Get the free franklin county unclaimed funds

Show details

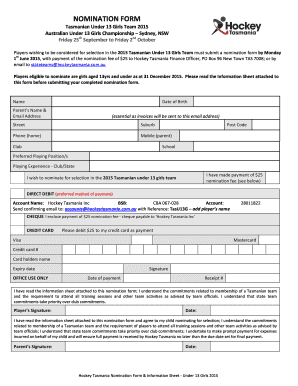

Effective 7-1-85. Revised 11/03 Franklin County Auditor Fiscal Services Division ATTN Unclaimed Funds 373 South High Street Columbus Ohio 43215-6310 614-462-3357 DO NOT FAX The undersigned makes claim to Unclaimed Funds now in the custody of the Franklin County Auditor s Office in the amount and kind as specified below pursuant to Chapter 9. 39 of the Ohio Revised Code. THIS FORM MUST BE FILLED OUT IN ITS ENTIRETY AND SUBMITTED WITH PROOF OF CL...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unclaimed funds franklin county form

Edit your franklin county unclaimed funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unclaimed funds ohio franklin county form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit unclaimed funds franklin county online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit franklin county ohio unclaimed funds form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out franklin county unclaimed funds form

How to fill out Franklin County unclaimed funds?

01

First, gather all necessary information and documents such as proof of identification, social security number, previous addresses, and any past financial documents that may be related to unclaimed funds.

02

Visit the official website of Franklin County and navigate to their unclaimed funds page. Look for the appropriate forms or online portal to access the unclaimed funds search.

03

If using an online portal, create an account or login if you already have one. Follow the provided instructions to search for any unclaimed funds in your name or the name of any family members.

04

Enter the required information and search for any potential matches. Be sure to check for variations in names or misspellings.

05

If any unclaimed funds are found, read the instructions and requirements for submitting a claim. This may include filling out a claim form, providing supporting documents, and ensuring all information is accurate.

06

Fill out the necessary forms accurately and provide any requested documents. This may include a copy of a valid identification, proof of address, social security number, and any relevant financial documents.

07

Double-check all the information provided to avoid any errors or delays in processing your claim.

08

Submit your completed claim form and supporting documents through the designated method provided by Franklin County. This may be through mail, fax, or online submission, depending on the specific instructions given.

09

After submitting your claim, keep track of any reference numbers or confirmation emails provided by Franklin County. This will help you in case you need to follow up on the status of your claim.

Who needs Franklin County unclaimed funds?

01

Individuals who have lived or worked in Franklin County at any point in their lives may have unclaimed funds.

02

People who believe that they may have forgotten about funds held in their name by financial institutions, insurance companies, or other entities within the county.

03

Relatives or heirs of deceased individuals who may have unclaimed funds left behind in their name.

Overall, anyone who has a reason to believe that they may have unclaimed funds in Franklin County should take the necessary steps to search and potentially claim those funds.

Fill

unclaimed funds franklin county ohio

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is franklin county unclaimed funds?

Franklin County unclaimed funds refer to financial assets that have been abandoned by their rightful owners and are being held by the county until they can be claimed.

Who is required to file franklin county unclaimed funds?

Certain entities such as businesses, financial institutions, and government agencies are required to file franklin county unclaimed funds if they are in possession of abandoned or unclaimed assets.

How to fill out franklin county unclaimed funds?

To fill out franklin county unclaimed funds, you need to gather information about the abandoned assets, including the owner's name, last known address, and any relevant contact information. You then need to complete the required forms provided by the county and submit them along with the necessary documentation.

What is the purpose of franklin county unclaimed funds?

The purpose of franklin county unclaimed funds is to protect the rights of rightful owners by holding their abandoned assets until they can be claimed. It also helps reunite individuals with their lost financial assets.

What information must be reported on franklin county unclaimed funds?

The information that must be reported on franklin county unclaimed funds includes the owner's name, last known address, contact information, a description of the abandoned assets, and any other relevant details about the abandonment or escheatment process.

How can I edit franklin county unclaimed funds from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like franklin county unclaimed funds, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for the franklin county unclaimed funds in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your franklin county unclaimed funds and you'll be done in minutes.

Can I edit franklin county unclaimed funds on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign franklin county unclaimed funds right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your franklin county unclaimed funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Franklin County Unclaimed Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.