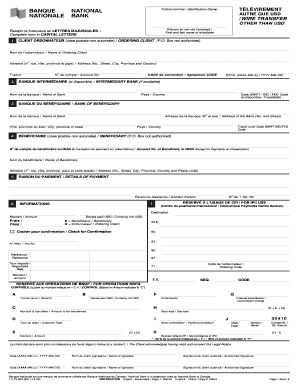

Canada 11179-003 2010 free printable template

Show details

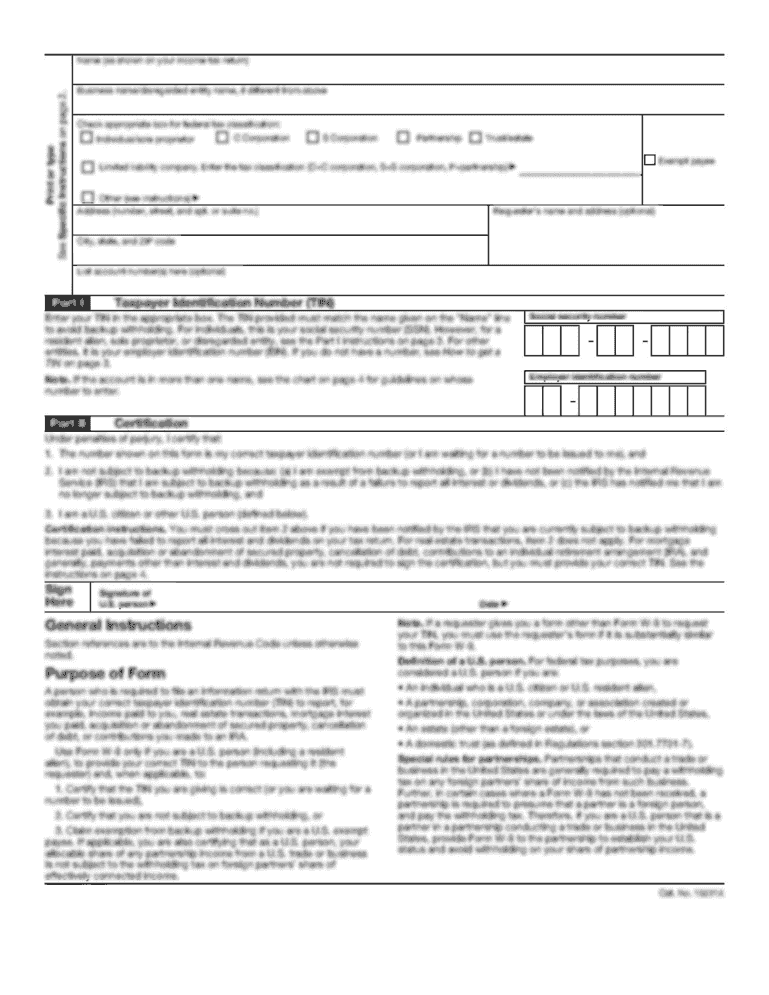

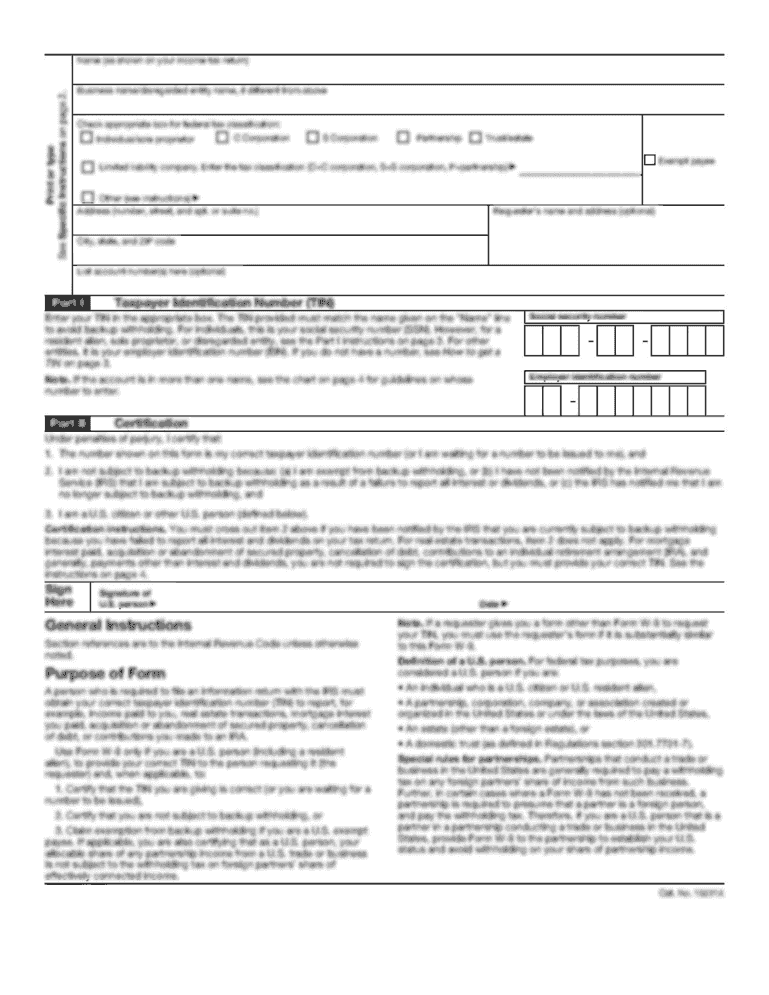

Timbre nominal / Identification Stamp T L FIREMEN / WIRE TRANSFER Repair LE formula ire en letters majuscule. / Complete form in capital letters. 1. CLIENT ORDONNATEUR (case postal non actors e) /

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada 11179-003

Edit your Canada 11179-003 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada 11179-003 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada 11179-003 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada 11179-003. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada 11179-003 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada 11179-003

How to fill out Canada 11179-003

01

Obtain a copy of Form Canada 11179-003.

02

Read the instructions provided with the form to understand its purpose.

03

Fill out the applicant's information in the designated sections, including full name, address, and contact details.

04

Provide details related to the specific request or application you are submitting.

05

Include any supporting documents as required based on the instructions.

06

Review the completed form to ensure all information is accurate and complete.

07

Sign and date the form where indicated.

08

Submit the form and any accompanying documents to the appropriate authority.

Who needs Canada 11179-003?

01

Individuals or organizations applying for a specific service or benefit that requires this form.

02

Health care professionals needing to document patient information relevant to the application.

03

Researchers requiring a formal process to submit health data requests.

Fill

form

: Try Risk Free

People Also Ask about

Is bank account number unique in Canada?

Institution Number: a 3-digit code that tells you which bank the account belongs to — unique for every Canadian bank. Account Number: a 7-digit code that identifies the account within the branch and bank entered.

What are bank account codes Canada?

Article Detail Bank nameBank code (or institution number)Bank of Montreal001Scotiabank (The Bank of Nova Scotia)002Royal Bank of Canada003The Toronto-Dominion Bank004111 more rows • Apr 6, 2023

What is a 15 digit account number Canada?

An account number is a 15-digit number which consists of your unique 9-digit BN to identify your business, two letters to identify the government program, and four digits to identify a specific government account.

How do Canadian bank account numbers work?

The transit number (five digits) identifies which branch you opened your account at. The three-digit institution number identifies your bank. The account number (11 digits) identifies your individual account.

How do I send a bank transfer to Canada?

When sending a wire into Canada, you'll need the following information: Beneficiary Name (who you're sending the wire to) Beneficiary Address (their business or home address) Beneficiary Bank (Usually the SWIFT Code) Beneficiary Bank Address. Beneficiary Account Number (transit+account, more on this later) Amount.

What is the format for bank account numbers in Canada?

Find the number associated with your deposit or Personal Line of Credit account which appears in the format xx-yy-yyyyy: the first 5-digit number [xx] is the transit number and the last 7-digit number [yy-yyyyy] is the bank account number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Canada 11179-003 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your Canada 11179-003 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send Canada 11179-003 for eSignature?

Canada 11179-003 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out Canada 11179-003 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign Canada 11179-003 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is Canada 11179-003?

Canada 11179-003 is a specific tax form used by individuals or entities in Canada for reporting certain financial information to the Canada Revenue Agency (CRA).

Who is required to file Canada 11179-003?

Individuals or businesses that have specific tax obligations or need to report certain types of income or financial activities are required to file Canada 11179-003.

How to fill out Canada 11179-003?

To fill out Canada 11179-003, one should gather the necessary financial documents, follow the instructions provided on the form, and accurately input required information, ensuring all sections are completed as per CRA guidelines.

What is the purpose of Canada 11179-003?

The purpose of Canada 11179-003 is to ensure that the CRA receives important financial information necessary for tax assessment and compliance.

What information must be reported on Canada 11179-003?

Canada 11179-003 requires reporting of income, deductions, and any other relevant financial data as specified by the CRA, depending on the taxpayer's circumstances.

Fill out your Canada 11179-003 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada 11179-003 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.