Get the free Pension Payment Agreement

Show details

This document outlines the terms and conditions regarding the payment of an account-based pension to the member, including details on startup, administration, and implications upon the member's death.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pension payment agreement

Edit your pension payment agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pension payment agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

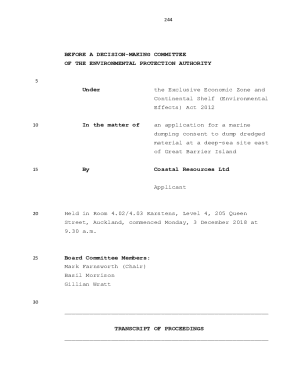

Editing pension payment agreement online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pension payment agreement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pension payment agreement

How to fill out Pension Payment Agreement

01

Obtain a Pension Payment Agreement form from the relevant pension authority or employer.

02

Fill in your personal information, including full name, address, and Social Security number.

03

Indicate the type of pension plan you are enrolling in or transferring to.

04

Specify the amount of your pension payment or percentage you wish to allocate.

05

Review any terms or conditions listed in the agreement carefully.

06

Provide any required documentation, such as proof of employment or identification.

07

Sign and date the agreement to certify that you understand and agree to its terms.

08

Submit the completed agreement to the appropriate department or agency.

Who needs Pension Payment Agreement?

01

Individuals who are nearing retirement and wish to secure their pension benefits.

02

Employees participating in company-sponsored pension plans.

03

Beneficiaries of pension funds who need to establish payment arrangements.

04

Individuals transferring pension funds from one plan to another.

05

Financial advisors assisting clients in managing retirement benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is the formal name of the pension arrangement?

A retirement annuity contract (RAC) is the formal name for what is commonly called a personal pension and is a particular type of insurance contract approved by Revenue. It is a defined contribution pension plan.

What is the other name of pension?

The terms "retirement plan" and "superannuation" tend to refer to a pension granted upon retirement of the individual; the terminology varies between countries. Retirement plans may be set up by employers, insurance companies, the government, or other institutions such as employer associations or trade unions.

Is it better to take a lump-sum or monthly pension?

A Historically, the normal advice is to take the maximum lump sum. Primarily because it is tax free, whereas pension income is taxable. Furthermore taking the lump sum gives more flexibility and is particularly useful for paying off mortgages.

What's another name for a pension plan?

As the names imply, a defined-benefit plan — also commonly known as a traditional pension plan — provides a specified payment amount in retirement. A defined-contribution plan allows employees to contribute and invest in funds and other securities over time to save for retirement.

What is a pension scheme arrangement?

A pension scheme is a scheme or other arrangement which is comprised in one or more instruments or agreements, having or capable of having effect so as to provide benefits to or in respect of persons on retirement, on death, on having reached a particular age, on the onset of serious ill-health or incapacity or in

What is the name of a pension scheme?

There are two types of workplace pension schemes – defined benefit and defined contribution schemes. To find out which type of workplace pension scheme you're in, check with your pension provider.

What is a pension plan in English?

A pension plan is a retirement plan that requires employers to contribute to a pool of funds for a worker's future benefit. A defined-benefit pension plan guarantees a set monthly payment for life or a lump-sum payment at retirement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Pension Payment Agreement?

A Pension Payment Agreement is a legal document that outlines the terms under which pension benefits are to be paid to an individual or entity.

Who is required to file Pension Payment Agreement?

Typically, individuals or entities receiving pension benefits, pension plan administrators, or employers offering pension plans are required to file a Pension Payment Agreement.

How to fill out Pension Payment Agreement?

To fill out a Pension Payment Agreement, one must provide personal information, details about the pension plan, payment terms, and any relevant beneficiary information, usually following the guidelines set forth by the pension plan.

What is the purpose of Pension Payment Agreement?

The purpose of a Pension Payment Agreement is to formalize the obligations regarding pension payments between the pensioner and the pension provider, ensuring clear understanding and compliance with payment terms.

What information must be reported on Pension Payment Agreement?

The information that must be reported on a Pension Payment Agreement typically includes the names of the parties involved, pension plan details, payment amounts and frequency, and any relevant dates or terms regarding the payment.

Fill out your pension payment agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pension Payment Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.