Bank of Advance Loan AppPersonal Financial Statement free printable template

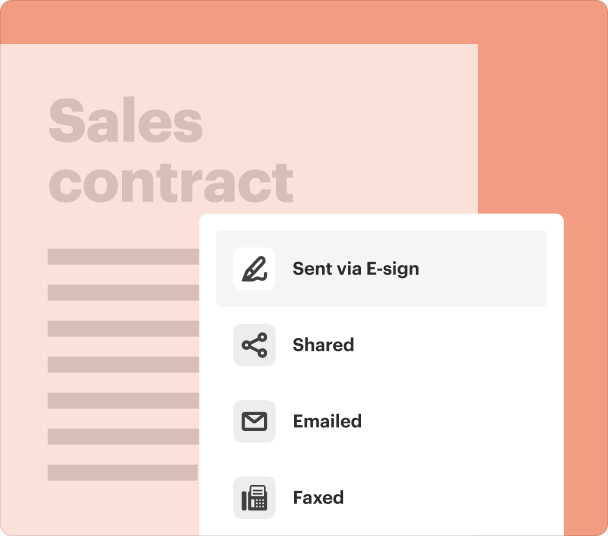

Fill out, sign, and share forms from a single PDF platform

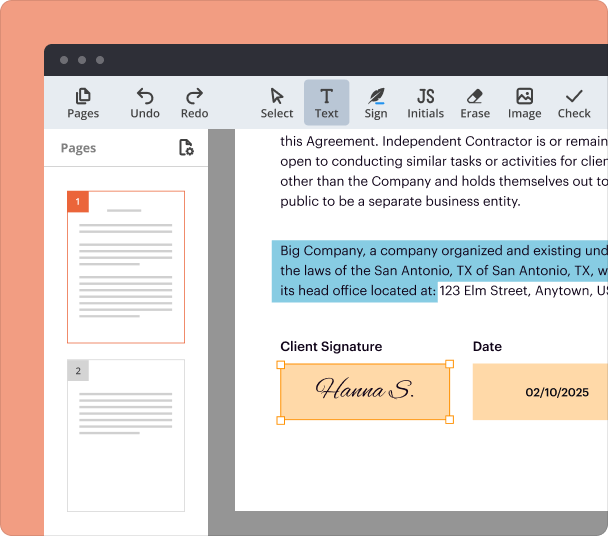

Edit and sign in one place

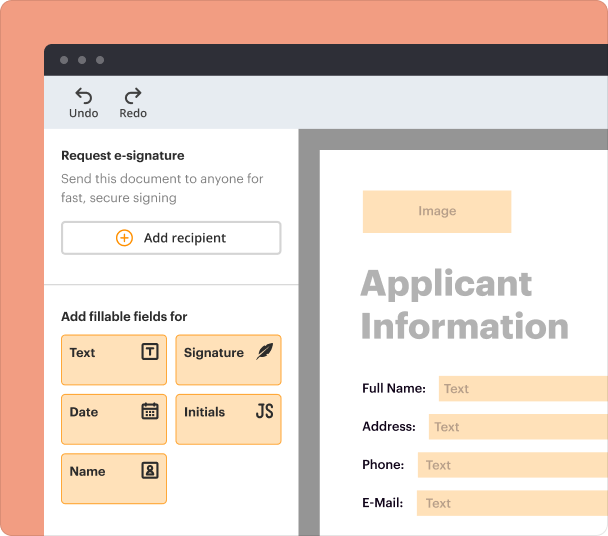

Create professional forms

Simplify data collection

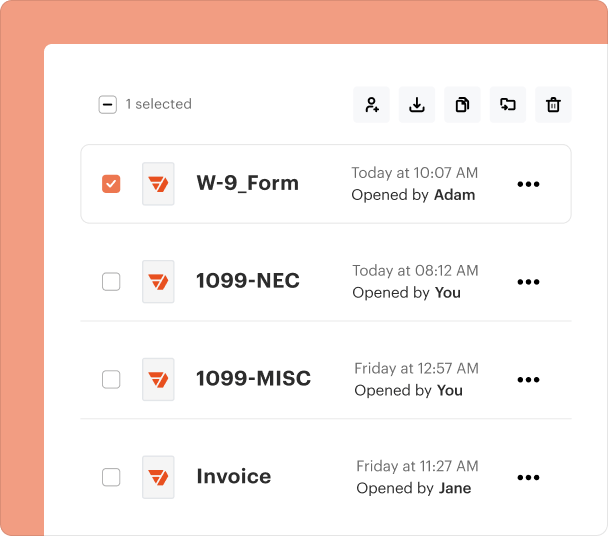

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

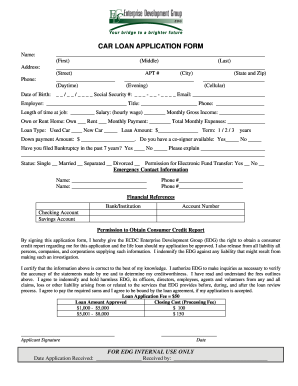

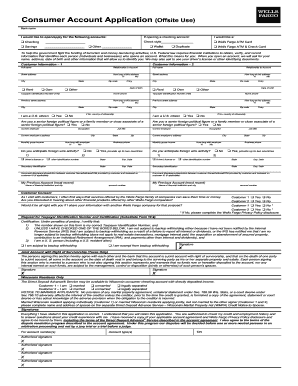

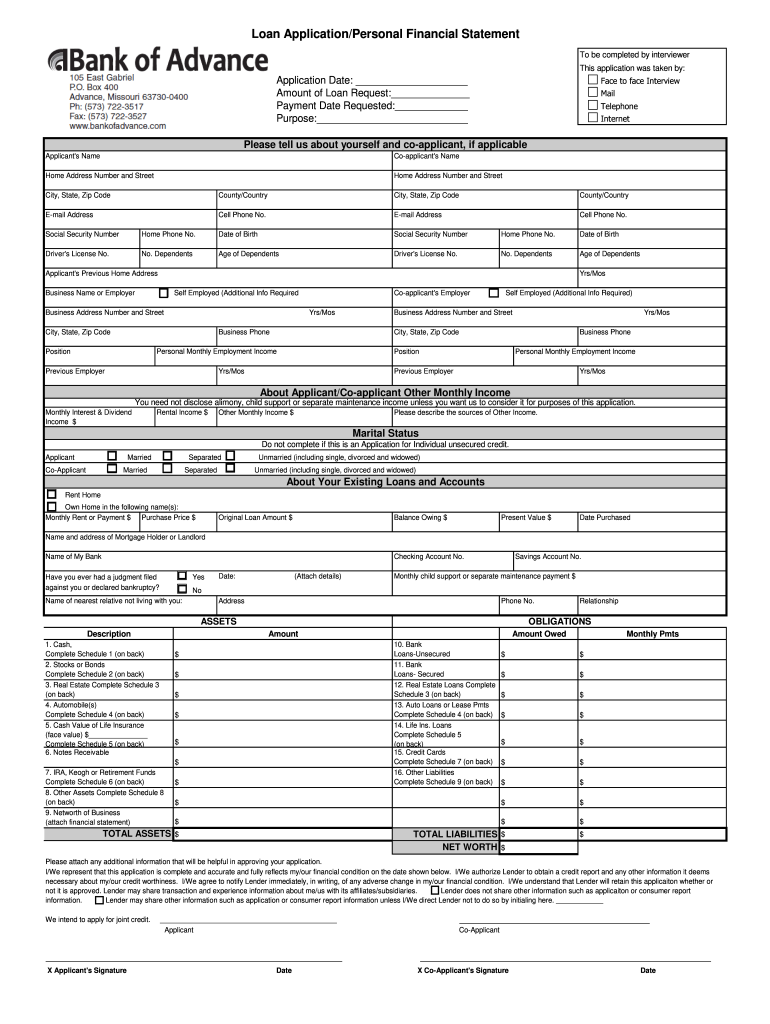

Understanding the Bank of Advance Loan Form

What is the bank of advance loan form

The bank of advance loan form is a formal application used by borrowers to request a loan from the bank. This document collects essential details about the applicant's financial status, employment history, and purpose for seeking the loan. It serves as a foundational tool for banks to assess the creditworthiness of potential borrowers.

Key Features of the bank of advance loan form

Key features of the bank of advance loan form include comprehensive fields for personal and financial information. Applicants are required to provide their full name, address, Social Security Number, and employment details. The form also includes sections for listing existing debts and income sources, allowing the bank to perform a thorough analysis of the borrower’s financial health.

Required Documents and Information

When completing the bank of advance loan form, applicants need to furnish several documents. This typically includes proof of identity such as a driver's license, bank statements, pay stubs, and tax returns. This documentation is vital for verifying the information provided in the application and assessing the applicant's financial situation.

How to Fill the bank of advance loan form

Filling out the bank of advance loan form requires careful attention to detail. Start by entering personal information accurately, ensuring all data matches your identification documents. Next, provide employment and income information. Be sure to complete sections related to obligations and assets fully, and double-check for any errors before submitting to avoid delays in processing.

Best Practices for Accurate Completion

To ensure a smooth application process, it is wise to follow best practices when completing the bank of advance loan form. Always use clear and legible handwriting if filling it out by hand, or opt for a digital format if available. Review each section thoroughly, and provide honest and precise information. It is also helpful to have all required documentation readily accessible during the application process.

Review and Validation Checklist

Having a review and validation checklist can significantly reduce errors in the loan application. Before submission, check that all fields are completed, your personal details are accurate, and all required documents are attached. It is also beneficial to verify that you meet the eligibility criteria outlined by the bank.

Common Errors and Troubleshooting

Common errors when completing the bank of advance loan form include incorrect personal information, missing documentation, and calculation mistakes in financial sections. If you encounter issues during the process, take time to identify the specific error. Review the instructions provided with the form, or consult a financial advisor if needed.

Frequently Asked Questions about bank account application form

What information is required for the bank of advance loan form?

The bank of advance loan form requires details such as your name, address, Social Security Number, employment history, income details, and information regarding existing debts and assets.

How long does the application process take?

The processing time for loan applications can vary depending on the bank's policies, but typically ranges from a few days to several weeks after submission of the bank of advance loan form.

pdfFiller scores top ratings on review platforms