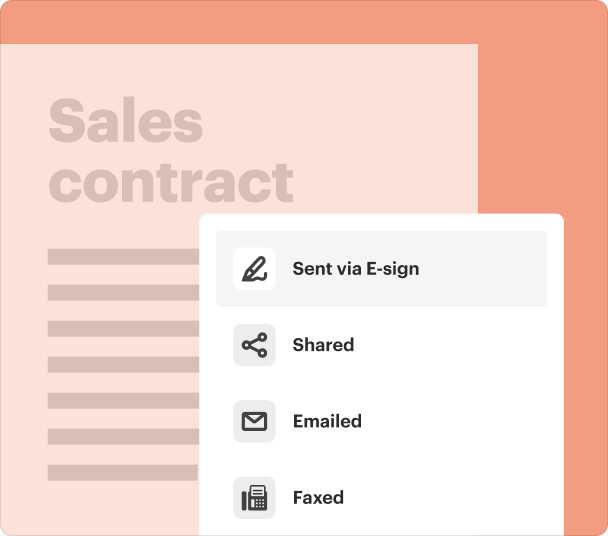

End-to-end document management

Accessible from anywhere

Secure and compliant

Voluntary surrender of motor vehicle guide

How does the voluntary surrender process work?

Voluntary surrender of motor vehicles occurs when an individual willingly returns their vehicle to the lender, usually due to financial difficulties. This process can help borrowers avoid burdensome payments when they can no longer manage their debts. Understanding the legal implications and requirements for voluntary surrender is crucial for those seeking this option.

-

Voluntary surrender refers to the act of returning a vehicle to the lender or dealership.

-

Individuals may consider this when they can no longer afford payments or are facing repossession.

-

It potentially impacts credit reports and outstanding financial responsibilities.

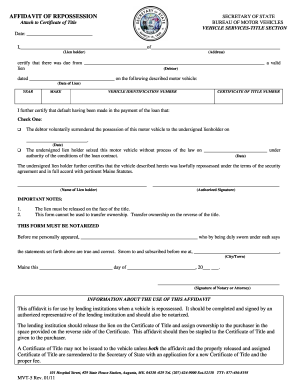

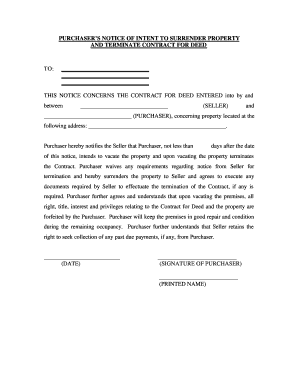

What are the key components of the voluntary surrender document?

A comprehensive voluntary surrender form includes essential details that must be accurately provided to avoid complications. Each component has significance during the surrender process, and understanding these can streamline your experience effectively.

-

Details such as year, make, model, and VIN are necessary for identification.

-

Include amounts on any promissory notes or loans related to the vehicle.

-

Instructions need to outline how rights to the vehicle are transferred back to the lender.

How can fill out the voluntary surrender form correctly?

Completing the voluntary surrender form requires attention to detail to ensure accuracy and completeness. Following a structured approach can help you avoid common mistakes.

-

Be precise in entering the vehicle's specifications to prevent issues during processing.

-

Clearly list all financial obligations to provide a complete picture of your circumstances.

-

Follow guidelines to indicate who will retain rights to the vehicle post-surrender.

What should know about my obligations following a vehicle surrender?

After surrendering your vehicle, it is vital to understand your remaining financial obligations. This includes any agreements you had with your lender and how the surrender may impact your credit.

-

You may still owe money if the sale of the vehicle does not cover the outstanding loan.

-

Knowing your rights allows you to respond appropriately to lender communications.

-

Voluntary surrender can negatively affect your credit score, so it’s essential to plan accordingly.

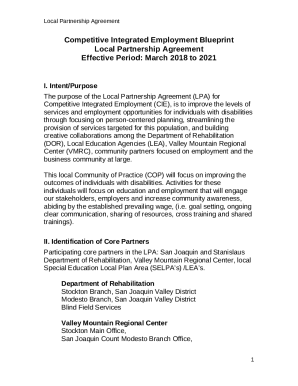

How can pdfFiller assist with my voluntary surrender document?

Using pdfFiller simplifies the process of creating and managing your voluntary surrender document. This cloud-based platform offers essential tools that empower users to edit, sign, and collaborate effectively on their forms.

-

Generating your voluntary surrender form is straightforward via the pdfFiller platform.

-

It allows for electronic signatures and easy editing, making the process more efficient.

-

pdfFiller simplifies form management, ensuring that no essential steps are missed.

What common mistakes should avoid during vehicle surrender?

Mistakes during the voluntary surrender process can lead to complications, so being aware of common pitfalls is paramount. Here are some critical areas to focus on to ensure a smooth process.

-

Double-check all entries on your voluntary surrender form for accuracy.

-

Remove all personal items from the vehicle before surrendering it.

-

Seek help if you're unsure about legal aspects to avoid complications.

Frequently Asked Questions about voluntary surrender of vehicle form

What happens if I change my mind after surrendering?

Once you have voluntarily surrendered your vehicle, changing your mind is complicated. Typically, the lender may not allow you to reclaim the vehicle unless special circumstances arise, such as damage or error.

Can I negotiate the terms of my surrender with the lender?

Negotiating terms may be possible, especially if you are proactive about your situation. Contact your lender to discuss options available to you prior to surrendering the vehicle.

How will voluntary surrender affect my ability to buy a car in the future?

Voluntary surrender may negatively impact your credit score, making future car loans more challenging. However, maintaining good payment history post-surrender can mitigate these effects over time.

Is voluntary surrender the same as repossession?

No, voluntary surrender is an act initiated by the borrower, while repossession typically involves the lender taking back the vehicle without consent for missed payments.

Who is responsible for the vehicle after surrendering?

After surrender, the lender takes responsibility for the vehicle. However, the borrower may still owe money if the vehicle sells for less than the remaining balance on the loan.

pdfFiller scores top ratings on review platforms