Get the free Form 2422 - dads state tx

Show details

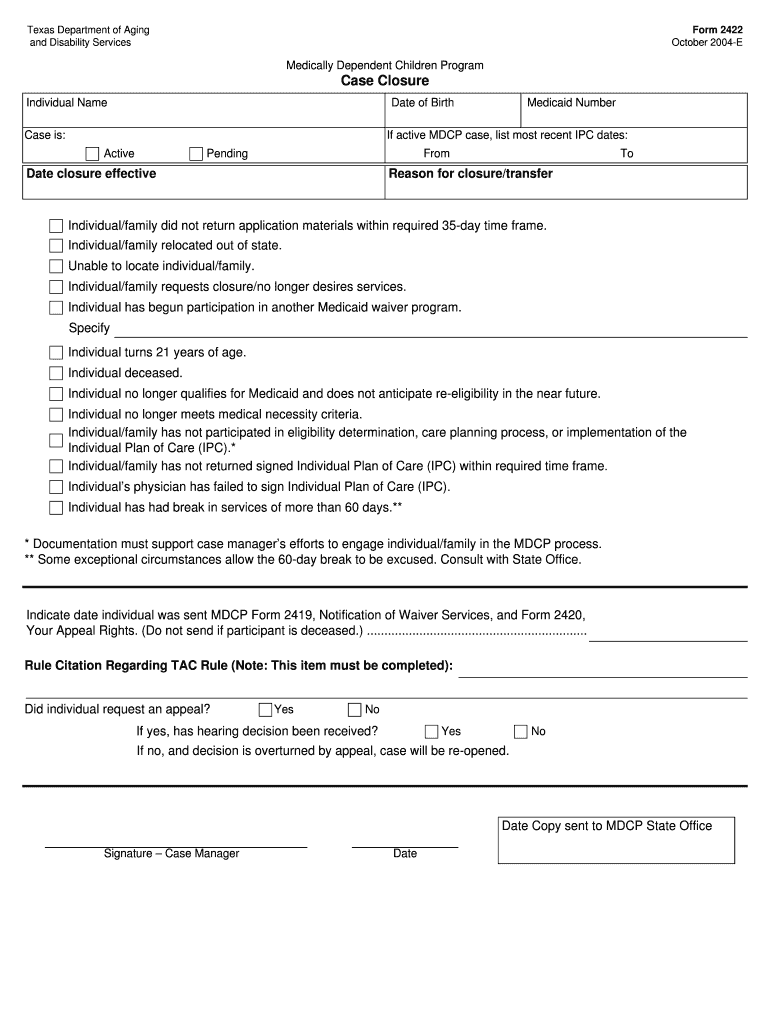

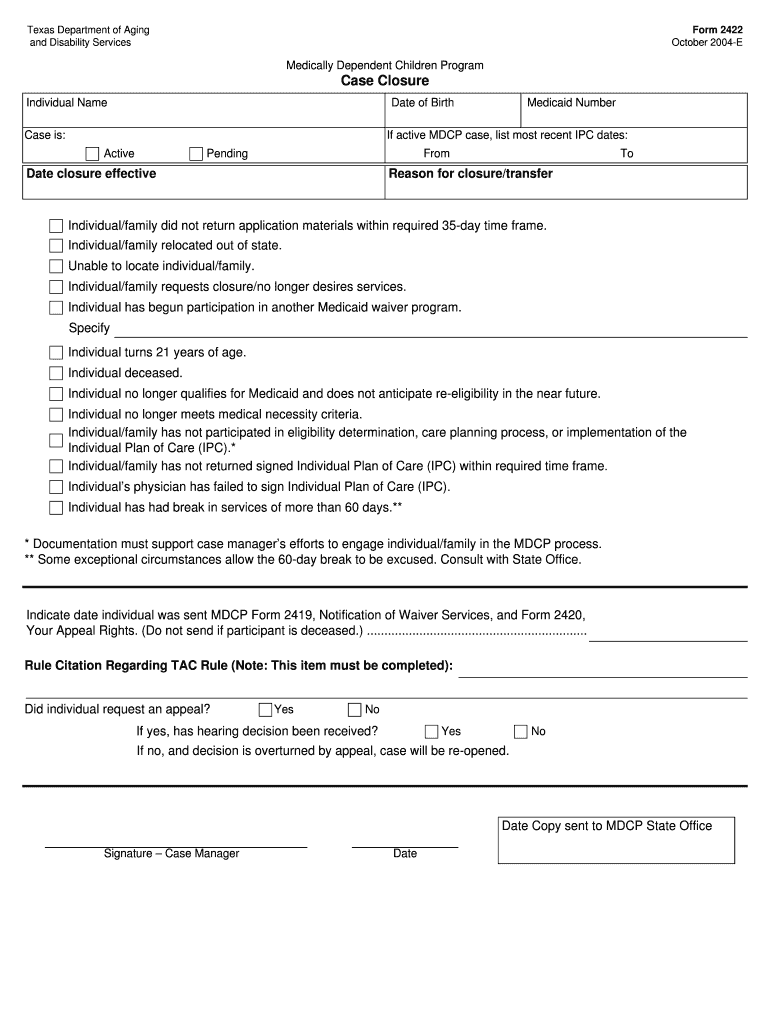

This document is used for the closure of cases in the Medically Dependent Children Program, detailing reasons for closure, appeal rights, and relevant dates.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 2422 - dads

Edit your form 2422 - dads form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 2422 - dads form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 2422 - dads online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 2422 - dads. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 2422 - dads

How to fill out Form 2422

01

Step 1: Obtain Form 2422 from the relevant authority's website or office.

02

Step 2: Read the instructions carefully to understand the requirements.

03

Step 3: Fill in your personal details in the designated fields, including name and contact information.

04

Step 4: Provide any additional information required, such as identification numbers or relevant dates.

05

Step 5: Review the form to ensure all information is accurate and complete.

06

Step 6: Sign and date the form at the specified section.

07

Step 7: Submit the completed form as per the instructions, either online or via mail.

Who needs Form 2422?

01

Individuals applying for specific benefits or services governed by the regulations pertaining to Form 2422.

02

Applicants who are required to provide proof of certain eligibility criteria or conditions.

Fill

form

: Try Risk Free

People Also Ask about

How to fill self declaration form in english?

How to fill out the Self-Declaration Form for Personal Information? Read the instructions carefully before starting. Gather all the required personal information and documents. Fill out each section accurately without leaving any fields blank. Review your filled form for any mistakes or missing information.

Who qualifies for form 2441?

If you hire someone to care for a dependent or your disabled spouse, and you report income from employment or self-employment on your tax return, you may be able to take the credit for child and dependent care expenses on Form 2441.

Who is a qualifying person for form 2441?

Qualifying Person(s) A qualifying person is any of the following. A qualifying child under age 13 whom you can claim as a dependent. If the child turned 13 during the year, the child is a qualifying person for the part of the year they were under age 13.

What form do I need from daycare for taxes?

To claim the credit, taxpayers must complete Form 2441, a two-page document that reports child and dependent care expenses as part of a federal income tax return and is used to determine the amount of child and dependent care expenses the taxpayer can claim.

Who completes form 2441?

Form 2441 is used to claim the Child and Dependent Care Credit, which is available to those who pay someone to care for dependent children under 13, disabled spouses, or other dependents who cannot mentally or physically care for themselves.

Who is eligible for child dependent care expenses?

A qualifying individual for the child and dependent care credit is: Your dependent qualifying child who was under age 13 when the care was provided, Your spouse who was physically or mentally incapable of self-care and lived with you for more than half of the year, or.

Is there a tax form for dependent care in FSA?

Yes, unlike healthcare and limited health FSAs, you must file a form with your tax return when you have a DCFSA. When submitting your tax return, you must complete a Child and Dependent Care Expenses form (Form 2441 for a 1040 return; Schedule A for a 1040-A return).

What disqualifies the taxpayer from claiming the Child and Dependent Care Credit?

In most years you can claim the credit regardless of your income. The Child and Dependent Care Credit does get smaller at higher incomes, but it doesn't disappear - except for 2021. In 2021, the credit is unavailable for any taxpayer with adjusted gross income over $438,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 2422?

Form 2422 is a tax form used by certain U.S. taxpayers to report specific information regarding their foreign financial assets.

Who is required to file Form 2422?

Taxpayers who have foreign financial assets exceeding certain thresholds are required to file Form 2422.

How to fill out Form 2422?

To fill out Form 2422, taxpayers must provide accurate information regarding their foreign financial assets, ensuring that all required sections are completed as instructed in the form's guidelines.

What is the purpose of Form 2422?

The purpose of Form 2422 is to ensure compliance with U.S. tax laws regarding the reporting of foreign financial assets and to help prevent tax evasion.

What information must be reported on Form 2422?

Form 2422 requires reporting of details such as the type and value of foreign financial assets, account numbers, and the names of foreign financial institutions.

Fill out your form 2422 - dads online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 2422 - Dads is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.