WI WT-4 2014 free printable template

Show details

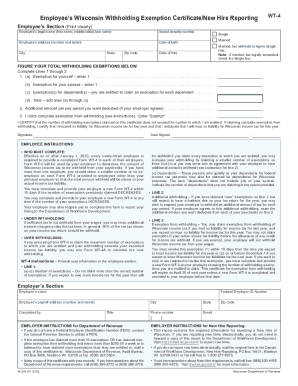

Save Print Clear Employee’s Wisconsin Withholding Exemption Certificate/New Hire Reporting WT-4 Employee’s SectioEmployee’s’s Legal Name (last, first, middle initial) Employee’s address

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI WT-4

Edit your WI WT-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI WT-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI WT-4 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit WI WT-4. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI WT-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI WT-4

How to fill out WI WT-4

01

Obtain the WI WT-4 form from the Wisconsin Department of Revenue website or from your employer.

02

Fill in your personal information such as your name, address, and Social Security number at the top of the form.

03

Indicate your filing status by checking the appropriate box (Single, Married, Head of Household).

04

Provide any additional income information required, such as total wages and other income sources.

05

Calculate the additional withholding amount, if applicable, based on your tax situation.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to your employer for processing.

Who needs WI WT-4?

01

Employees in Wisconsin who wish to specify additional withholding amounts for state income tax.

02

Workers who have multiple jobs or other income sources and want to manage their state tax withholding appropriately.

Fill

form

: Try Risk Free

People Also Ask about

How to fill out a Wisconsin WT-4 form?

We've got the steps here; plus, important considerations for each step. Step 1: Enter your personal information. Step 2: Account for all jobs you and your spouse have. Step 3: Claim your children and other dependents. Step 4: Make other adjustments. Step 5: Sign and date your form.

Was there a change in federal tax withholding 2023?

Broadly speaking, the 2023 tax brackets have increased by about 7% for all filing statuses. This is significantly higher than the roughly 3% and 1% increases enacted for 2022 and 2021, respectively.

What is a WT 4A form?

Form WT-4A is an agreement between the employee and employer that a lesser amount will be withheld from the employee's wages than is provided for in the Wisconsin income tax withholding tables.

When was 2023 w4 released?

A draft of the 2023 Form W-4 was released Dec. 7 by the Internal Revenue Service. Changes in the draft primarily removed references to the IRS's tax withholding estimator at several points in the form and instructions. Amounts used in the Step 2(b) and Step 4(b) worksheets were also updated.

Is there a new W-4 form for 2023?

The new W-4 form for 2023 is now available. Unlike the big W-4 form shakeup of 2020, there aren't significant changes to the new form. But that doesn't mean you shouldn't familiarize yourself with it. You may not file Form W-4 with the IRS, but your payroll depends on it.

What is the difference between wt4 and wt4a?

OVER WITHHOLDING: If you are using Form WT‑4 to claim the maximum number of exemptions to which you are entitled and your withholding exceeds your expected income tax liability, you may use Form WT‑4A to minimize the over withholding. WT-4 Instructions – Provide your information in the employee section.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send WI WT-4 to be eSigned by others?

When you're ready to share your WI WT-4, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit WI WT-4 online?

With pdfFiller, the editing process is straightforward. Open your WI WT-4 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How can I fill out WI WT-4 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your WI WT-4. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is WI WT-4?

WI WT-4 is a tax form used in Wisconsin for withholding tax purposes, specifically for employers to report the amount of state income tax withheld from their employees' wages.

Who is required to file WI WT-4?

Employers in Wisconsin are required to file WI WT-4 if they withhold state income tax from their employees' wages.

How to fill out WI WT-4?

To fill out WI WT-4, employers must provide information regarding the employee's name, address, Social Security number, filing status, and the amount of withholding allowances claimed.

What is the purpose of WI WT-4?

The purpose of WI WT-4 is to inform the Wisconsin Department of Revenue about the amounts withheld from employees' wages for state income tax.

What information must be reported on WI WT-4?

The information that must be reported on WI WT-4 includes the employee's name, address, Social Security number, filing status, number of exemptions claimed, and any additional withholding amounts requested.

Fill out your WI WT-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI WT-4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.