Get the free tpin registration form download

Show details

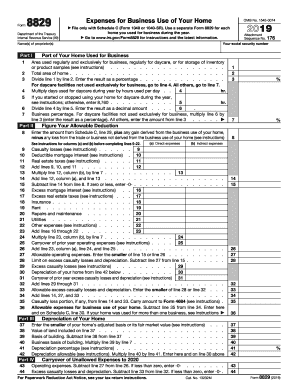

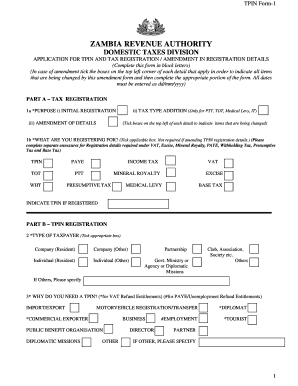

3-00/01 MALAWI REVENUE AUTHORITY Application for Registration for Income Tax and Value Added Tax Business The completed form should be hand delivered to your Income Tax Office or send to the Regional Income Tax office below Regional Manager South PO Box 94 Blantyre MALAWI For official use only Date of receipt Private Bag 26 Lilongwe TPIN Mzuzu Application checked by Captured By Date Captured Verified By Date Verified All information to be completed fully and in Block Letters. Make a cross X...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mra tpin application form

Edit your tpin registration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tipin download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mra tpin registration online online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mra tpin registration login form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tpin application form

How to fill out tpin registration form download:

01

First, download the tpin registration form from the official website.

02

Open the form on your computer or print it out if you prefer to fill it out manually.

03

Start by entering your personal information, such as your name, address, and contact details, in the designated fields.

04

Next, provide your tax identification number (TIN) and any other required identification numbers.

05

Fill in the sections pertaining to your employment or business information, including your employer's name and address.

06

If applicable, provide details about your income, deductions, and sources of income.

07

Verify that all the information entered is accurate and complete.

08

Sign and date the form to confirm the validity of the provided information.

09

Submit the filled-out form to the appropriate tax authority, either electronically or by mailing it to the designated address.

Who needs tpin registration form download:

Individuals or businesses who are required to obtain a tax identification number or update their existing information would need to download the tpin registration form. This can include taxpayers who have recently started a business, individuals who have never registered for a TIN before, or those who need to update their information due to changes in their personal or employment circumstances. By filling out this form, individuals can ensure compliance with tax regulations and facilitate the efficient processing of their tax-related matters.

Fill

tpin registration form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tpin registration form download?

TPIN registration form download refers to the process of downloading a Taxpayer Identification Number (TPIN) registration form. TPIN is a unique identification number provided by the tax authority of a country to individuals or entities for tax-related purposes. This form is used to apply for a TPIN and includes personal or organizational details, such as name, address, contact information, and other relevant information required by the tax authority. To obtain a TPIN, individuals or entities need to download the registration form, fill it out accurately, and submit it to the respective tax authority for processing.

Who is required to file tpin registration form download?

The TPIN (Taxpayer Identification Number) registration form is typically required to be filed by individuals or entities that are liable to pay taxes in a particular jurisdiction. This may include:

1. Individuals earning income from a business, profession, or employment.

2. Companies, partnerships, or other business entities.

3. Non-profit organizations.

4. Foreign entities operating in the jurisdiction.

5. Any individual or entity undertaking transactions that are subject to tax regulations.

It is important to note that the specific requirements for TPIN registration may vary depending on the jurisdiction and its tax regulations. Therefore, it is recommended to refer to the local tax authority or consult with a tax professional for accurate and detailed information regarding TPIN registration requirements.

How to fill out tpin registration form download?

To fill out a TPIN (Taxpayer's Personal Identification Number) registration form, follow these steps:

1. Visit the relevant government website or taxation authority's website to download the TPIN registration form. You may find the form under the section related to taxpayer identification or registration.

2. Open the downloaded form using a PDF reader or any compatible program.

3. Read the instructions or guidelines provided on the form carefully to understand the required information.

4. Start by filling out the personal details section, which usually includes your full name, date of birth, gender, and contact information. Provide accurate and up-to-date information.

5. Proceed to fill in your address details, including your residential and/or mailing address. Ensure the address provided is correct and complete.

6. If applicable, provide your business or employment details. This section usually includes information about the type of business or the name of your employer.

7. In the "Taxpayer Status" section, indicate whether you are an individual taxpayer, corporate taxpayer, or hold any other status as specified in the form.

8. If required, specify your tax identification number from a previous registration or provide any other relevant details requested.

9. Review the form thoroughly to ensure all the information you have filled in is accurate and complete. Make corrections if necessary.

10. If there are any additional sections or declarations, fill them as instructed. These might include details about your dependents, financial information, or declaration of accuracy.

11. Finally, sign the form using your legal signature as it appears on official documents. Depending on the form's format, you may be able to sign electronically or will need to print the form and sign physically.

12. Make copies of the completed form for your personal records, if necessary.

Note: The exact steps and information required may vary depending on the country and specific TPIN registration form. It is always recommended to refer to the specific guidelines provided on the form or consult the relevant authority if you have any doubts or questions while filling out the form.

What is the purpose of tpin registration form download?

The purpose of a TPIN (Taxpayer Personal Identification Number) registration form download is to provide individuals or businesses with a means to apply for a TPIN. A TPIN is a unique identification number assigned to taxpayers in some countries for tax-related purposes. By downloading the TPIN registration form, individuals or businesses can fill it out, provide the necessary information, and submit it to the relevant tax authority to obtain a TPIN. The TPIN is then used for various tax-related activities, such as filing tax returns, making tax payments, or conducting other tax-related transactions.

How do I execute tpin registration in malawi online?

pdfFiller has made it simple to fill out and eSign zra tpin registration form pdf. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the tpin registration code in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your download a tpin registration form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit wwww download t pin com on an Android device?

You can make any changes to PDF files, such as tpin malawi form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your tpin registration form download online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tpin Registration Form Download is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.