Get the free Credit Eligibility Survey

Show details

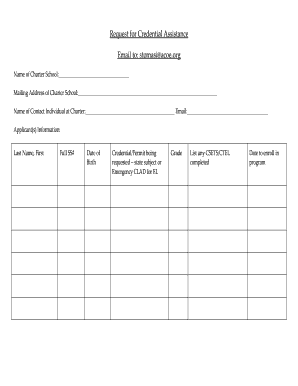

This document is a credit eligibility survey used to evaluate the financial status and creditworthiness of businesses applying for financing. It requires information about the business, ownership,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit eligibility survey

Edit your credit eligibility survey form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit eligibility survey form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit eligibility survey online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit eligibility survey. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit eligibility survey

How to fill out Credit Eligibility Survey

01

Gather all relevant personal and financial information such as income, expenses, and debts.

02

Access the Credit Eligibility Survey online or obtain a physical copy from the provider.

03

Start by entering your personal details, including your name, address, and contact information.

04

Provide information about your employment status and monthly income.

05

List all your existing debts, such as loans and credit card balances.

06

Report your monthly expenses accurately, including rent, utilities, and other necessary payments.

07

Answer any additional questions regarding credit history, if asked.

08

Review all provided information for accuracy before submitting the survey.

09

Submit the survey according to the specified method (online or by mail).

Who needs Credit Eligibility Survey?

01

Individuals seeking to understand their creditworthiness for loan applications.

02

Those looking to improve their financial planning and budgeting.

03

People interested in assessing their eligibility for credit products.

04

Potential borrowers wanting to gauge their chances of approval before applying for credit.

Fill

form

: Try Risk Free

People Also Ask about

Do employees get anything from WOTC?

What Does WOTC Do for Employees? Employees hired under WOTC don't reap monetary rewards, but if employers are aware of their WOTC eligibility, this could make a job candidate more attractive in the eyes of a prospective employer.

Why do I have to fill out a WOTC?

The WOTC has two main goals: To encourage employers to hire people from target groups. To provide tax credits to employers who do so.

Is WOTC worth it?

Absolutely! We know that statistically over the last 20+ years of performing WOTC services that 10-15% of the workforce qualifies for the WOTC program. So, if we have 100 new hires per year, we know 15% of them qualify we say the average tax credit is $2,000. That's $30,000 in tax credit savings per year.

Does WOTC reduce wages?

WOTC wages are reduced by any supplementation payments made to the employer for an employee under Social Security Act §482(e). Additional limitations may apply when calculating the credit.

Should I answer the WOTC questionnaire?

No Impact on Employment: Completing the WOTC questionnaire will not disqualify you from employment opportunities. In fact, it can enhance your chances of being hired. Employers may prefer WOTC-eligible applicants because of the valuable tax credits they can receive. 2.

Is War of the Chosen worth it?

An already excellent campaign is built upon with an extra layer of depth and replay value. Not to mention, it improves the performance of the base game by removing the annoying lag spikes and stuttering. This DLC is a must-have for fans who want an even more refined adrenaline rush experience.

Do employees benefit from WOTC?

What Does WOTC Do for Employees? Employees hired under WOTC don't reap monetary rewards, but if employers are aware of their WOTC eligibility, this could make a job candidate more attractive in the eyes of a prospective employer.

Should I do the WOTC survey?

Completing the WOTC questionnaire is a simple, secure, and advantageous step in your job application process. It not only helps potential employers but can also significantly improve your employment prospects. Don't hesitate – take the step and complete your WOTC questionnaire today!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Credit Eligibility Survey?

The Credit Eligibility Survey is a tool used to assess an individual's or entity's eligibility for credit. It typically collects various financial and personal information to evaluate creditworthiness.

Who is required to file Credit Eligibility Survey?

Individuals and businesses seeking credit or financing from lenders are generally required to file a Credit Eligibility Survey as part of the application process.

How to fill out Credit Eligibility Survey?

To fill out a Credit Eligibility Survey, applicants need to provide accurate personal and financial information, including income, employment details, debts, and assets, as instructed on the form.

What is the purpose of Credit Eligibility Survey?

The purpose of the Credit Eligibility Survey is to enable lenders to make informed decisions regarding credit approvals by evaluating the financial stability and credit history of the applicant.

What information must be reported on Credit Eligibility Survey?

The information that must be reported typically includes personal identification details, income, employment history, existing debts, assets, and any other financial obligations.

Fill out your credit eligibility survey online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Eligibility Survey is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.