Canada BUL-1 - Alberta 2011 free printable template

Show details

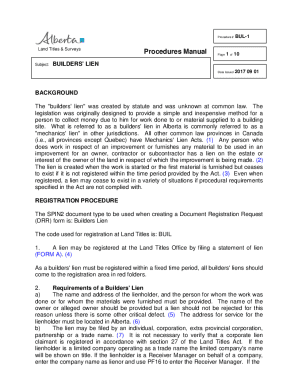

Procedure # BUL-1 Land Titles Procedures Manual Page 1 of 9 Subject: BUILDERS' LIEN Date Issued 2011 08 26 BACKGROUND The buildersLIli n” was created by statute and was unknown at common law. The

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada BUL-1 - Alberta

Edit your Canada BUL-1 - Alberta form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada BUL-1 - Alberta form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada BUL-1 - Alberta online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada BUL-1 - Alberta. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada BUL-1 - Alberta Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada BUL-1 - Alberta

How to fill out Canada BUL-1 - Alberta

01

Obtain a copy of the Canada BUL-1 form from the official website or local administrative office.

02

Read through the instructions provided with the form to understand the required information.

03

Fill in your personal information in the designated fields, including your full name, address, and contact information.

04

Provide details about your assets and liabilities, ensuring that all figures are accurate and up to date.

05

If applicable, include information regarding any previous claims or financial situations.

06

Review the form to ensure all sections are completed correctly.

07

Sign and date the form at the bottom where indicated.

08

Submit the completed form to the appropriate Alberta authorities via mail or in person.

Who needs Canada BUL-1 - Alberta?

01

Individuals or businesses located in Alberta who are required to report their financial situation.

02

Those applying for financial assistance or benefits that require a detailed financial disclosure.

03

Individuals filing for bankruptcy or looking for debt relief options.

Fill

form

: Try Risk Free

People Also Ask about

How does a construction lien work in Alberta?

A builders' lien gives contractors, subcontractors, suppliers, and labourers a way to collect money owed to them for labour and materials used to improve the land, including work on any structures on the land.

How do builders liens work in Alberta?

An Alberta Builders Lien is primarily used with delinquent customers, as leverage to get paid. When you file builders liens in Alberta you are registering your legal interest against the property where the work was done, or materials supplied.

How long is a builders lien good for in Alberta?

Subject to some exceptions, a lien for materials, services, or wages may be registered any time up to 45 days from the day the last materials, services, or wages were provided, or since the contract was abandoned. After those 45 days elapse, the lien expires.

How do I put a lien on a builder in Alberta?

To register an interest, fill out the form for the type of lien you wish to register and drop it off at a registry agent. Some interests must be registered within specific time frames. You should allow adequate lead time for processing by a registry agent if there are any legislative time limits for registration.

How long to file a builders lien in Alberta?

The contractor or supplier is then entitled to lien for the entire value of the contract by registering a lien within 45 days of the last day services or materials are provided, as opposed to filing within 45 days of each service that is provided or material that is furnished.

What is the builders lien legislation in Alberta?

Overview. On August 29, 2022, the changes to the Alberta Builders' Lien Act will take effect, making Alberta the third province in Canada to implement prompt payment and adjudication in its lien legislation. The new act will be called the Prompt Payment and Construction Lien Act (the PPCLA or the Act).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada BUL-1 - Alberta for eSignature?

Once your Canada BUL-1 - Alberta is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute Canada BUL-1 - Alberta online?

With pdfFiller, you may easily complete and sign Canada BUL-1 - Alberta online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit Canada BUL-1 - Alberta straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit Canada BUL-1 - Alberta.

What is Canada BUL-1 - Alberta?

Canada BUL-1 - Alberta is a tax return form used for reporting the provincial sales tax in Alberta, Canada.

Who is required to file Canada BUL-1 - Alberta?

Businesses that are registered for the Alberta provincial sales tax (PST) must file Canada BUL-1 - Alberta.

How to fill out Canada BUL-1 - Alberta?

To fill out Canada BUL-1 - Alberta, businesses need to provide their business information, total taxable sales, total tax collected, and any exempt sales.

What is the purpose of Canada BUL-1 - Alberta?

The purpose of Canada BUL-1 - Alberta is to report and remit the provincial sales tax collected by businesses in Alberta.

What information must be reported on Canada BUL-1 - Alberta?

The information that must be reported includes the business's name, PST account number, total sales, tax collected, and any deductions for exempt sales.

Fill out your Canada BUL-1 - Alberta online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada BUL-1 - Alberta is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.