Get the free CMHC 2835

Show details

This document outlines the terms of the transfer and servicing of mortgage pools related to mortgage-backed securities between a legal entity and Canada Mortgage and Housing Corporation (CMHC).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cmhc 2835

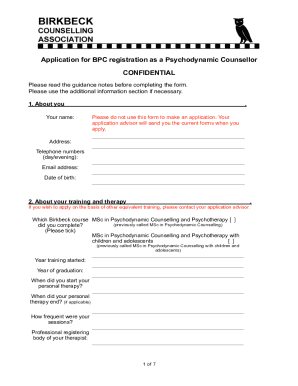

Edit your cmhc 2835 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cmhc 2835 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cmhc 2835 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cmhc 2835. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cmhc 2835

How to fill out CMHC 2835

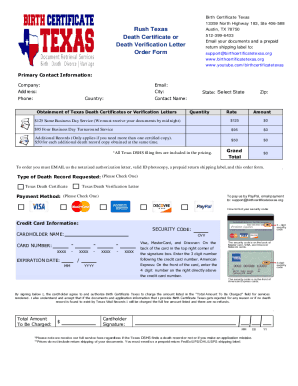

01

Begin by downloading the CMHC 2835 form from the official CMHC website.

02

Fill in your personal information at the top of the form, including name, address, and contact information.

03

Indicate the purpose of the form in the designated section.

04

Provide detailed descriptions of the project or request, including relevant dates and locations.

05

Attach any supporting documentation as required by the form's instructions.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form in the designated areas.

08

Submit the form using the specified method (mail, email, or online submission).

Who needs CMHC 2835?

01

Individuals or organizations applying for CMHC financing or mortgage insurance.

02

Contractors or builders engaged in projects that require CMHC approval.

03

Real estate professionals involved in CMHC-related transactions.

Fill

form

: Try Risk Free

People Also Ask about

What is the new home buyers program in Canada?

Under the RRSP Home Buyers' Plan (HBP), first-time home buyers can withdraw up to $60,000 from their RRSP to put toward a home purchase. There's no special contribution limit for the HBP itself; your annual RRSP contribution room is still determined by your income and CRA limits.

What are the new changes to mortgages in Canada?

What are the mortgage rule changes? 30-year mortgage amortizations for all buyers of new builds: For Canadians buying a new construction home, the government is allowing 30-year mortgage amortizations – an increase from the standard 25-year amortization period.

What is the new to Canada CMHC program?

The CMHC Newcomers program is available to borrowers with permanent and non-permanent residence status. The program helps them access housing they can afford and meets their needs. A permanent resident is someone who has been given permanent resident status by immigrating to Canada, but is not a Canadian citizen.

What is the CMHC improvement program?

CMHC Improvement is for homebuyers purchasing an existing home that requires some work or building a new home from the ground up. The product offers insured financing up to 95% of the “as-improved” value for 1- or 2-unit owner-occupied properties, and up to 90% for 3- or 4-unit properties.

What is a CMHC in English?

Canada Mortgage and Housing Corporation. CMHC.

What is the CMHC new to Canada program?

CMHC Newcomer Details. CMHC-insured financing is available to borrowers with permanent and non-permanent residency status. Must have permanent resident status or legal authorization to work in Canada (e.g., work permit). No minimum period of residency required.

What is a CMHC loan in Canada?

The term Canada Mortgage and Housing Corporation (CMHC) refers to a Canadian Crown Corporation that serves as the national housing agency of Canada. The goal of the agency is to make mortgage loans affordable for all Canadians through a housing development strategy and mortgage insurance, among other initiatives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CMHC 2835?

CMHC 2835 is a specific form used in Canada for reporting certain mortgage and housing-related information to the Canada Mortgage and Housing Corporation (CMHC).

Who is required to file CMHC 2835?

Entities such as mortgage lenders, financial institutions, and organizations involved in housing finance and administration are required to file CMHC 2835.

How to fill out CMHC 2835?

To fill out CMHC 2835, gather necessary data regarding mortgage portfolios, complete the form with accurate figures, and submit it as per CMHC guidelines.

What is the purpose of CMHC 2835?

The purpose of CMHC 2835 is to collect standardized information about mortgages in Canada to support housing research and policy making.

What information must be reported on CMHC 2835?

The form requires reporting details such as mortgage amounts, types of loans, geographic distribution, and other relevant housing data.

Fill out your cmhc 2835 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cmhc 2835 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.