Get the free III( Instructions for Recipient I LPI Information Systems # PS350 Form ...

Show details

Instructions for Recipient III(Original Issue discount (Old) is the excess of an obligation's stripped or coupon), you may have to figure the correct about of 010 to report on your rectum. See Pub.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your iii instructions for recipient form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iii instructions for recipient form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit iii instructions for recipient online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit iii instructions for recipient. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

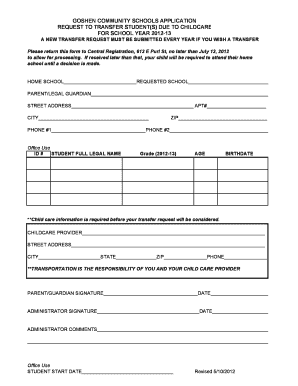

How to fill out iii instructions for recipient

To fill out iii instructions for the recipient, follow these steps:

01

Read through the instructions carefully to understand the requirements.

02

Gather all the necessary documents or information related to the recipient.

03

Start by filling out the recipient's personal details, such as their full name, contact information, and any other required identifiers.

04

Proceed to fill out the specific instructions for the recipient, ensuring clarity and accuracy in the details provided.

05

Double-check all the information filled in to avoid any mistakes or discrepancies.

06

Submit the completed iii instructions for the recipient as per the specified guidelines.

6.1

iii instructions for the recipient are typically required by individuals or organizations who need to provide specific instructions or guidelines to the recipient. This could be related to various matters such as legal documents, financial transactions, employment procedures, or any other situation where providing clear instructions is essential. The purpose is to ensure that the recipient understands the expectations and can follow the instructions accurately for a successful outcome.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

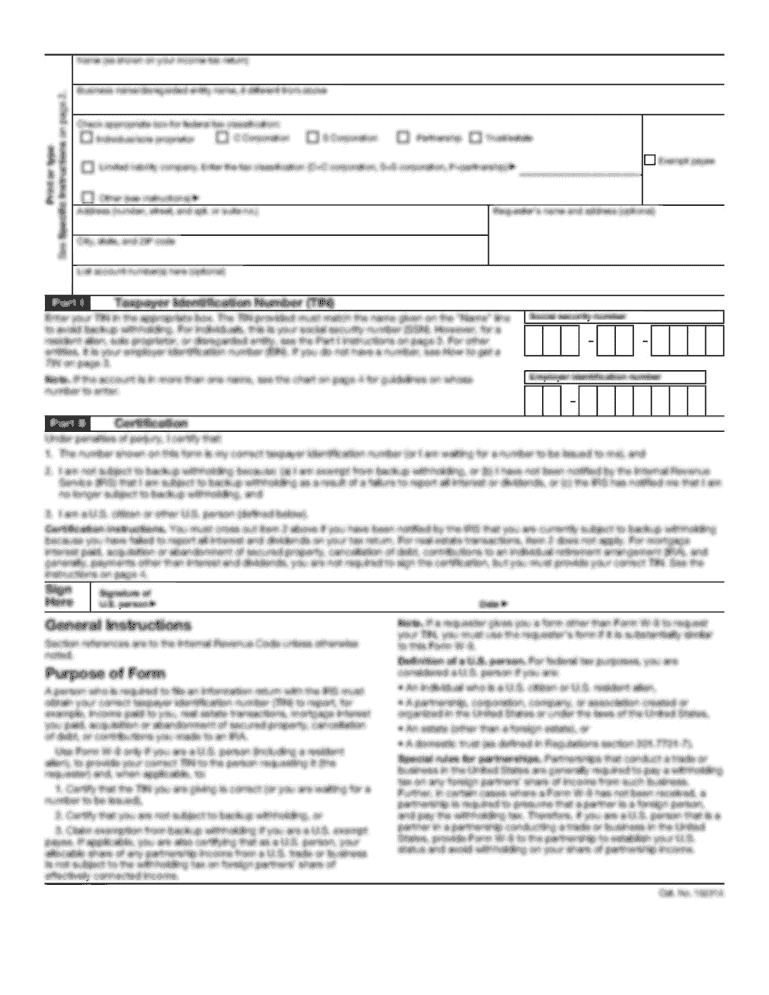

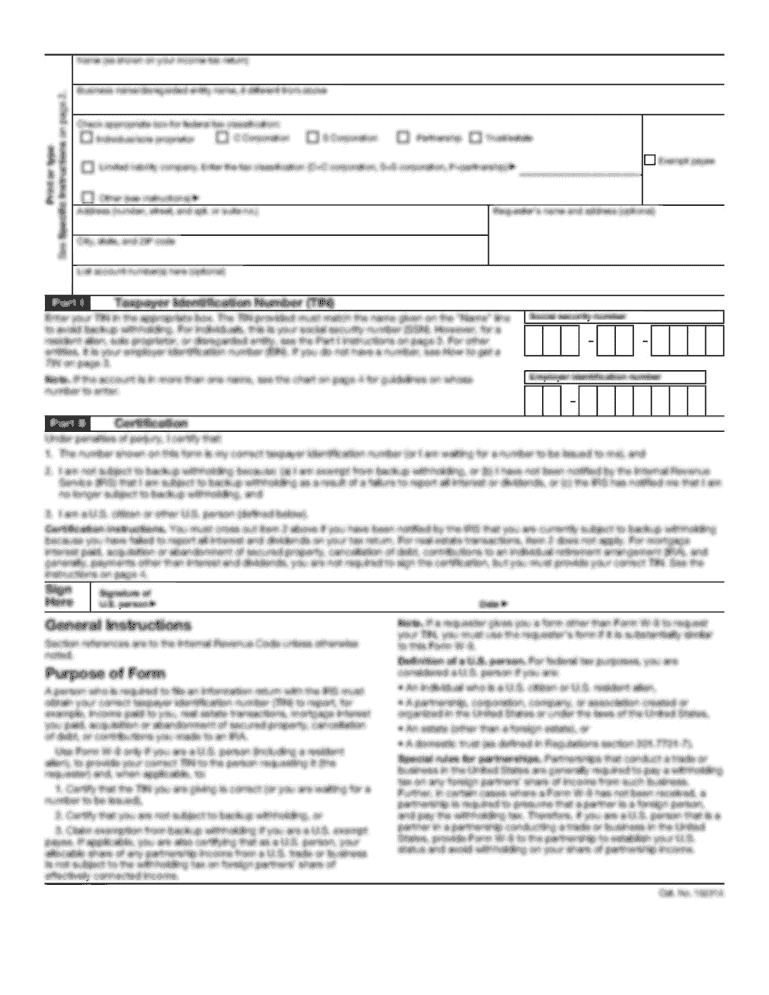

What is iii instructions for recipient?

iii instructions for recipient is a set of guidelines and information provided by the Internal Revenue Service (IRS) to individuals or entities who have received certain payments, such as income from independent contracting or other non-employee compensation. The instructions outline how to report and file taxes on these payments.

Who is required to file iii instructions for recipient?

Individuals or entities who have received certain payments, such as income from independent contracting or other non-employee compensation, are required to file iii instructions for recipient.

How to fill out iii instructions for recipient?

To fill out iii instructions for recipient, you must carefully review the instructions provided by the IRS. The instructions will guide you on what information to report, where to report it, and any additional forms or schedules that may be required.

What is the purpose of iii instructions for recipient?

The purpose of iii instructions for recipient is to ensure that individuals or entities accurately report and file taxes on certain payments they have received. By following the instructions, recipients can fulfill their tax obligations and avoid potential penalties.

What information must be reported on iii instructions for recipient?

The specific information that must be reported on iii instructions for recipient may vary depending on the type of payment received. Generally, recipients must provide their identifying information, details about the payment received, and any applicable expenses or deductions.

When is the deadline to file iii instructions for recipient in 2023?

The specific deadline to file iii instructions for recipient in 2023 will be determined by the IRS. It is recommended to consult the IRS website or seek professional guidance to ensure the accurate deadline.

What is the penalty for the late filing of iii instructions for recipient?

The penalty for the late filing of iii instructions for recipient can vary and is determined by the IRS. It is important to file the instructions on time to avoid potential penalties. The specific penalty amount may depend on factors such as the amount of tax owed and the length of delay in filing.

How can I get iii instructions for recipient?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific iii instructions for recipient and other forms. Find the template you need and change it using powerful tools.

How do I edit iii instructions for recipient in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing iii instructions for recipient and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I complete iii instructions for recipient on an Android device?

Complete iii instructions for recipient and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your iii instructions for recipient online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.