Get the free irs form 8903 for 2010

Show details

Form 8903. (Rev. December 2010). Department of the Treasury. Internal Revenue Service. Domestic Production Activities Deduction. Attach to your tax return.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs form 8903 for

Edit your irs form 8903 for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 8903 for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs form 8903 for online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs form 8903 for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs form 8903 for

How to fill out IRS form 8903:

01

Obtain the necessary form: You can download IRS form 8903 from the official IRS website or request a copy by calling their helpline.

02

Provide personal information: Fill in your name, address, and social security number in the appropriate fields on the form.

03

Determine your qualifying production activities: Assess whether you engage in eligible production activities that qualify for the Domestic Production Activities Deduction (DPAD), which is the purpose of form 8903. These activities may include manufacturing, construction, architectural services, film production, and more.

04

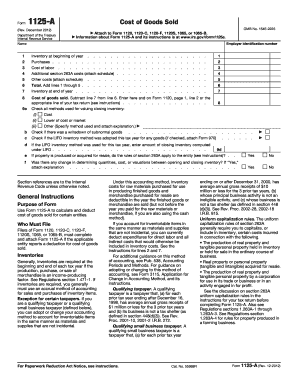

Calculate your qualified production activities income: Determine the revenue generated from your eligible production activities and report the amount on line 2 of form 8903.

05

Factor in any costs or deductions: Deduct any necessary expenses related to your qualified production activities, such as supplies, labor costs, and overhead expenses. Report the net amount on line 9 of form 8903.

06

Calculate the Domestic Production Activities Deduction: Use the provided worksheet in the form's instructions to calculate your DPAD. This deduction allows eligible businesses to lower their taxable income.

07

Transfer the calculated deduction: Once you've determined your DPAD amount, transfer it to the appropriate line on your individual or corporate tax return (e.g., Form 1040 or Form 1120).

Who needs IRS form 8903:

01

Business owners engaged in qualified production activities: Any individual, partnership, or corporation that engages in eligible production activities within the United States may need to fill out IRS form 8903.

02

Those seeking to claim the Domestic Production Activities Deduction: The form is specifically designed for taxpayers who want to claim the DPAD, which allows them to lower their tax liability based on their qualifying production activities.

03

Taxpayers wanting to reduce their taxable income: By properly completing form 8903 and claiming the DPAD, individuals and businesses can potentially reduce their taxable income, leading to lower overall tax liability.

Note: It's always advisable to consult a tax professional or refer to the IRS instructions for form 8903 to ensure accurate completion and eligibility for the Domestic Production Activities Deduction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file irs form 8903 for?

IRS Form 8903 is a tax form used by businesses to claim certain credits related to domestic production activities. The form is required to be filed by any business that:

• Is engaged in domestic production activities

• Has income or expenses related to those activities

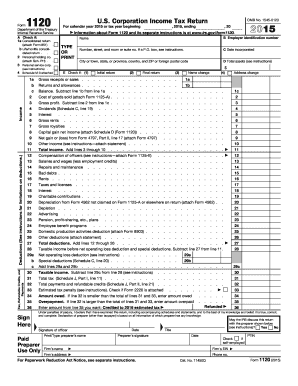

• Is filing Form 1120, U.S. Corporation Income Tax Return

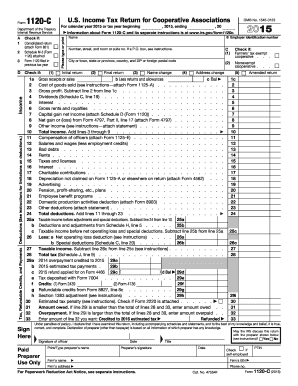

• Is filing Form 1120-F, U.S. Income Tax Return of a Foreign Corporation

• Is filing Form 1120S, U.S. Income Tax Return for an S Corporation

• Is filing Form 1041, U.S. Income Tax Return for Estates and Trusts

• Is filing Form 1065, U.S. Return of Partnership Income

• Is filing Form 990-T, Exempt Organization Business Income Tax Return.

What information must be reported on irs form 8903 for?

Form 8903 is an IRS form used to claim the Domestic Production Activities Deduction. This form requires the taxpayer to provide information about their business activities such as gross receipts, cost of goods sold, wages, and other expenses. Additionally, the taxpayer must provide a breakdown of the activity that qualifies for the deduction, including the type and amount of qualifying production activities.

What is irs form 8903 for?

IRS Form 8903, also known as the Domestic Production Activities Deduction, is used by taxpayers to claim a deduction for certain domestic production activities. It is specifically designed for businesses engaged in manufacturing, producing, growing or extracting activities within the United States. The deduction aims to incentivize and promote domestic production and job creation. The deduction is calculated based on a percentage of the qualified production activities income (revenue derived from eligible activities) and can result in a reduced tax liability for eligible taxpayers.

How to fill out irs form 8903 for?

IRS Form 8903 is used to claim the Domestic Production Activities Deduction (DPAD) for qualified domestic production activities. To fill out Form 8903, follow these steps:

1. Obtain a copy of the Form 8903 from the IRS website or from your tax preparation software.

2. Start by entering your name and Social Security number (SSN) or employer identification number (EIN) at the top of the form.

3. Part I: Qualification Through Form 1099-PATR – If you have income from cooperative dividends reported on Form 1099-PATR, follow the instructions to qualify for DPAD and calculate the deduction in this section.

4. Part II: Qualification Through Production Activities Income – If you don't have any income from Form 1099-PATR but have income from domestic production activities, use this section to calculate your DPAD. Follow the instructions provided to determine qualifying income and expenses.

5. Part III: Overall DPAD – Combine the qualifying DPAD amounts from Part I and Part II to calculate your overall DPAD. Follow the instructions provided to compute the deduction.

6. Part IV: Vendor and Contractor Notification – If you paid or incurred expenses for qualified activities to vendors or contractors, enter the required information in this section. This information is necessary to comply with the notification requirement.

7. Part V: Alternative Minimum Tax (AMT) – If you're subject to the AMT, follow the instructions to determine if your DPAD is limited by the AMT rules.

8. Part VI: Carryforward of DPAD – If you had an excess DPAD in a prior year, follow the instructions to calculate if any portion can be carried forward to subsequent years.

9. Sign and date the form at the bottom.

Ensure you read the instructions accompanying Form 8903 thoroughly, as they provide specific guidance for certain line items and additional calculations that may be necessary in certain situations. It's also wise to consult a tax professional or use tax preparation software to ensure accuracy and maximize your deductions.

What is the purpose of irs form 8903 for?

IRS Form 8903 is used to calculate the Domestic Production Activities Deduction (DPAD) for eligible manufacturers, producers, and certain other businesses. The DPAD allows eligible businesses to deduct a percentage of their qualified production activities income from their federal income tax. The purpose of Form 8903 is to determine the amount of this deduction by calculating the qualified production activities income and the allowable deduction.

How can I send irs form 8903 for to be eSigned by others?

When you're ready to share your irs form 8903 for, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete irs form 8903 for online?

pdfFiller has made it easy to fill out and sign irs form 8903 for. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit irs form 8903 for on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share irs form 8903 for from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your irs form 8903 for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 8903 For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.