KPMG Personal Income Tax Questionnaire for US Individual Tax Returns 2011-2025 free printable template

Get, Create, Make and Sign tax questionnaire kpmg form

Editing 2011 kpmg questionnaire form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2011 kpmg questionnaire form

How to fill out KPMG Personal Income Tax Questionnaire for US Individual

Who needs KPMG Personal Income Tax Questionnaire for US Individual?

Video instructions and help with filling out and completing 2011 kpmg questionnaire

Instructions and Help about 2011 kpmg questionnaire form

I'm Jana Merlin no I'm a principal in our Washington National Tax Office I'm also the leader of the firm's energy sustainability tax practice in the US really send about the green tax index which was recently released in if it's a survey of 21 different jurisdictions went to KPMG practices around the world and had them provide a survey on tax incentives for green activity whether it be renewable energy efficiency really the whole gamut of what would be in the sustainability bucket we ranked the countries in terms of how green their tax code is overall as well as in different categories, so it's going to be really helpful I think the companies as they try and plan their sustainability investments around the world to rely on it to determine where they can get the best after tax rate of return on those investments one of the interesting findings I thought was that the US ranked number one I think a lot of people don't think of the US as being an extremely green jurisdiction in our policy but at least as it relates to the tax code we are the US was the leader by a pretty wide margin in terms of using the Taco to drive green behavior however you want to measure that other interesting findings were that the US was almost all incentives whereas other jurisdictions like France for example used almost all penalties so depending on how you view the world is centers are penalties you get different outcomes

People Also Ask about

How can I ask for tax questions for free?

Where can I get free answers to tax questions?

What is a tax questionnaire?

How can I get free answers to income tax questions?

What are common tax questions?

Where can I ask tax questions online for free?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2011 kpmg questionnaire form online?

How do I fill out 2011 kpmg questionnaire form using my mobile device?

How do I fill out 2011 kpmg questionnaire form on an Android device?

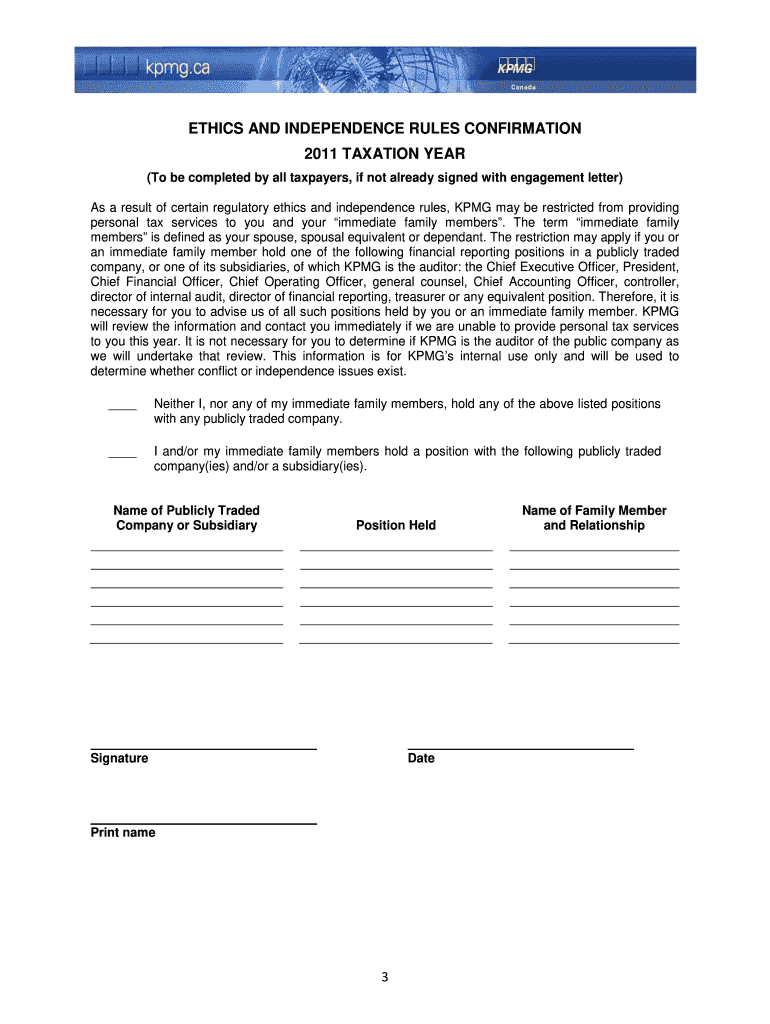

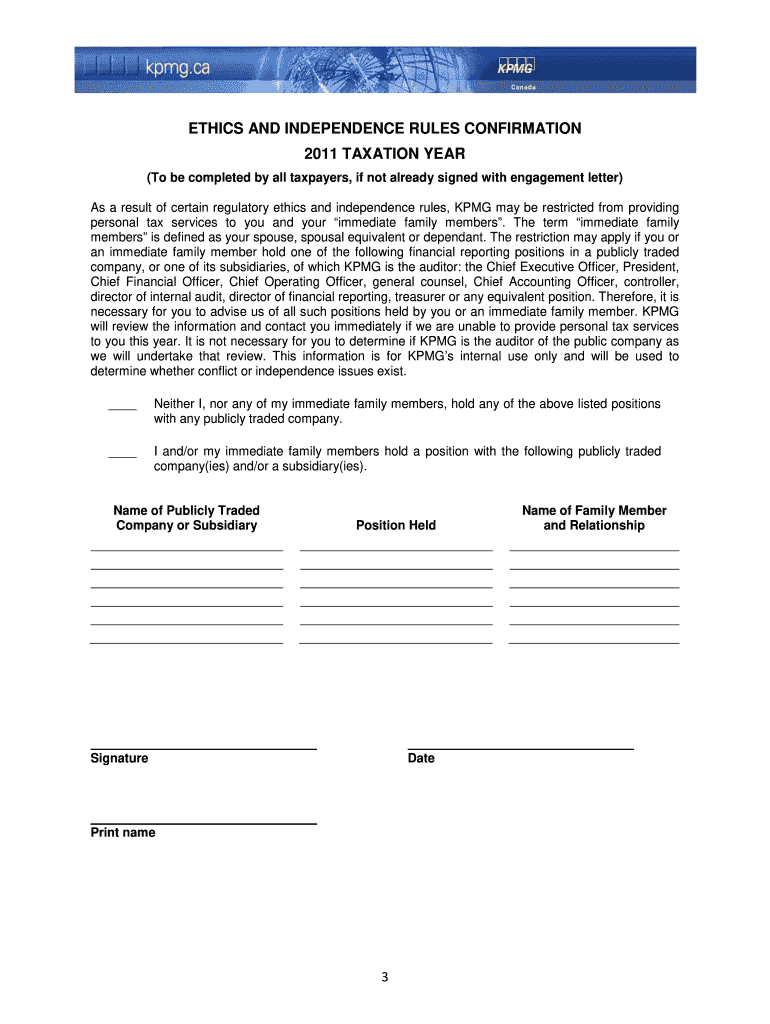

What is KPMG Personal Income Tax Questionnaire for US Individual?

Who is required to file KPMG Personal Income Tax Questionnaire for US Individual?

How to fill out KPMG Personal Income Tax Questionnaire for US Individual?

What is the purpose of KPMG Personal Income Tax Questionnaire for US Individual?

What information must be reported on KPMG Personal Income Tax Questionnaire for US Individual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.