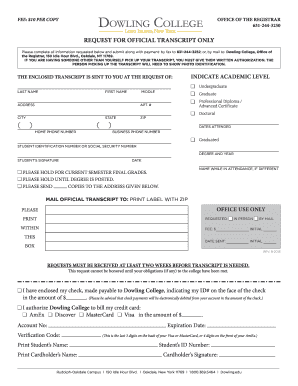

Get the free form 1048 irs 2011

Show details

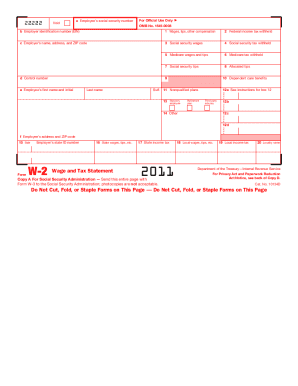

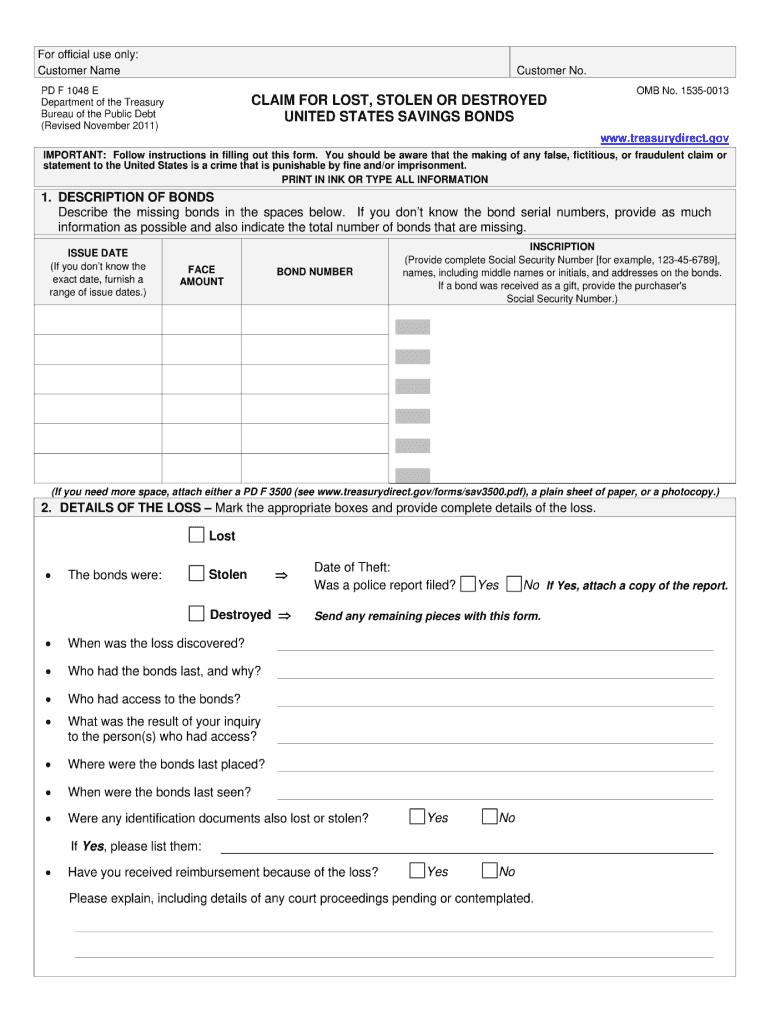

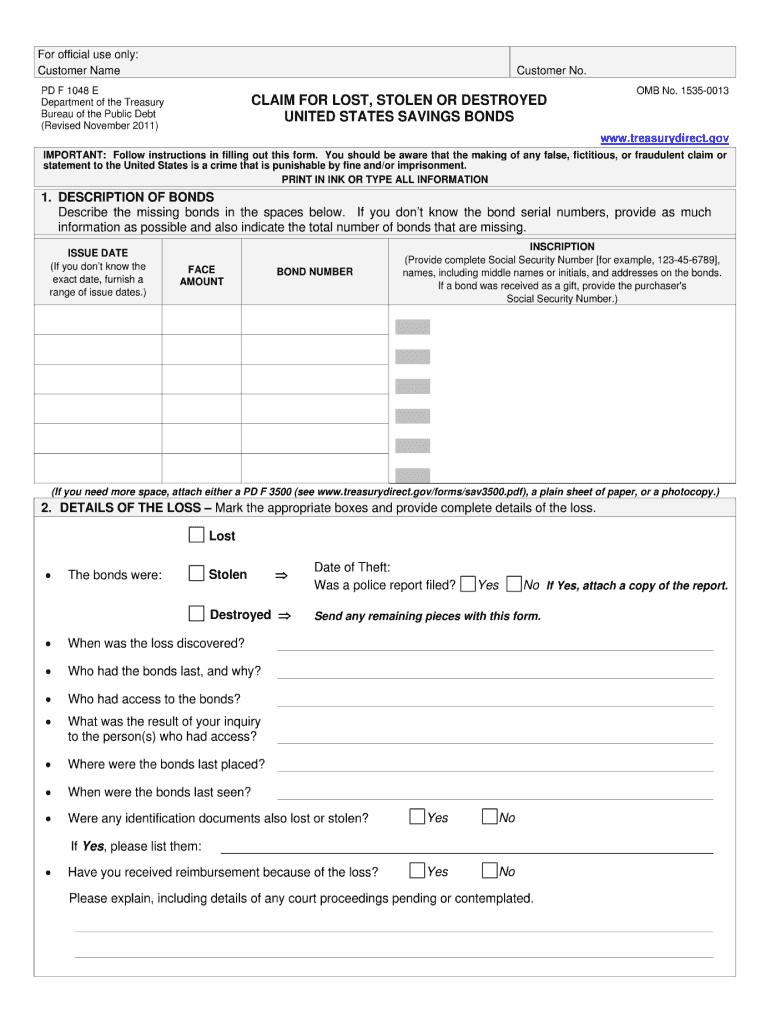

RESET For official use only Customer Name Customer No. PD F 1048 E Department of the Treasury Bureau of the Public Debt Revised January 2013 CLAIM FOR LOST STOLEN OR DESTROYED UNITED STATES SAVINGS BONDS OMB No. 1535-0013 www. treasurydirect. gov IMPORTANT Follow instructions in filling out this form* You should be aware that the making of any false fictitious or fraudulent claim or statement to the United States is a crime that is punishable by fine and/or imprisonment. PRINT IN INK OR TYPE...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 1048 irs 2011

Edit your form 1048 irs 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1048 irs 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1048 irs 2011 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 1048 irs 2011. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

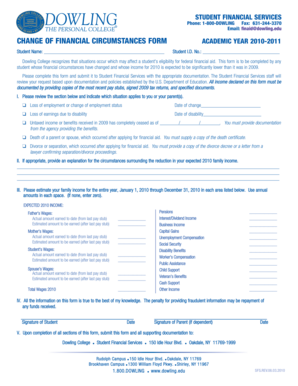

How to fill out form 1048 irs 2011

How to fill out Treasury FS 1048

01

Obtain the Treasury FS 1048 form from the official Treasury website or your financial institution.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal identification information, including name, address, and Social Security number.

04

Provide the details of the payment you are claiming, including the amount and reason for the claim.

05

Sign and date the form certifying that the information provided is accurate.

06

Submit the completed form to the designated address or online portal as instructed.

Who needs Treasury FS 1048?

01

Individuals or entities who are entitled to claim payment on U.S. Treasury securities.

02

Beneficiaries of a decedent's estate who need to claim funds from Treasury accounts.

03

Anyone seeking to request a refund or payment related to Treasury instruments.

Fill

form

: Try Risk Free

People Also Ask about

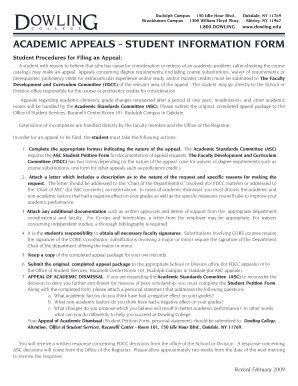

What is the 1048 tax form?

What is a form 1048? United States Savings Bonds & Notes To file a claim for a savings bond that is lost, stolen, or destroyed, complete a Claim for Lost, Stolen, or Destroyed United States Savings Bonds (FS Form 1048). You will need to show a description of the bond(s) in the spaces provided on the form.

How do I avoid paying taxes on savings bonds?

You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs. That includes expenses you pay for yourself, your spouse or a qualified dependent. Only certain qualified higher education costs are covered, including: Tuition.

How do I claim savings bonds on my taxes?

If your total interest isn't more than $1500 for the year, and you're not otherwise required to report interest income on Schedule B, report the savings bond interest with your other interest on the "Interest" line of your tax return. For more information, see the Instructions for Schedule B (Form 1040).

Is there a penalty for not cashing in matured EE savings bonds?

While the Treasury will not penalize you for holding a U.S. Savings Bond past its date of maturity, the Internal Revenue Service will. Interest accumulated over the life of a U.S. Savings Bond must be reported on your 1040 form for the tax year in which you redeem the bond or it reaches final maturity.

How do I get my money from TreasuryDirect?

Log into your primary TreasuryDirect® account. Click the ManageDirect® tab at the top of the page. Under the heading Manage My Securities, click "Redeem securities".

Do I need to report Series I bonds on my taxes?

In addition to the interest for the year you are now reporting, you must also report all interest those bonds earned in the years before you changed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 1048 irs 2011 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your form 1048 irs 2011 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make changes in form 1048 irs 2011?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your form 1048 irs 2011 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I fill out form 1048 irs 2011 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your form 1048 irs 2011 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is Treasury FS 1048?

Treasury FS 1048 is a form used for reporting information related to the Treasury's management of certain financial accounts, specifically focusing on Federal Government securities.

Who is required to file Treasury FS 1048?

Individuals and entities that hold financial instruments issued by the U.S. Treasury are typically required to file Treasury FS 1048, especially if they have transactions related to these securities within a specified reporting period.

How to fill out Treasury FS 1048?

To fill out Treasury FS 1048, individuals should provide specific details related to their investment, including account information, transaction details, and any applicable identifiers, following the guidelines provided in the form's instructions.

What is the purpose of Treasury FS 1048?

The purpose of Treasury FS 1048 is to ensure proper reporting and accountability for transactions involving U.S. Treasury securities, contributing to the financial transparency of government operations.

What information must be reported on Treasury FS 1048?

The information that must be reported on Treasury FS 1048 includes the names of the securities held, the transaction dates, the amounts and values of the securities, and any relevant identifiers for the reporting entity.

Fill out your form 1048 irs 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1048 Irs 2011 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.