Get the free credit investigation form

Fill out, sign, and share forms from a single PDF platform

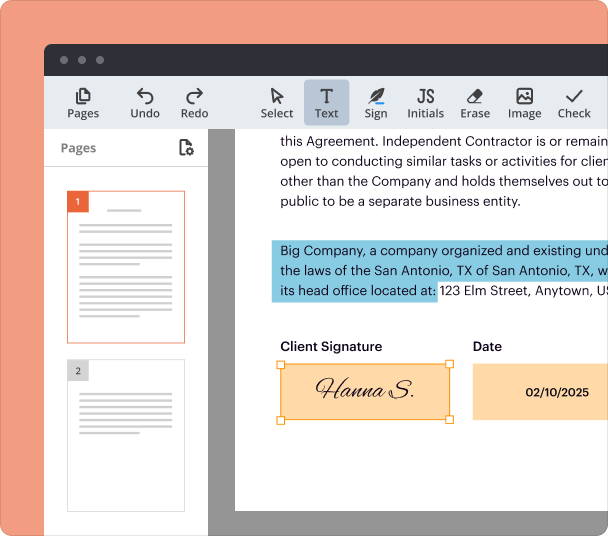

Edit and sign in one place

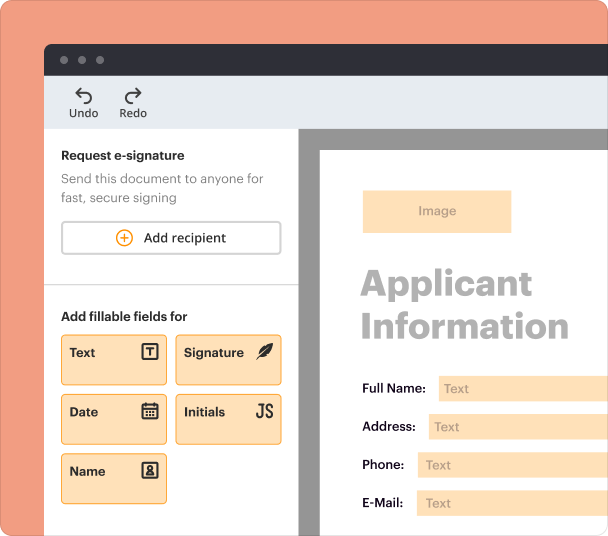

Create professional forms

Simplify data collection

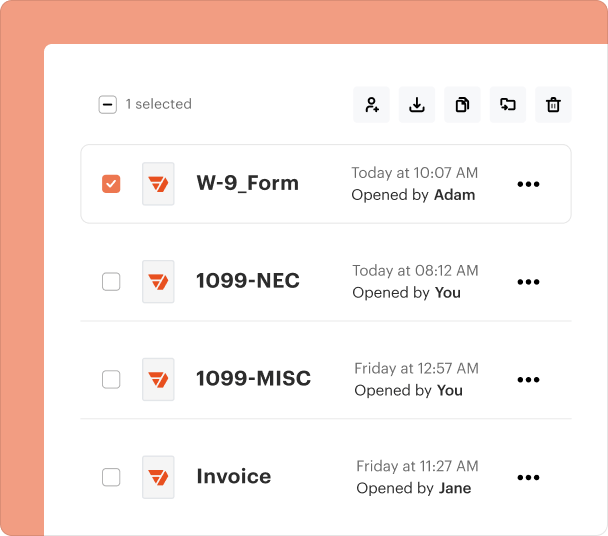

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

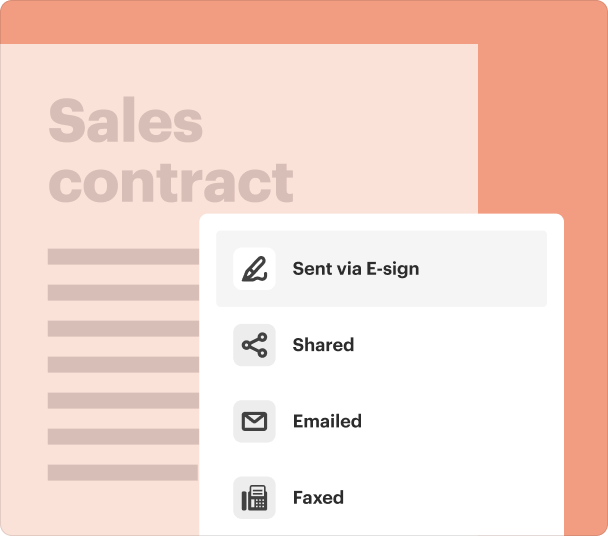

End-to-end document management

Accessible from anywhere

Secure and compliant

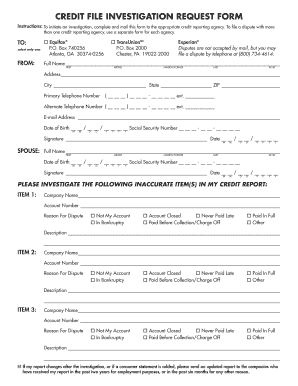

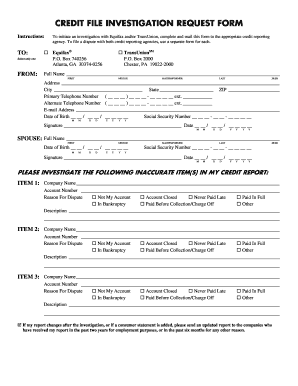

Understanding the Credit Investigation Form

What is the credit investigation form

The credit investigation form is a crucial document used to initiate a review of inaccuracies present in a credit report. This form allows individuals to formally dispute errors or discrepancies found in their credit history, which can impact credit scores and borrowing capabilities. The completion of this form helps ensure that the information reported to credit bureaus reflects accurate and up-to-date records.

Key Features of the credit investigation form

The credit investigation form includes essential details such as personal information, contact details, and specific areas of dispute. Key features often consist of sections for account details, nature of the dispute, and a space for elaboration. This structured format facilitates a thorough review and ensures that all relevant information is captured, increasing the chances of a successful resolution to the reported issues.

How to Fill the credit investigation form

Filling out the credit investigation form requires accuracy and attention to detail. Begin by entering personal information, including your full name, address, and contact information. Clearly indicate the credit report order number and specify the nature of your dispute by selecting relevant categories. In the elaboration sections, provide detailed explanations of the inaccuracies, including any supporting information. Make sure to review all entries for completeness before submitting the form.

Common Errors and Troubleshooting

Common errors when completing the credit investigation form can lead to delays in resolving disputes. Ensure that all fields marked as mandatory are filled out correctly. Double-check the accuracy of your contact information, as this will be crucial for follow-up communications. Additionally, provide clear and concise descriptions of your disputes to avoid misunderstandings. If your request is denied or you receive no response, consider re-evaluating your submitted information for completeness.

Benefits of Using the credit investigation form

Utilizing the credit investigation form provides several benefits, including a formal means to dispute inaccuracies within credit reports. By submitting this form, consumers can protect their financial well-being by ensuring that their credit history accurately reflects their financial behaviors. This proactive approach can lead to improved credit scores, thereby enhancing borrowing opportunities and lowering interest rates.

Frequently Asked Questions about credit file investigation request form

What should I do if my dispute is not resolved after submitting the form?

If your dispute is not resolved, consider contacting the credit bureau directly for further clarification. You may also gather additional evidence to support your claim and resubmit the credit investigation form.

Is there a fee associated with submitting a credit investigation form?

Typically, submitting a credit investigation form is free of charge, but it is advisable to check with the specific credit bureau for their policies.

pdfFiller scores top ratings on review platforms