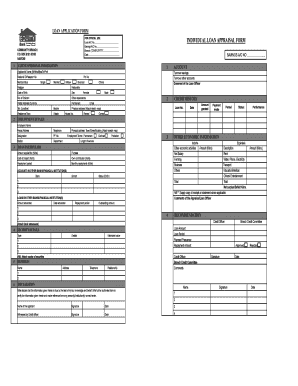

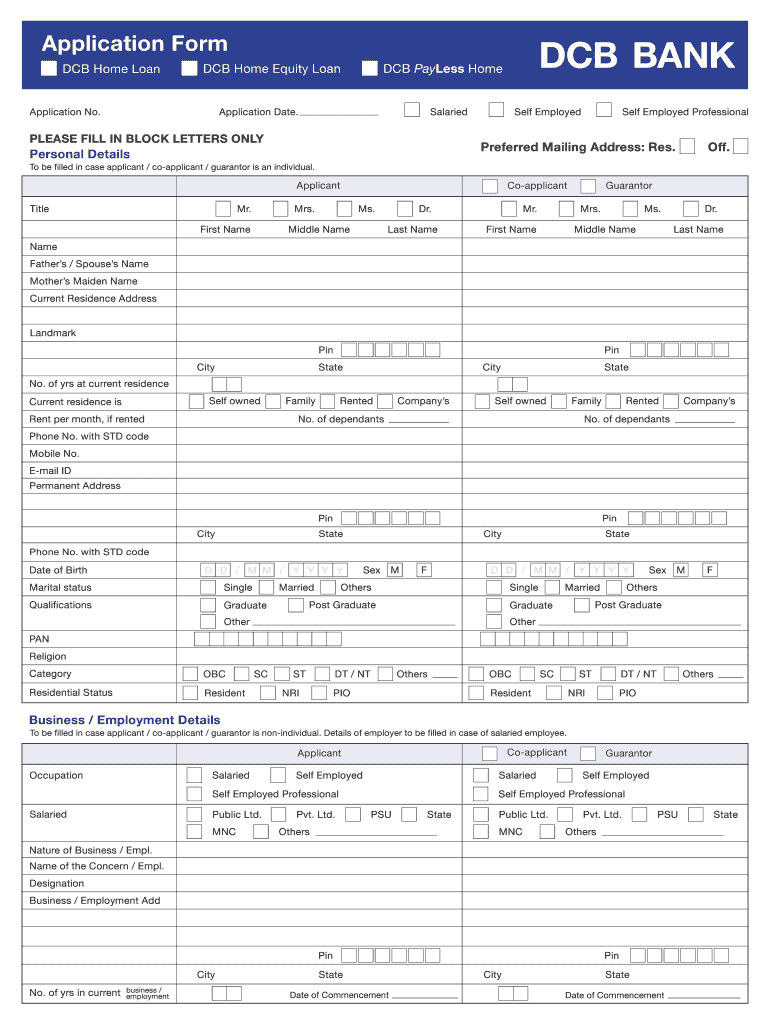

India DCB Bank Home LoanHome Equity free printable template

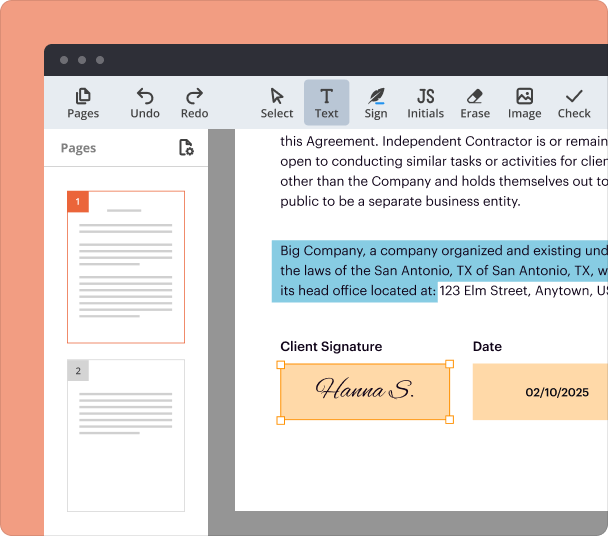

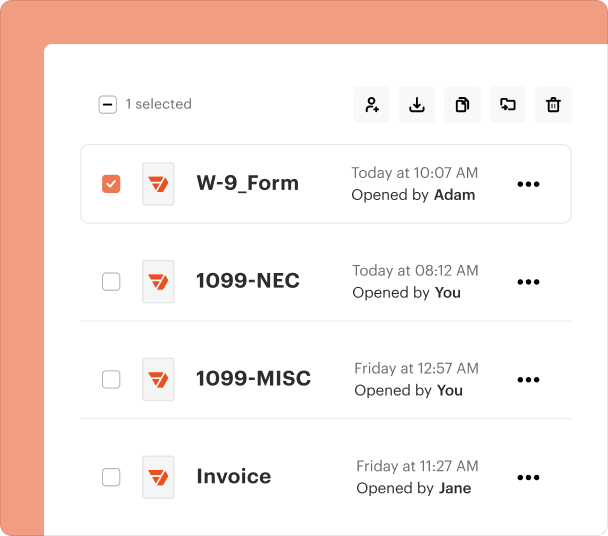

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

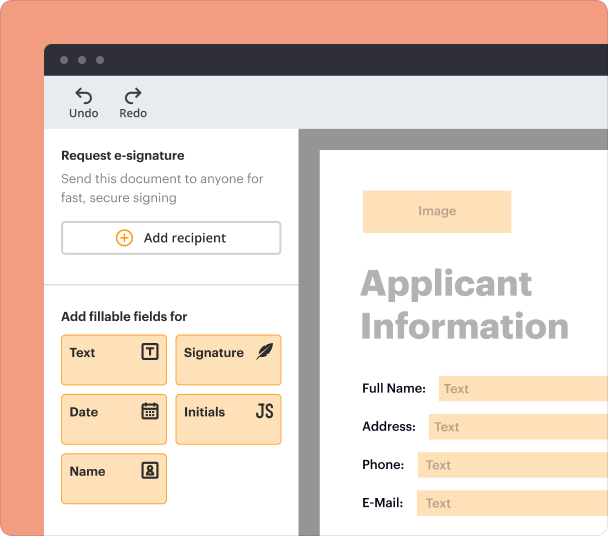

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out a DCB Bank home loan application form

Filling out the DCB Bank home loan application form can seem daunting, but understanding the process can make it much easier. This guide outlines how to successfully navigate the application for a DCB home loan, including detailed steps to fill out the form and tips for ensuring your application is approved.

Understanding DCB home loans

DCB Bank offers home loans that cater to various needs in property financing, making them a flexible choice for borrowers. Home loans from DCB come in several types, including PayLess Home Loans and Home Equity Loans, which allow homeowners to leverage their property as collateral.

-

DCB’s offerings include tailored solutions like PayLess Home Loans, which focus on lower initial EMI rates, and Home Equity Loans that utilize existing property for funding.

-

Taking a DCB home loan can help buyers access their dream home with manageable repayment options.

-

With competitive interest rates and flexible terms, DCB stands out for borrowers seeking tailored home financing solutions.

What are the eligibility criteria for DCB home loans?

The eligibility requirements for DCB home loans differ for salaried and self-employed individuals, ensuring that various income sources are accommodated. Applicants must also consider the minimum salary requirements, which support a steady and reliable income stream.

-

Salaried applicants generally need to provide proof of consistent monthly earnings, while self-employed borrowers must show a stable profit over recent years.

-

DCB specifies minimum income thresholds, which help determine borrowing limits and repayment capacities.

-

A good CIBIL score reflects creditworthiness and plays a crucial role in loan eligibility.

How does the DCB home loan application process work?

Applying for a DCB home loan involves a straightforward process. Following a step-by-step guide will help applicants effectively complete the online application form and gather necessary documents.

-

Gather all necessary documentation, including proof of identity, income, and address.

-

Complete the online application form carefully with accurate details to facilitate quicker processing.

-

Once submitted, DCB will review your application and notify you of any further requirements or approvals.

How to complete the DCB home loan application form?

Accuracy in filling out the home loan application form is paramount. Begin by correctly providing your personal details, followed by employment information, and pay close attention to the applicant, co-applicant, and guarantor sections.

-

Ensure all personal data is correct to avoid delays. Include current employment status and details.

-

Add necessary details for any co-applicants or guarantors to improve the likelihood of approval.

-

Double-check all entries for completeness and correctness to expedite the loan approval process.

What should you know about interest rates and fees?

Understanding the financial implications of interest rates and related fees is crucial before committing to a home loan. DCB typically offers competitive interest rates compared to market standards, while processing fees and potential hidden charges should be carefully reviewed.

-

Stay informed about the current rates and how they align with prevailing market rates.

-

Consider all processing fees upfront to avoid surprises later in the borrowing process.

-

Interest rates significantly affect your Equated Monthly Installments (EMI), so calculate potential repayments accurately.

How to understand home loan terms?

Grasping common home loan terminologies such as EMI (Equated Monthly Installment) and MCLR (Marginal Cost of Funds based Lending Rate) is essential for potential borrowers. These terms influence overall borrowing costs.

-

The EMI includes the principal and interest you pay each month for the duration of the home loan.

-

MCLR is the benchmark rate that banks use for pricing their loans, impacting how much you might pay in interest.

-

Leverage resources like pdfFiller to calculate potential EMIs and manage loan documents effectively.

What additional considerations should you make?

Before making a final decision on a home loan, it's vital to evaluate multiple offers and compare terms. Reading through the fine print of loan agreements can reveal fantastic opportunities or potential pitfalls.

-

Weigh the pros and cons of various home loan products to find one that fits your financial situation.

-

Ensure you understand all aspects of your loan agreement, including fees and penalties.

-

Stay aware of local regulations, as they may affect your borrowing capacity and loan terms.

How can pdfFiller assist in managing your application?

pdfFiller empowers users to fill out, edit, and securely eSign documents, making the home loan application process easier. It enhances collaboration for those managing multiple loan applications and tracks progress effectively.

-

Easily fill in application details and make adjustments if changes arise during the application process.

-

Work collaboratively with teams to manage loan applications through a single platform.

-

Monitor your DCB Home Loan application and receive updates directly through the platform.

Frequently Asked Questions about loan form dcb bank

What documents are needed for a DCB home loan application?

To apply for a DCB home loan, you typically need to provide proof of identity, income statements, tax returns, and property documents. Having these ready can streamline the application process.

How long does the DCB home loan approval process take?

The approval process for a DCB home loan can vary, but it generally takes between 7 to 14 business days. Factors that can influence this timeline include documentation accuracy and any additional verification processes.

Can I transfer my home loan to DCB Bank?

Yes, DCB Bank facilitates home loan transfers from other banks. Borrowers can take advantage of better rates or terms by transferring their existing loan.

What happens if my home loan application is rejected?

If your home loan application is rejected, you can inquire about the reasons for the denial and address any issues raised before applying again. It’s important to rectify eligibility criteria or credit score issues.

Is there a penalty for early loan repayment?

Most banks, including DCB, may charge a penalty for early repayment, especially during the lock-in period. It’s crucial to understand the terms of your agreement regarding early closure.

pdfFiller scores top ratings on review platforms