Get the free english chinese tax glossary form

Show details

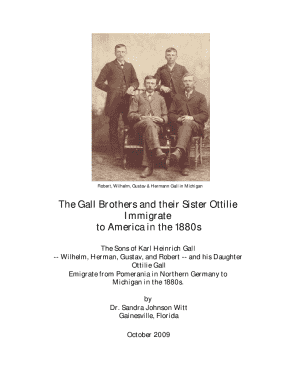

The purpose of this booklet is to assist Chinese-speaking individuals who need help to understand the technical tax terms contained in the state income tax forms and instructions. The booklet contains a glossary of terms that FTB commonly uses. The terms are rst presented in English and then translated into Chinese. The booklet contains a glossary of terms that FTB commonly uses. The terms are rst presented in English and then translated into Chi...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign english chinese tax glossary

Edit your english chinese tax glossary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your english chinese tax glossary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing english chinese tax glossary online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit english chinese tax glossary. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out english chinese tax glossary

To fill out the English Chinese tax glossary, follow these steps:

01

Begin by gathering relevant tax terms in English and their corresponding translations in Chinese. This can be done through research or obtaining a tax glossary from reliable sources.

02

Ensure that the translations are accurate and appropriate in the context of tax terminology. It is recommended to consult with professional translators or bilingual experts to verify the accuracy of the translations.

03

Organize the glossary in a structured format, such as alphabetical order, to make it user-friendly and easily accessible. This will help users navigate through the glossary more efficiently.

04

Include clear definitions or explanations for each term in both English and Chinese. This will provide a comprehensive understanding of the tax terms for users who may have varying levels of knowledge in both languages.

05

Consider including additional information, such as examples or usage notes, to enhance the understanding of the tax terms. This can help users apply the terms correctly in practical situations.

Who needs the English Chinese tax glossary?

01

Individuals or businesses involved in international trade or investment between English-speaking and Chinese-speaking countries may need the glossary to understand and communicate effectively about tax matters.

02

Translators or interpreters working in the field of taxation may find the glossary useful for accurately conveying tax terminology between English and Chinese.

03

Students or professionals studying or researching tax laws and regulations in both English and Chinese jurisdictions can benefit from the glossary to improve their understanding of tax concepts and terminology.

Overall, the English Chinese tax glossary serves as a valuable resource for anyone seeking to bridge the language gap and gain a comprehensive understanding of tax terms in both English and Chinese.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my english chinese tax glossary directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your english chinese tax glossary and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I complete english chinese tax glossary on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your english chinese tax glossary. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit english chinese tax glossary on an Android device?

You can edit, sign, and distribute english chinese tax glossary on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is english chinese tax glossary?

The English Chinese tax glossary is a document that provides a comprehensive list and explanation of tax-related terms and concepts in both English and Chinese languages. It helps taxpayers and tax professionals understand and navigate the complexities of tax laws and regulations in both languages.

Who is required to file english chinese tax glossary?

The English Chinese tax glossary does not need to be filed by taxpayers. It is a reference document developed by tax authorities or tax organizations to assist taxpayers and tax professionals in understanding tax terminology in both English and Chinese languages.

How to fill out english chinese tax glossary?

The English Chinese tax glossary does not require any specific filing or filling out. It is a reference document that can be used by taxpayers and tax professionals for understanding tax terminology in both English and Chinese languages.

What is the purpose of english chinese tax glossary?

The purpose of the English Chinese tax glossary is to provide a comprehensive list and explanation of tax-related terms and concepts in both English and Chinese languages. It aims to facilitate communication and understanding between taxpayers, tax professionals, and tax authorities by providing a common vocabulary of tax terminology in both languages.

What information must be reported on english chinese tax glossary?

The English Chinese tax glossary does not require any specific information to be reported. It is a reference document that provides a list and explanation of tax-related terms and concepts in both English and Chinese languages.

Fill out your english chinese tax glossary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

English Chinese Tax Glossary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.