ON RHT Form N5 2002 free printable template

Show details

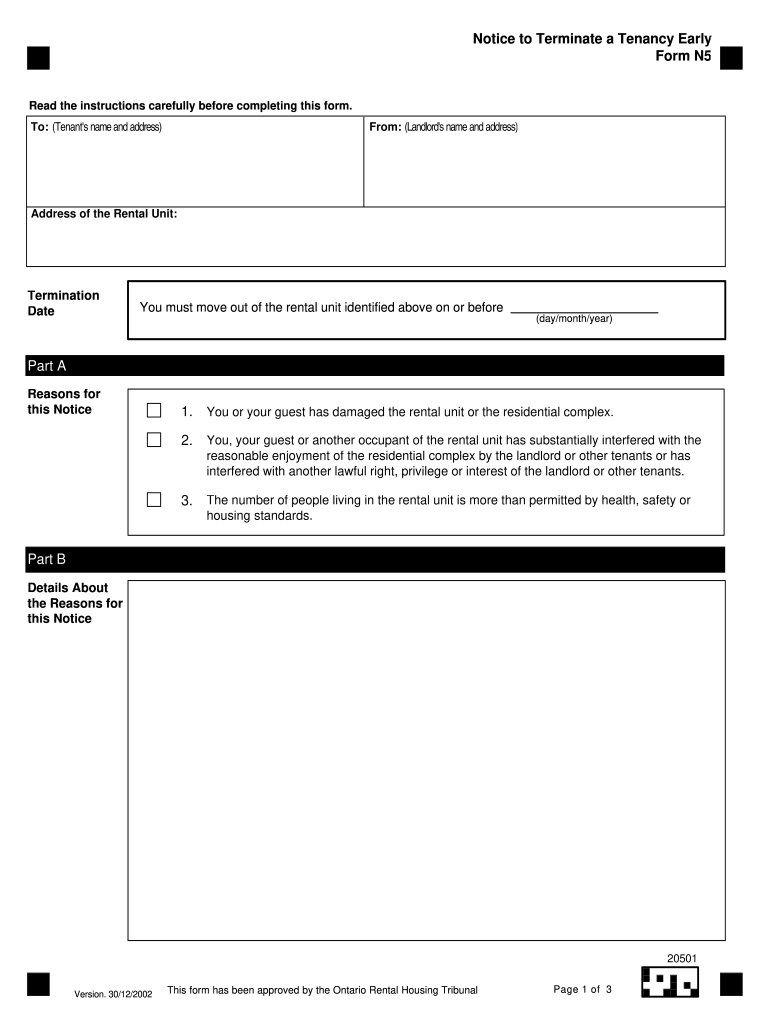

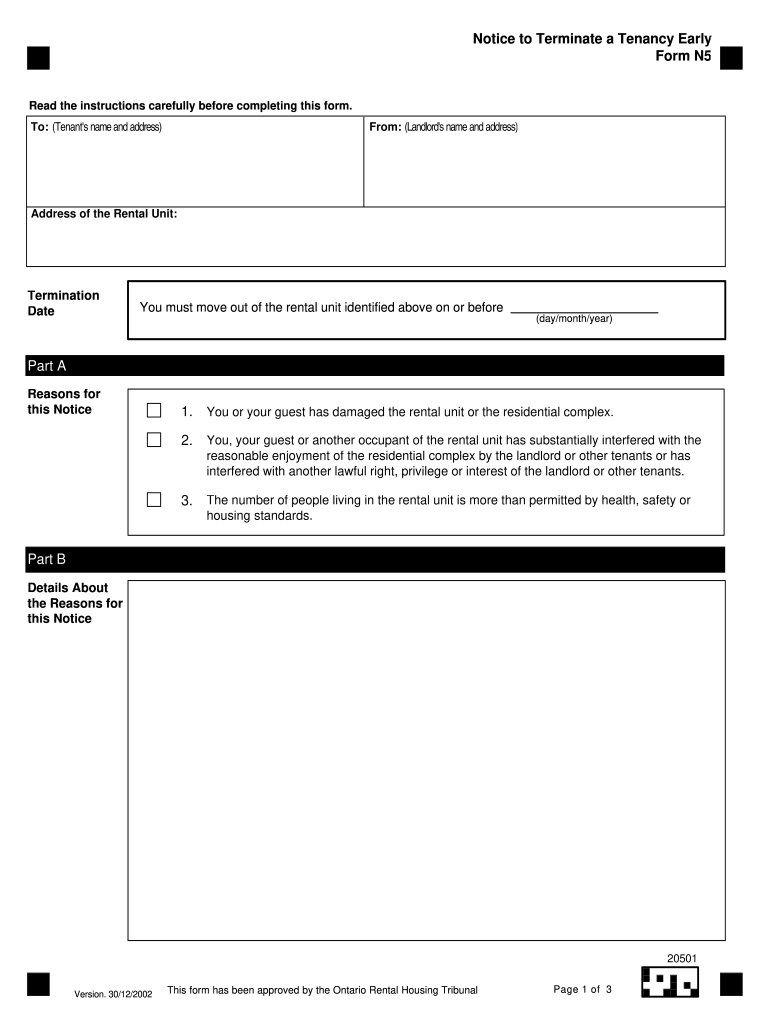

Notice to Terminate a Tenancy Early Form N5 Read the instructions carefully before completing this form. To Tenant s name and address From Landlord s name and address Address of the Rental Unit Termination Date You must move out of the rental unit identified above on or before day/month/year Part A Reasons for this Notice 1. You or your guest has damaged the rental unit or the residential complex. 2. You your guest or another occupant of the rental unit has substantially interfered with the...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ON RHT Form N5

Edit your ON RHT Form N5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ON RHT Form N5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ON RHT Form N5 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ON RHT Form N5. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ON RHT Form N5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ON RHT Form N5

How to fill out ON RHT Form N5

01

Obtain the ON RHT Form N5 from the official website or local office.

02

Fill in your personal details at the top of the form, including your name and address.

03

Indicate the type of request you are making on the form.

04

Provide all required information related to your request, ensuring accuracy.

05

Attach any necessary documentation that supports your request.

06

Review the completed form for any errors or omissions.

07

Sign and date the form at the designated area.

08

Submit the form as directed, either online or by mail, to the appropriate office.

Who needs ON RHT Form N5?

01

Individuals or businesses who are applying for the Ontario RHT (Residential Health Tax) reduction or exemption.

02

Landlords seeking to file for a tax rebate related to residential properties.

03

Taxpayers who believe they qualify for an adjustment or refund regarding residential taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is the form for non payment of rent in Ontario?

A landlord can give a tenant a Form N4 notice as early as the day after the rent is due. For example, if rent is due on the 1st of the month and is not paid in full, the landlord can give the Form N4 on the 2nd day of the month. Landlords are encouraged to act promptly and issue notice as soon as possible.

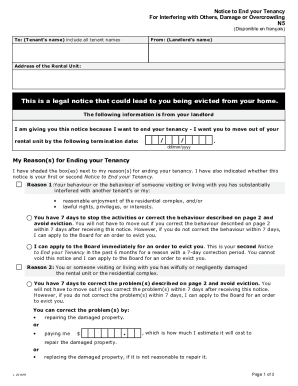

What is an N5 form in Ontario?

Notice to End your Tenancy For. Interfering with Others, Damage or. Overcrowding.

How do you respond to N5?

The N5 Termination Notice gives the tenant three options: Correct all the issues identified and void the notice within 7 days; Move out of the unit by the termination date; or. Ignore the notice and wait until the landlord files with the Landlord and Tenant Board.

What is the difference between N5 and N7?

N5 – Damage, Substantial interference, Impairing safety or Overcrowding. N6 – Misrepresentation of Income (if tenant pays Rent Geared to Income) N7 – Illegal Act. N8 – Persistent late payment.

What is an N7 in Ontario?

Form N7 is a 10-day termination notice, and it does not give the tenant an opportunity to void it. When calculating the termination date, the day this notice is served to the tenant is considered Day 0, the next day is Day 1.

What comes after N5?

Giving this notice is the first step in evicting a tenant for the above reasons. If the tenant does not stop the activities or correct the behaviour described within 7 days of being given the Form N5, then, starting on the 8th day, you can apply to the Landlord and Tenant Board (LTB) to evict the tenant.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the ON RHT Form N5 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your ON RHT Form N5 in seconds.

Can I create an electronic signature for signing my ON RHT Form N5 in Gmail?

Create your eSignature using pdfFiller and then eSign your ON RHT Form N5 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit ON RHT Form N5 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share ON RHT Form N5 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is ON RHT Form N5?

ON RHT Form N5 is a tax form used in Ontario, Canada, for reporting a taxpayer's income and determining their eligibility for certain tax credits and benefits.

Who is required to file ON RHT Form N5?

Individuals who earn income in Ontario and are subject to the Ontario Retention Tax must file ON RHT Form N5. This typically includes employees, self-employed individuals, and businesses.

How to fill out ON RHT Form N5?

To fill out ON RHT Form N5, you must provide personal information such as your name, address, and tax identification number, report your income details, calculate any applicable deductions, and sign the form before submission.

What is the purpose of ON RHT Form N5?

The purpose of ON RHT Form N5 is to collect information for calculating the Ontario Retention Tax and determining compliance with provincial tax obligations.

What information must be reported on ON RHT Form N5?

The information that must be reported on ON RHT Form N5 includes taxpayer identification details, income sources, any claimed deductions or credits, and overall tax liability.

Fill out your ON RHT Form N5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ON RHT Form n5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.