Get the free Resident of India

Show details

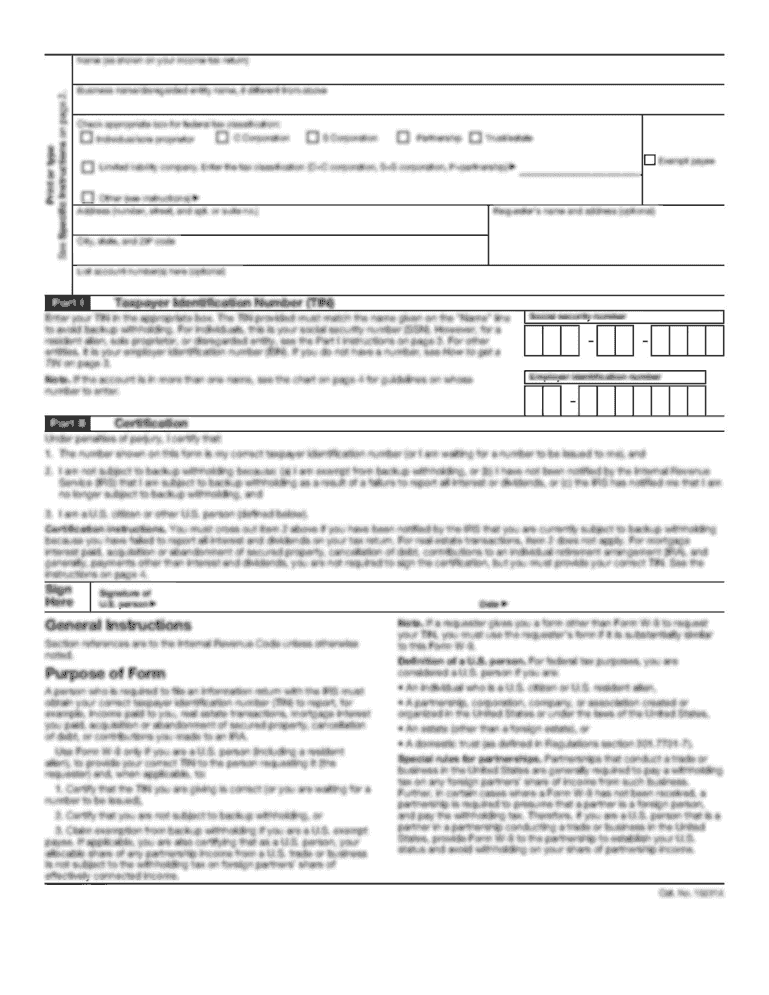

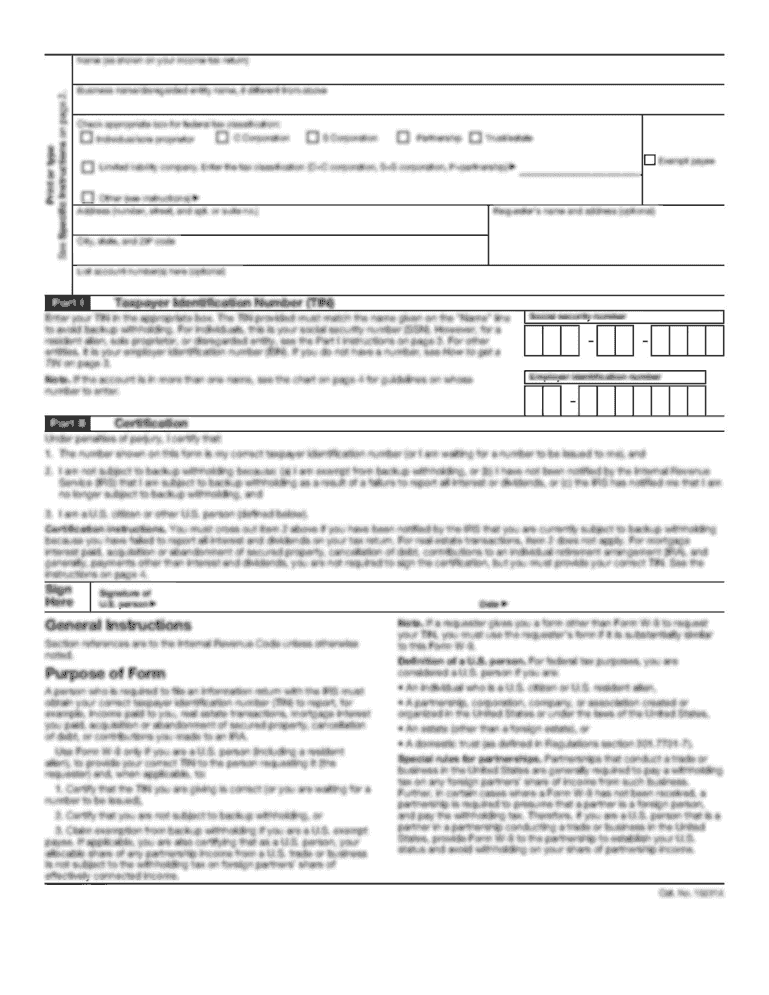

Gurgaon APPLICATION FORM CHECKLIST OF DOCUMENTS TO BE SUBMITTED ALONG WITH THE APPLICATION FORM 1. Resident of India ? Copy of PAN Card ? Photograph ? Identity Proof ? Residence address proof 2. NRI/Foreign

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your resident of india form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your resident of india form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing resident of india online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit resident of india. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out resident of india

How to fill out resident of India:

01

Obtain the necessary application form from the designated authority, such as the municipal corporation or local government office.

02

Fill in the required personal details like name, address, date of birth, and other relevant information as per the instructions provided.

03

Attach the necessary documents as proof of identity, such as a valid passport, Aadhaar card, or voter identification card.

04

Provide supporting documents to establish proof of residence, which could include rental agreements, utility bills, or property ownership documents.

05

Submit the completed application form along with the supporting documents to the designated authority.

06

Pay the applicable fees, if any, as required by the authority.

07

Follow up with the authority to check the status of your application and any further steps that might be required.

Who needs resident of India:

01

Indian citizens above the age of 18 who are residing in India and need to establish their identity and residential status officially often require a resident of India certificate.

02

Non-resident Indians (NRIs) who have returned to India for employment, education, or any other purpose and need to prove their residency might also need a resident of India certificate.

03

Individuals who are applying for government benefits or schemes that are exclusively available to Indian residents may be asked to provide a resident of India certificate as part of the application process.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is resident of india?

Resident of India refers to an individual who meets the criteria of being a resident as per the Income Tax Act of India.

Who is required to file resident of india?

Any individual who meets the criteria of being a resident of India as per the Income Tax Act is required to file resident of India.

How to fill out resident of india?

To fill out resident of India, one needs to provide the necessary information as per the guidelines provided by the Income Tax department of India.

What is the purpose of resident of india?

The purpose of resident of India is to determine the tax liability of individuals based on their residential status.

What information must be reported on resident of india?

The information that must be reported on resident of India includes personal details, income sources, deductions, and other relevant financial information.

When is the deadline to file resident of india in 2023?

The deadline to file resident of India in 2023 will be announced by the Income Tax department of India. Please refer to their official notifications for the exact date.

What is the penalty for the late filing of resident of india?

The penalty for the late filing of resident of India is subject to the provisions of the Income Tax Act. It can include a monetary penalty or other consequences as determined by the tax authorities.

How do I edit resident of india online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your resident of india and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an eSignature for the resident of india in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your resident of india right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit resident of india straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing resident of india.

Fill out your resident of india online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.